The software industry, once the darling of Wall Street and venture capital, is facing its most significant transformation since the cloud revolution. As artificial intelligence reshapes everything from code generation to business models, investors are placing billion-dollar bets on what comes next while traditional SaaS companies scramble to adapt or risk obsolescence.

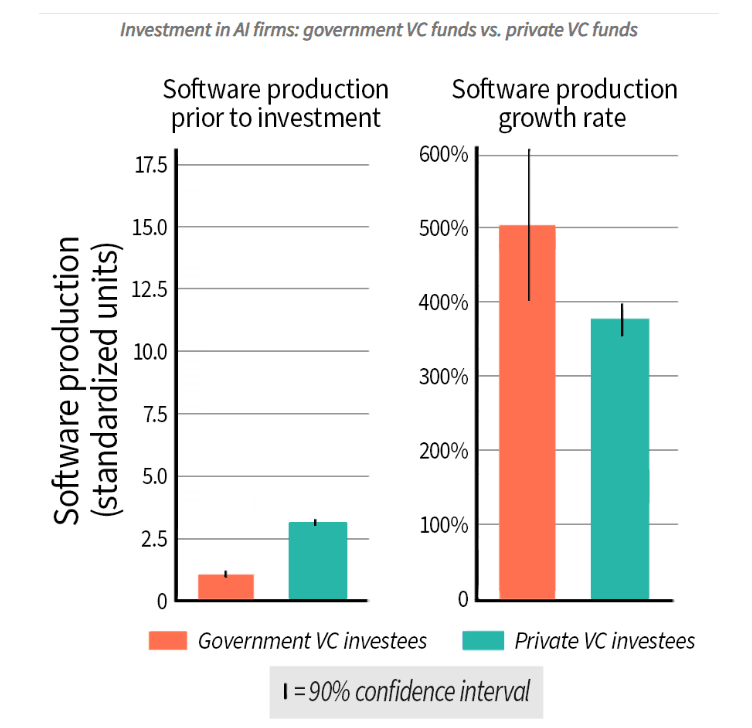

China's government venture capital funds have invested $912 billion over the past decade, with 23% directed to AI-related firms, creating a massive wave of investment that private venture capitalists have followed. According to Stanford research, this government-led push has resulted in 4,115 AI firms receiving funding from both government and private sources, with government-funded AI firms achieving 500% growth in software production by 2023. Yearly investments are comparable to the annual spending of entire nations.

Meanwhile, in Western markets, the disruption is playing out through valuation compression and strategic pivots. Earlier this year, Bloomberg reported that AI disruption fears sparked intense investor scrutiny of software stocks, with traditional SaaS leaders facing questions about their long-term viability. The concern is real: when news broke that a leading AI company was developing hiring solutions, shares of established players dropped 2% to 3% in a single day.

The productivity gains are undeniable. McKinsey research suggests AI technologies could enhance software development productivity by up to 50% through automation and advanced coding tools. Microsoft's leadership has been particularly vocal about this shift - their CEO reported that AI currently writes 20% to 30% of their code, with projections reaching 95% by 2030. That's not just incremental improvement; that's fundamentally changing how software gets made.

So where are investors placing their bets? According to RBC analysts, vertical software companies, those serving specific industries like healthcare, construction, or finance - are emerging as "AI-proof" contenders. These companies boast gross revenue retention rates of 98% to 99%, demonstrating customer loyalty that's hard to disrupt. Their secret? They solve deeply specific problems with proprietary data that AI startups can't easily replicate.

The transition from SaaS to AI-as-a-Service (AIaaS) represents another major shift. As AlixPartners noted in their analysis, enterprise software companies that successfully transition to GenAI and AI agents could see 4-6x increases in revenue multiples. But here's the catch: this requires more than just adding AI features to existing products. It demands fundamental business model changes, from seat-based pricing to outcome-based models where revenue depends on customer success metrics.

Looking ahead to 2026, AlixPartners predicts enterprise software M&A will surge 30% to 40% year-over-year to an estimated $600 billion. The consulting firm's report outlines seven critical dynamics reshaping the industry, including what they call "the AI productivity paradox", companies are seeing 20-30% faster software development but struggling to turn that productivity into profits.

The human element remains crucial, though. Vertical software companies often succeed because they're founded by industry veterans who understand specific pain points that generic AI solutions can't address. As one investment firm noted, "there will always still be a plumber fixing a boiler; a metal worker handling a laser cutter; a pest control technician ridding a building of bugs." AI enhances these roles rather than replacing them entirely.

What's fascinating is how different regions are approaching this transformation. While China's government-led model focuses on strategic national investment, Western markets are seeing a more decentralized, competitive sector. Both approaches are creating massive value, China's government-funded AI firms achieved that 500% software production growth, while Western companies like Klarna report their AI assistant, powered by OpenAI, is doing the job of 700 workers and contributed to an estimated $40 million profit improvement in 2024.

The bottom line? Software isn't going away, but it's getting smarter. Companies that embrace AI transformation not just as a feature add-on but as a core business strategy, are positioning themselves for the next valuation leap. Those that cling to traditional SaaS models risk becoming the next generation's legacy systems. In an industry where being first often means being dominant, the race to AI-native isn't just about technology; it's about survival.