Apple confirmed its acquisition of Israeli AI startup Q.ai on January 29, 2026, in a deal reportedly valued at nearly $2 billion. The purchase marks Apple's second-largest acquisition ever, trailing only the $3 billion Beats Electronics purchase in 2014.

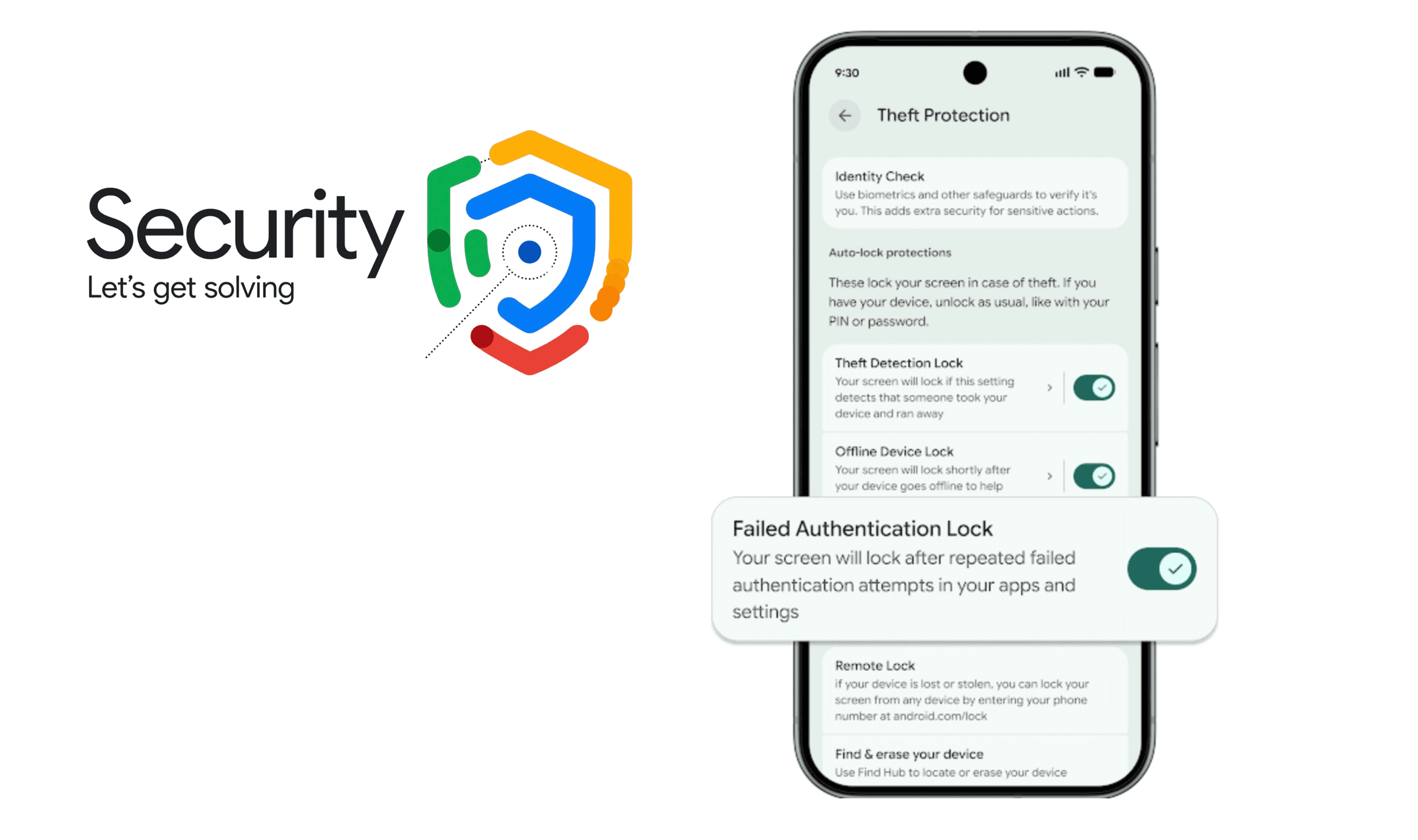

The four-year-old startup specializes in machine learning technology that interprets whispered speech and analyzes facial micro-movements for "silent speech" recognition. Q.ai's patents describe systems that detect subtle muscle activity in the face to understand commands without audible sound.

All 100 Q.ai employees will join Apple, including CEO Aviad Maizels and co-founders Yonatan Wexler and Avi Barliya. Maizels previously founded PrimeSense, a 3D sensing company Apple acquired in 2013 that later powered Face ID technology across iPhone models.

Apple hardware executive Johny Srouji called Q.ai "a remarkable company that is pioneering new and creative ways to use imaging and machine learning" in a statement provided to Reuters. The company did not disclose specific integration plans but noted the technology aligns with Apple's focus on voice interaction and ambient computing.

