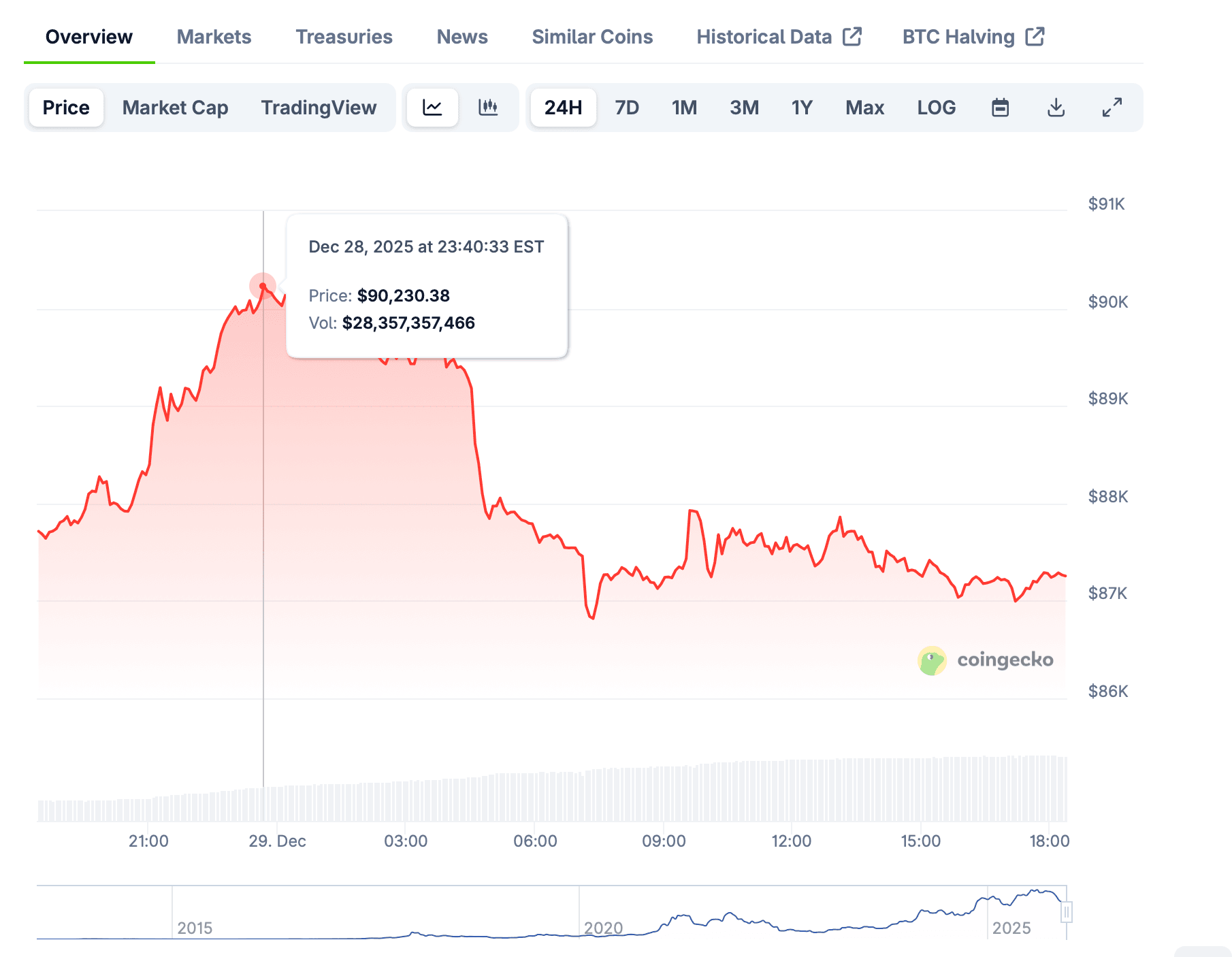

Bitcoin reclaimed the $90,000 level on Monday after trading below that threshold for much of the past six weeks, sparking renewed debate about its 2026 trajectory. The cryptocurrency traded at $90,018.02 with a 2.8% gain, according to CoinGecko data from December 29.

Investor Mike Alfred placed a high-stakes bet on Christmas Day, pledging to sell his entire Bitcoin portfolio and delete his X account if the asset doesn't reach $1 million by December 31, 2033. "You only live once, and I think it's important to take a stand, believe in something, and put your money where your mouth is," Alfred wrote.

