Apple reports first-quarter earnings today amid fresh leaks about iPhone 18 camera upgrades, iOS 27 AI features, and 2026 Mac refreshes. The company faces investor scrutiny over rising memory costs and AI strategy execution.

Prediction markets price a 94.5% probability Apple beats earnings expectations, according to 24/7 Wall St analysis. Shares are down more than 5% this year and have declined nearly 11% from their December peak as memory shortages drive up component costs across iPhone, Mac, and iPad production.

Apple's fiscal Q1 results arrive with Wall Street expecting $138.48 billion revenue and $2.67 earnings per share. The company previously projected 10-12% revenue growth for the holiday quarter, marking the first full quarter of iPhone 17 sales.

Memory costs present a near-term challenge. DRAM and NAND flash prices have soared due to AI data center demand, potentially compressing hardware margins. Morgan Stanley analyst Erik Woodring notes the Street hasn't fully accounted for memory cost impacts in 2026 estimates.

iPhone 18 Camera and AI Upgrades

January leaks reveal Apple testing variable aperture lenses for iPhone 18 Pro cameras, according to MacRumors reports. The system would adjust light intake similar to professional photography gear, enabling sharper low-light performance and better depth control.

iPhone 18 rumors extend beyond camera hardware. 9to5Mac reports suggest under-display Face ID and AI-driven features could reshape the device's design and functionality. The updates would represent what some analysts describe as Apple's most significant iPhone redesign in years. Apple continues to support older iPhone models with surprise updates even as it develops next-generation devices.

