Samsung's Galaxy Z TriFold sold out within minutes across global markets this month, exceeding initial industry expectations for the dual-folding smartphone. The device launched in five markets including South Korea, UAE, Singapore, Taiwan, and China, with first batches disappearing within hours of pre-order openings.

In South Korea, all units designated for the December 12 launch sold out immediately. A December 17 restock vanished in just two minutes, according to industry reports. Samsung scheduled a third restock for January to meet continued Korean demand.

The approximately $2,400 device reportedly sells at a loss, with production costs exceeding retail price according to supply chain sources. Android Authority estimates suggest losses of several hundred dollars per unit, a strategic move to build market share in the still-niche foldable segment.

Major online platforms in UAE, Singapore, and Taiwan reported immediate sellouts. In China, where daily sales remain capped, available units continue to sell out daily. The device has not yet officially launched in the United States, though interest in pre-orders is reportedly rising.

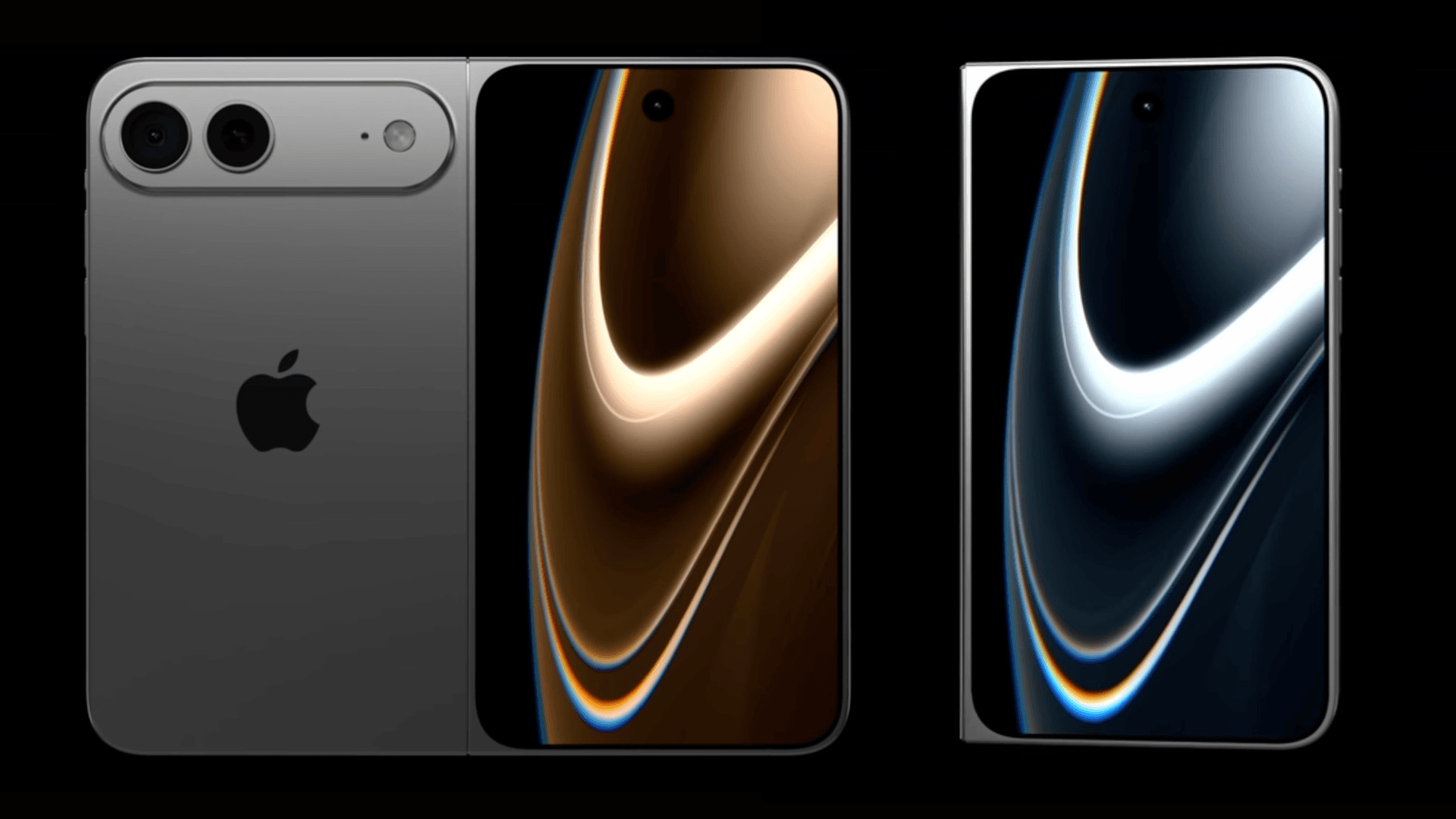

The Galaxy Z TriFold features a dual-folding form factor that expands to a 10-inch display when fully unfolded. At 12.9 millimeters thick when folded, it's the thinnest design in Samsung's Galaxy Fold series to date.

"Although initial reactions questioned whether the device would be too large or expensive, consumer response has been stronger than expected," industry officials told Pulse, the English service of Maeil Business News Korea. Positive reviews spread across social media and online communities.

Samsung's pricing strategy comes amid broader challenges for its mobile division. Rising component costs from advanced hinges to flexible displays have squeezed margins, impacting not just the TriFold but upcoming flagships like the Galaxy S26 series.

The company plans to utilize this momentum as the global foldable smartphone market expands. Worldwide foldable phone shipments will rise approximately 10 percent next year to reach 20.6 million units, according to industry projections.

Samsung's initial production run remains modest, estimated between 50,000 and 100,000 units according to social media reports from reliable leakers. This limited availability fuels the rapid sellouts while allowing Samsung to gather real-world feedback for future iterations.

The device integrates with Samsung's DeX mode for desktop-like experiences and supports S Pen for note-taking, features designed to lock users into Samsung's broader ecosystem of tablets, watches, and earbuds.

Competitors like Huawei's Mate XT feature similar tri-fold designs at higher price points but face limited Western market penetration due to U.S. sanctions. Chinese manufacturers including Xiaomi and Honor are developing their own tri-fold offerings at potentially lower costs.

Samsung's willingness to absorb losses on the TriFold mirrors historical console market strategies where hardware sells cheaply to build ecosystem loyalty. The company bets on long-term revenue from subscriptions and accessories rather than immediate device profitability.

Foldables currently account for less than 2 percent of global smartphone shipments despite years of development and marketing. Samsung's aggressive pricing could pressure rivals to lower barriers, potentially expanding the category beyond early adopters.

The device's success tests whether consumers will embrace advanced form factors at premium prices, even when subsidized by manufacturer losses. Broader market adoption hinges on perceived value beyond novelty, particularly as economic headwinds suppress luxury gadget demand.

Samsung's phased rollout continues with planned U.S. availability in the first quarter of 2026, according to Mashable. American consumer reception will determine whether the loss-leader strategy translates to Western markets where foldable penetration remains minimal.

Industry analysts watch whether short-term losses will pave the way for market dominance or strain Samsung's bottom line. The company's history includes successful risky innovations like the Galaxy Note series, which faced initial skepticism before achieving mainstream acceptance.

As Apple reportedly develops its own foldable iPhone for potential 2027 release, Samsung's early market positioning could prove crucial. The TriFold represents both technological advancement and financial gamble in a segment poised for gradual but significant growth.