Alfred's near-term forecast suggests Bitcoin could surge to $126,000 if it decisively breaks above $90,000 resistance. He previously predicted prices between $150,000 and $200,000 earlier this year, describing Bitcoin as "the most de-risked large-scale asset in history."

Swan Bitcoin CEO Cory Klippsten gives Bitcoin more than a 50% chance of reaching a new all-time high in 2026, with a target above $125,000. His forecast represents a potential 40% return over the next 12 months from current levels around $90,000.

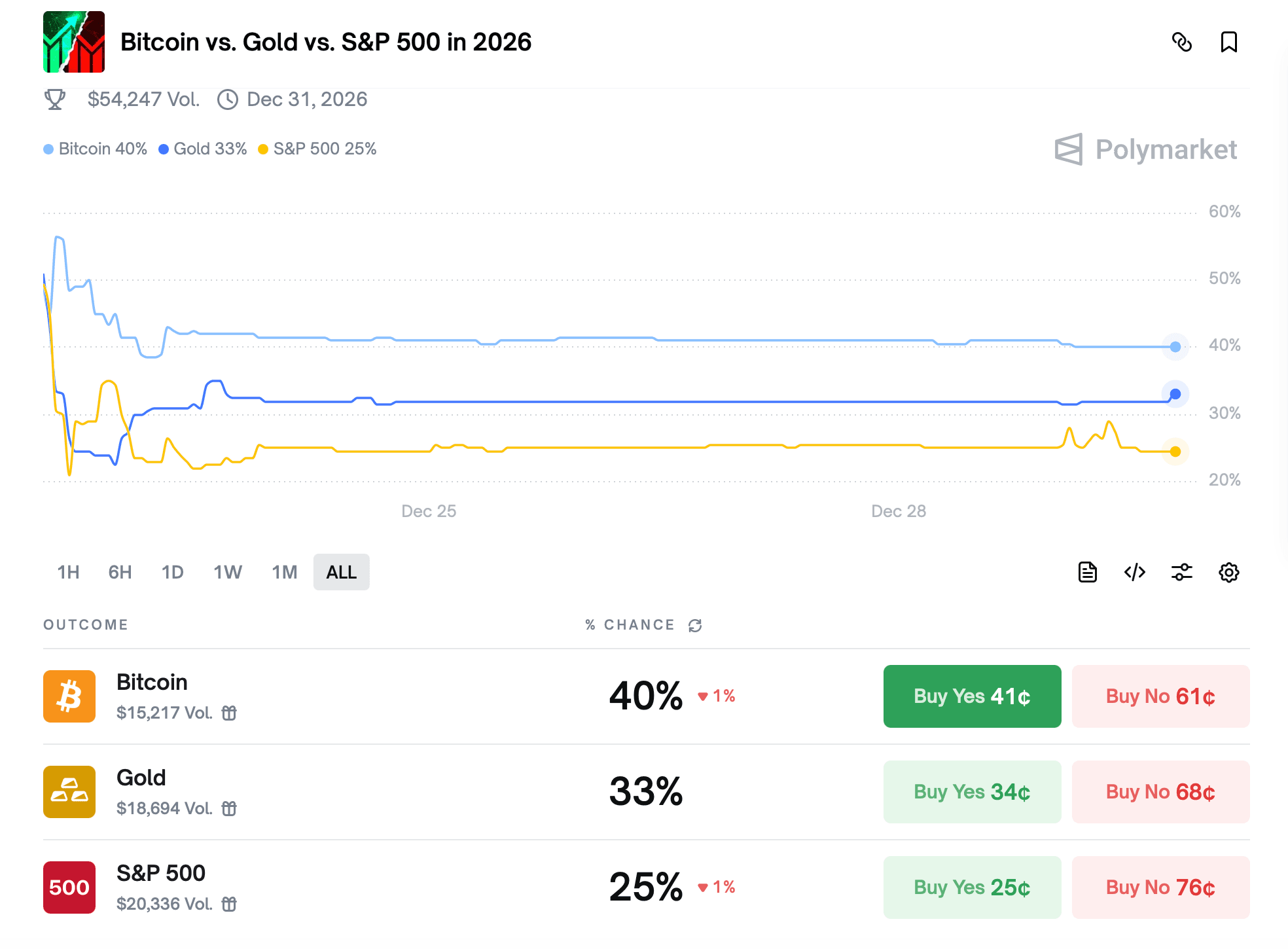

Prediction markets on Polymarket show traders assigning Bitcoin approximately 41% probability of outperforming both gold and the S&P 500 in 2026. Gold receives about 32% odds while the S&P 500 trails at approximately 26%, according to market data from December 29.