Q.ai's core innovation combines physics-based sensing with AI to capture whisper-like speech and enhance audio in challenging environments. Patent applications reveal the technology can detect "facial skin micromovements" to interpret mouthed words, identify individuals, and assess emotional states.

The acquisition comes as Apple faces pressure to catch up with rivals in generative AI and conversational assistants. The company recently announced plans to integrate Google's Gemini models into Siri, marking a significant shift toward external large language models.

Industry analysts suggest Q.ai's technology could integrate with future AirPods, Vision Pro headsets, or rumored smart glasses. The silent speech capabilities would enable discreet AI interactions in public settings without disturbing others.

Q.ai launched in 2022 and raised $24.5 million in seed funding from investors including Kleiner Perkins, Google's Gradient Ventures (now GV), and Spark Capital. The startup operated largely in stealth mode from its Ramat Gan, Israel headquarters.

The deal announcement coincided with Apple's fiscal first-quarter 2026 earnings report, which analysts expected to show strong holiday quarter performance. Apple maintains one of the largest corporate cash reserves, which provides ample resources for strategic AI investments.

Privacy concerns emerged following the acquisition announcement, with some social media users expressing unease about facial activity monitoring technology. Apple has historically emphasized on-device processing and privacy protections for biometric data.

The acquisition follows Apple's pattern of strategic Israeli tech purchases, including more than 50 previous exits to the company. Maizels becomes the first founder to sell two companies to Apple, following the PrimeSense transaction.

Competitors including Meta, Google, and OpenAI are developing similar multimodal interfaces for AI interaction. Meta's Ray-Ban smart glasses and Google's upcoming AR offerings represent direct competition in the wearable AI space.

Q.ai's technology could address a key limitation of current voice assistants: their inability to function effectively in noisy environments or private settings. The silent speech approach enables AI interaction in libraries, meetings, or crowded spaces without audible commands.

Apple's hardware integration expertise positions the company to deploy Q.ai's technology across multiple product categories. The combination of imaging sensors, machine learning, and Apple's custom silicon could create differentiated AI experiences.

The $2 billion valuation reflects premium pricing for AI talent and intellectual property in a competitive market. Recent AI startup valuations have reached unprecedented levels, with OpenAI valued at $157 billion in a 2024 funding round.

Industry observers expect Q.ai's technology to appear in Apple products within 12-24 months, potentially debuting at WWDC 2026 or subsequent developer conferences. The integration timeline depends on hardware development cycles and regulatory approvals.

The acquisition represents Apple's most significant bet on next-generation human-computer interaction since the introduction of Face ID. As AI assistants become more conversational, input methods must evolve beyond traditional voice commands.

Q.ai's team demonstrated resilience during the October 2023 Israel-Hamas conflict, with approximately 30% of staff serving in military reserve duty while continuing development work from bomb shelters according to investor reports.

The silent speech technology could prove particularly valuable for Apple's rumored AI pin device, which reportedly lacks a screen and would depend entirely on voice and gesture inputs for user interaction.

Apple's acquisition strategy typically involves absorbing technology teams and integrating their innovations across multiple product lines over several years. The Q.ai purchase follows this pattern of long-term technology investment.

Market analysts view the deal as defensive positioning against competitors advancing in wearable AI and multimodal interfaces. Apple's ecosystem advantage could accelerate adoption of silent speech technology across its billion-device installed base.

The technology's potential applications extend beyond consumer devices to accessibility features for users with speech impairments or hearing limitations. Q.ai's research includes emotion detection and physiological monitoring capabilities.

Regulatory scrutiny may increase as facial activity monitoring technology becomes more prevalent. The European Union's AI Act and similar legislation could impose restrictions on biometric data collection and processing.

Investor reaction to the acquisition has been positive, with venture capital partners praising the Q.ai team's technical capabilities and execution. The deal validates Israel's position as a leading source of AI innovation for major tech companies.

Apple's hardware-focused approach to AI differentiation contrasts with cloud-centric strategies pursued by competitors. On-device processing of silent speech data could provide privacy advantages over cloud-based alternatives.

The acquisition timing suggests Apple is accelerating its AI roadmap ahead of anticipated product launches in 2026-2027. Industry sources indicate multiple AI-focused hardware projects are in advanced development stages.

Q.ai's technology represents a convergence of computer vision, audio processing, and machine learning that could redefine how users interact with AI assistants. The shift from audible commands to silent communication marks a fundamental change in human-device interaction paradigms.

As AI becomes more integrated into daily life, input methods must adapt to social contexts and privacy considerations. Silent speech technology addresses these concerns while maintaining the convenience of voice-based interaction.

Apple's $2 billion investment signals confidence in the commercial viability of silent speech interfaces. The company's track record of successfully integrating acquired technologies suggests Q.ai's innovations will reach mainstream adoption through Apple's product ecosystem.