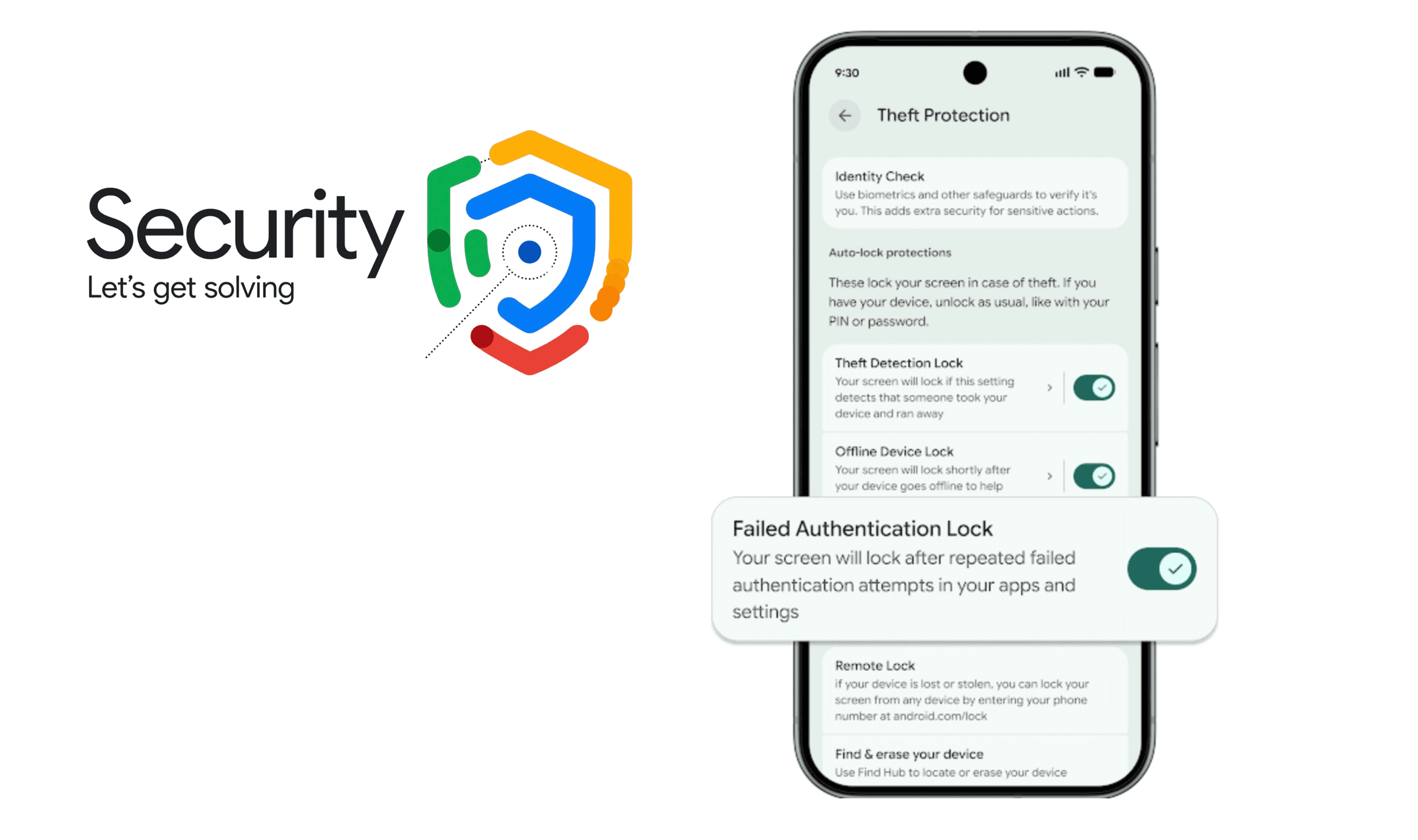

Apple's AI strategy faces pressure as competitors advance generative features. The company announced a Google Gemini partnership earlier this month to power Siri upgrades expected later this year, a deal that boosted Alphabet's stock significantly in 2025. This follows delays to several AI-related Siri features originally slated for 2025.

iOS 27 and Mac Roadmap

iOS 27 reportedly brings deeper AI integration and potential foldable device support, according to MacRumors sources. The update would represent Apple's next software evolution as rivals embed AI throughout their ecosystems. Apple recently released iOS 26.2.1 with support for second-generation AirTags, showing its continued commitment to software updates across its product line.

Mac hardware receives equal attention in 2026 leaks. Bloomberg reports outline Mac Pro updates and redesigned MacBook Pros featuring OLED displays. The refresh cycle could represent what Bloomberg describes as one of Apple's more significant Mac upgrade cycles in years as premium PC competition intensifies. Leaked files also hint at an M5 Max iMac Pro in development, marking the return of a high-end all-in-one desktop.

Former Apple executive Tony Fadell offered blunt criticism of current tech trends this week. He called Apple Vision Pro an "abject failure" commercially and slammed "AI-first" marketing hype. Fadell's comments align with reports that Apple scaled back Vision Pro production amid disappointing sales. Apple is reportedly developing smart glasses for late 2026 as it continues to explore the AR/VR market.

Memory Costs and Services Growth

Memory price inflation threatens Apple's gross margins across all product categories. Bank of America analyst Wamsi Mohan believes Apple can offset these costs through product pricing adjustments and continued Services growth.

Services revenue represents Apple's margin expansion engine, but Jefferies analysts warn of a "significant slowdown in App Store revenue growth." Maintaining double-digit Services growth remains critical for sustaining Apple's premium valuation.

Apple trades at 34 times trailing earnings, a multiple that assumes consistent margin expansion and AI monetization. Today's earnings report must demonstrate iPhone strength, margin stability, and Services growth to justify current valuation levels.

The company's supply chain relationships provide some insulation from memory shortages. Apple pre-purchases components 12-18 months in advance and benefits from procurement scale, reportedly shifting more DRAM sourcing to Samsung for iPhone 17 production.

Leadership and Product Pipeline

Succession planning advances as hardware engineering chief John Ternus emerges as the likely successor to CEO Tim Cook, according to supply chain reports. The transition timeline remains unspecified but gains importance as Apple navigates AI integration challenges.

Fadell, credited with iPod development and Nest founding, suggested Apple should pursue smart rings and foldable iPhones. He argued the company "flubbed" its car project by attempting traditional vehicle manufacturing rather than rethinking urban transportation.

Apple reportedly prepares a dedicated home hub for release this year, addressing smart home fragmentation. The company's health expertise positions it to dominate emerging categories like smart rings, though Fadell estimates the industry remains 5-6 years from seamless smart home experiences.

Today's earnings report arrives as Apple balances immediate financial pressures against long-term product evolution. Memory cost management, Services growth sustainability, and AI feature execution will determine whether the company maintains its premium market position through 2026's product transitions.