Michael Saylor's company Strategy purchased 1,229 Bitcoins between December 22-28 at an average price of $88,568. The acquisition was financed through $108.8 million raised via an ongoing ATM share sale program, according to SEC filings.

Strategy now holds 672,497 Bitcoins with an average cost of $74,997 per coin, positioning the company as one of the world's largest institutional Bitcoin holders. The total investment exceeds $50 billion based on current market valuations.

Saylor posted "Back to Orange" on his X account on December 29, a signal that historically precedes new Bitcoin purchases by his company. The message sparked market speculation about renewed accumulation despite Strategy pausing purchases last week.

Artificial intelligence models analyzing global financial conditions detect capital rotating back into risk assets, with Bitcoin emerging as a primary beneficiary. AI systems monitor interest rates, bond markets, and stablecoin activity to track liquidity shifts.

The crypto market added $80 billion in value over 24 hours, pushing total market capitalization to $3 trillion as Bitcoin regained momentum. This recovery occurred despite Bitcoin ETFs recording $275.88 million in daily outflows on December 26.

Technical analysis reveals concerning signals according to CCN analyst Victor Olanrewaju. Bitcoin broke below the lower boundary of a rising wedge pattern on weekly charts, a development that typically favors further downside rather than continuation.

The Moving Average Convergence Divergence indicator printed a bearish crossover on higher timeframes, reinforcing selling pressure. Olanrewaju notes that failure to reclaim resistance near $96,792 could expose Bitcoin to support at $78,596.

Market sentiment remains weak with the fear and greed index at 24, indicating extreme fear among traders. This contrasts with institutional accumulation patterns and long-term bullish forecasts from prominent industry figures.

Klippsten argues that today's Bitcoin market differs fundamentally from earlier cycles. "People don't tend to get into Bitcoin and then get out of it. They generally stick," he said, emphasizing institutional participation from pension funds and sovereign entities.

The shift represents a maturation from speculative retail dominance to institutional support that reduces collapse likelihood. Klippsten believes Bitcoin's consolidation between $85,000 and $90,000 sets the groundwork for a 2026 breakout.

Miners diversifying into artificial intelligence infrastructure hasn't impacted Bitcoin's security model, according to industry analysis. Companies like Core Scientific plan to focus on high-performance computing within two to three years.

Klippsten dismissed concerns about hash rate fluctuations affecting security. "Just because hash rate might fall or go up... it doesn't really change the security model of Bitcoin," he stated during a recent market analysis.

Federal Reserve rate cut odds for January 2026 fell to 15.5% after political developments affected market expectations. This reduction in monetary easing probability contributed to recent cryptocurrency volatility.

Prediction markets give Bitcoin just a 1% chance of reaching $100,000 before year-end, with $95,000 representing the most likely level at approximately 7% probability. These odds reflect cautious near-term sentiment despite long-term optimism.

Analyst Ted Pillows points to Bitcoin's stablecoin ratio entering key demand zones on weekly and monthly charts. The growing stablecoin supply indicates a calm market without mass exits or panic selling pressure.

Geopolitical tensions between Russia and Ukraine contributed to Bitcoin's recent price recovery as investors sought inflation hedges. Rising oil prices increased inflation concerns, boosting Bitcoin's appeal as digital gold during December.

Gold and silver prices slipped slightly despite recent record highs, with gold around $4,550 and silver near $76. Some analysts interpret this as capital rotating from precious metals into cryptocurrencies.

The market faces conflicting signals: institutional accumulation contrasts with technical breakdowns, while long-term forecasts conflict with near-term caution. Bitcoin's 2026 trajectory will likely depend on whether institutional support outweighs technical weakness.

Industry veterans including Fundstrat's Tom Lee and Pixelmatic CEO Samson Mow support the $1 million Bitcoin thesis. Lee projects prices above $200,000 long-term, while Mow's internal models point to $1 million by 2031 with potential for earlier achievement.

Market participants await clearer signals about whether 2026 will deliver higher highs or confirm lower lows. The answer may emerge in early 2026 as institutional accumulation patterns confront technical resistance levels and macroeconomic conditions.