Apple's restrained artificial intelligence strategy may deliver returns in 2026 as competitors face growing skepticism about massive AI investments, according to analysis from The Information. The company's measured approach contrasts with rivals spending hundreds of billions on data centers and model training.

Apple holds over $130 billion in cash and marketable securities after limiting AI-specific capital expenditures, according to multiple reports. This positions the company to pursue acquisitions or partnerships if AI startup valuations decline amid market corrections.

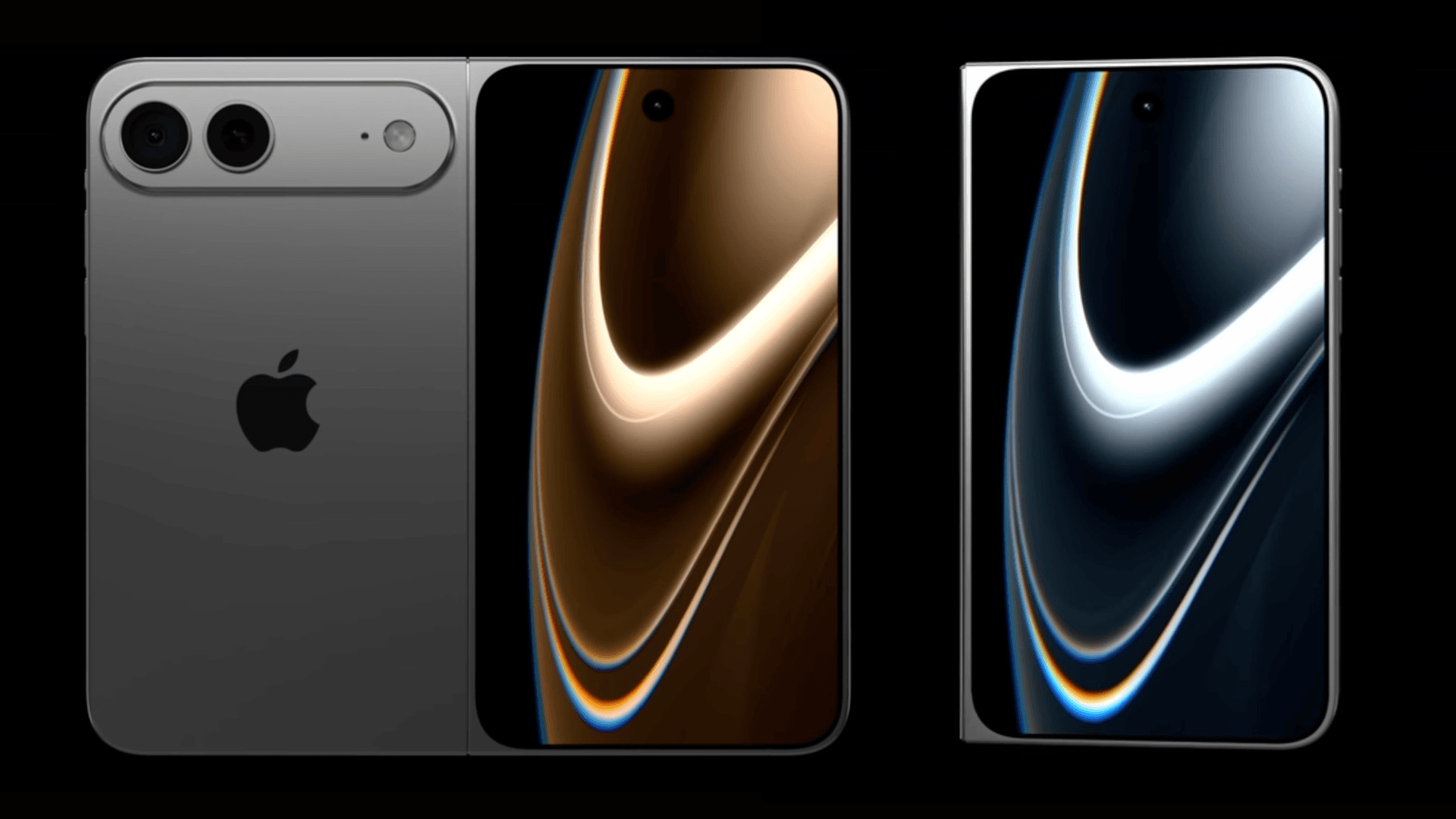

The iPhone maker's most significant AI move in 2026 will be a long-awaited Siri overhaul scheduled for spring release. The updated assistant will handle multi-step tasks and engage in more natural conversation, leveraging Google's Gemini models rather than proprietary development.

Bloomberg's Mark Gurman reports the new Siri version could launch in March with AI-powered web search capabilities. Gurman warned "there's no guarantee users will embrace it, that it will work seamlessly or that it can undo years of damage to the Siri brand."

Apple's strategy reflects an internal view that large language models may become commoditized, making massive proprietary development difficult to justify. The company can distribute AI features through software updates across its device ecosystem, an advantage standalone AI apps lack.

Organizational changes support this pivot. Siri reports to Mike Rockwell, who oversaw the Vision Pro headset launch, following organizational changes made earlier in 2025 after repeated delays to the assistant's overhaul. AI chief John Giannandrea announced his retirement earlier this month and will serve as an advisor before retiring in spring 2026, with his teams redistributed into product-focused groups.

Market sentiment toward AI spending shows increasing skepticism, with questions emerging about whether massive investments can generate near-term revenue. Competitors including Google, Meta, and OpenAI have committed hundreds of billions to infrastructure while Apple maintained financial flexibility.

The iPhone represents a key strategic advantage for Apple's AI deployment. Unlike web-based services, Apple can integrate AI directly into iOS through system updates, reaching hundreds of millions of devices without competing hardware development challenges.

Industry analysts note Apple's approach could appear prescient if enthusiasm for large-scale AI spending cools. The company's cash reserves and ecosystem integration provide insulation against potential market corrections in the AI sector.

Apple's AI history includes uneven performance since Siri's 2011 launch, but these shortcomings haven't materially harmed core businesses. The 2026 Siri revamp represents an inflection point where cautious strategy could translate to competitive advantage.

Separate market analysis from TrendForce projects global notebook shipments declining 5.4% in 2026 to around 173 million units. Apple's integrated supply chain and pricing power position it better than competitors facing memory cost pressures.

The company reportedly plans a low-cost MacBook for spring 2026, leveraging supply chain efficiencies amid challenging market conditions. This hardware strategy complements AI software developments for comprehensive ecosystem enhancement.

Apple's measured AI investments contrast with industry trends but align with its historical pattern of entering markets after technology matures. The approach prioritizes integration and user experience over being first to market with new capabilities.

As 2026 approaches, Apple faces pressure to demonstrate AI progress to investors while maintaining strategic discipline. The spring Siri launch will test whether restrained spending and ecosystem focus can overcome perceptions of lagging behind competitors.