Microsoft faces concentrated risk with OpenAI representing 45% of its $625 billion revenue pipeline. The software company reported $7.6 billion in quarterly net income from its OpenAI stake while simultaneously accelerating proprietary AI development.

Capital expenditures jumped 66% to $37.5 billion last quarter as Microsoft commits $140 billion to AI infrastructure this fiscal year.

The spending surge comes alongside declining share performance, with Microsoft stock down over 16% year-to-date despite exceeding revenue expectations.

AI leader Mustafa Suleyman directs Microsoft toward what he terms "true AI self-sufficiency." The company develops internal foundation models while maintaining its 27% OpenAI ownership and partnership extending through 2032. Microsoft's AI leadership has been making bold predictions about the technology's impact on the workforce.

Microsoft evaluates MAI model family performance against OpenAI and Anthropic systems. Concurrent hardware development includes the Maia 200 AI accelerator and Fairwater data center network, supported by SK Hynix HBM3E memory supply.

This move toward in-house AI chip development mirrors similar efforts across the tech industry.

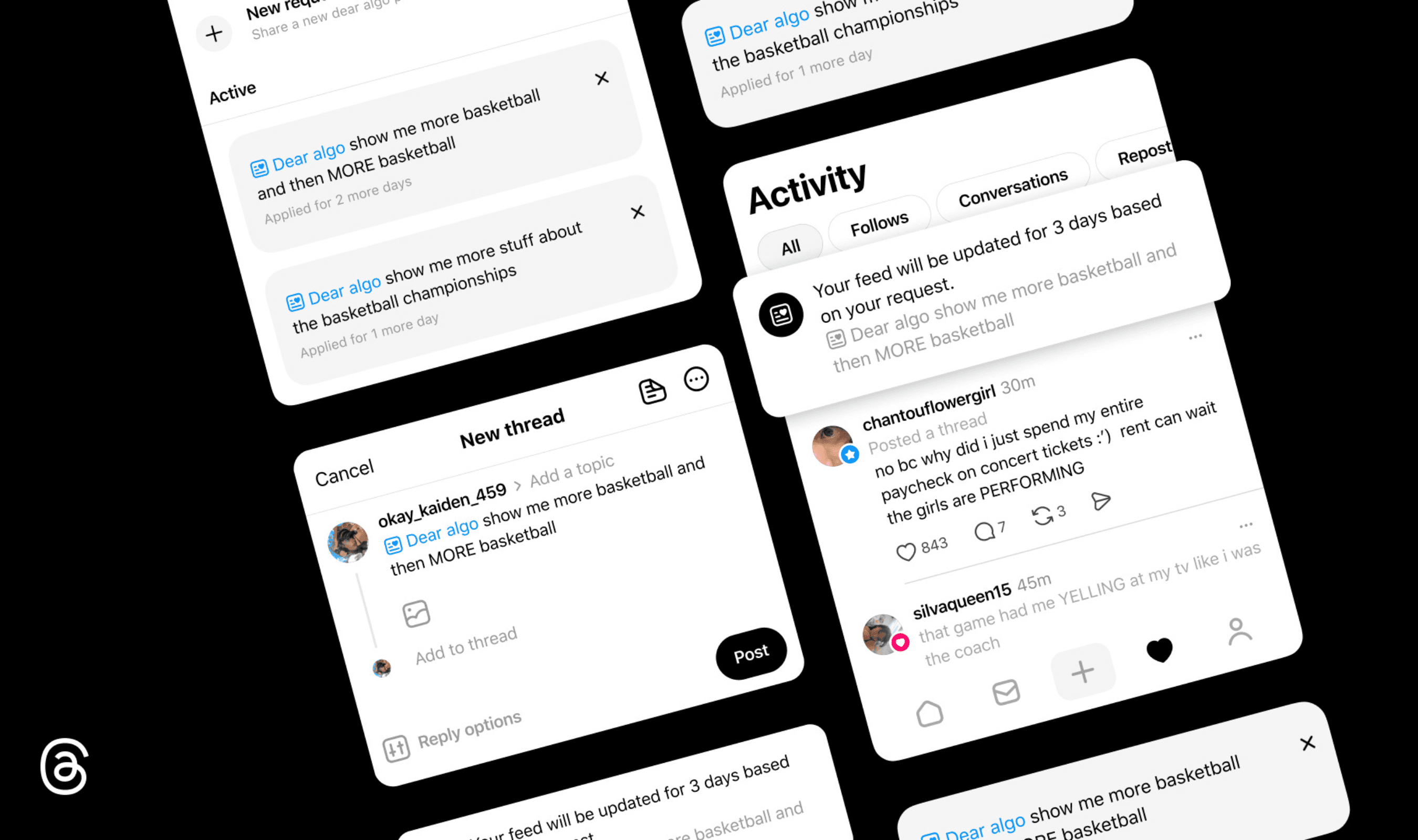

Office 365 will integrate Anthropic's Claude Sonnet 4 across Word, Excel, Outlook, and PowerPoint applications. The arrangement breaks Microsoft's exclusive OpenAI dependency for productivity software AI capabilities.

Azure already hosts multiple competing AI models including Anthropic's Claude, Meta's Llama, and Mistral offerings. This multi-provider approach reduces single-source vulnerability for enterprise clients.

OpenAI pursues alternative financing through SoftBank while developing competitive infrastructure. The AI company reportedly plans a professional networking platform challenging LinkedIn and collaborates with Broadcom on proprietary server chips targeting 2026 availability. OpenAI has faced internal challenges as it navigates its business strategy.

Microsoft shares fell 7% post-earnings as Azure growth of 39% disappointed analysts. The company's gross margin compressed to approximately 68%, its narrowest measurement in three years.

OpenAI committed to $250 billion in Azure services under their revised October 2025 agreement. Microsoft invested over $13 billion in OpenAI since 2019, creating complex interdependence between the technology partners.

Microsoft's strategic balancing act preserves OpenAI collaboration while constructing independent AI capabilities. The company positions Azure as neutral infrastructure supporting competing frontier models.

Financial markets express concern over AI investment scale despite Microsoft's $50 billion cloud revenue achievement. The company's remaining performance obligations reached $625 billion, with nearly half tied to OpenAI commitments.

Microsoft navigates simultaneous partnership maintenance and competitive separation in the accelerating AI sector. Proprietary chip development, data center expansion, and foundation model creation aim to establish long-term technological autonomy.