Salesforce stock declined nearly 21% last year, closing at a significant loss despite a late rally driven by artificial intelligence initiatives. The customer relationship management software company faced investor skepticism throughout most of the period, with its stock price dropping as much as 30% from January levels before recovering partially.

Investors viewed Salesforce as burdened by legacy technology associations, according to market analysis. Many market players felt it was guilty by apparent association with older software systems, creating headwinds for the stock even as competitors gained ground in the AI space.

Activist investor Starboard Value increased its stake in Salesforce by almost 50% during the second quarter, regulatory filings showed. The hedge fund reported owning 1.3 million shares on June 30, up from 849,679 shares at the end of the first quarter. This move came as the stock price had lost nearly 30% since January and was down approximately 9% over the previous 12 months.

Financial performance contributed to the stock's struggles. Net income under generally accepted accounting principles swung wildly, ranging from marginal declines to improvements exceeding 51%. Revenue growth remained in single-digit percentages for the first three quarters, failing to meet investor expectations for stronger performance.

The company implemented a 6% price increase for enterprise clients in August, which gradually improved market sentiment. This pricing adjustment came as Salesforce faced pressure to demonstrate stronger profitability amid rising competition in the CRM software market.

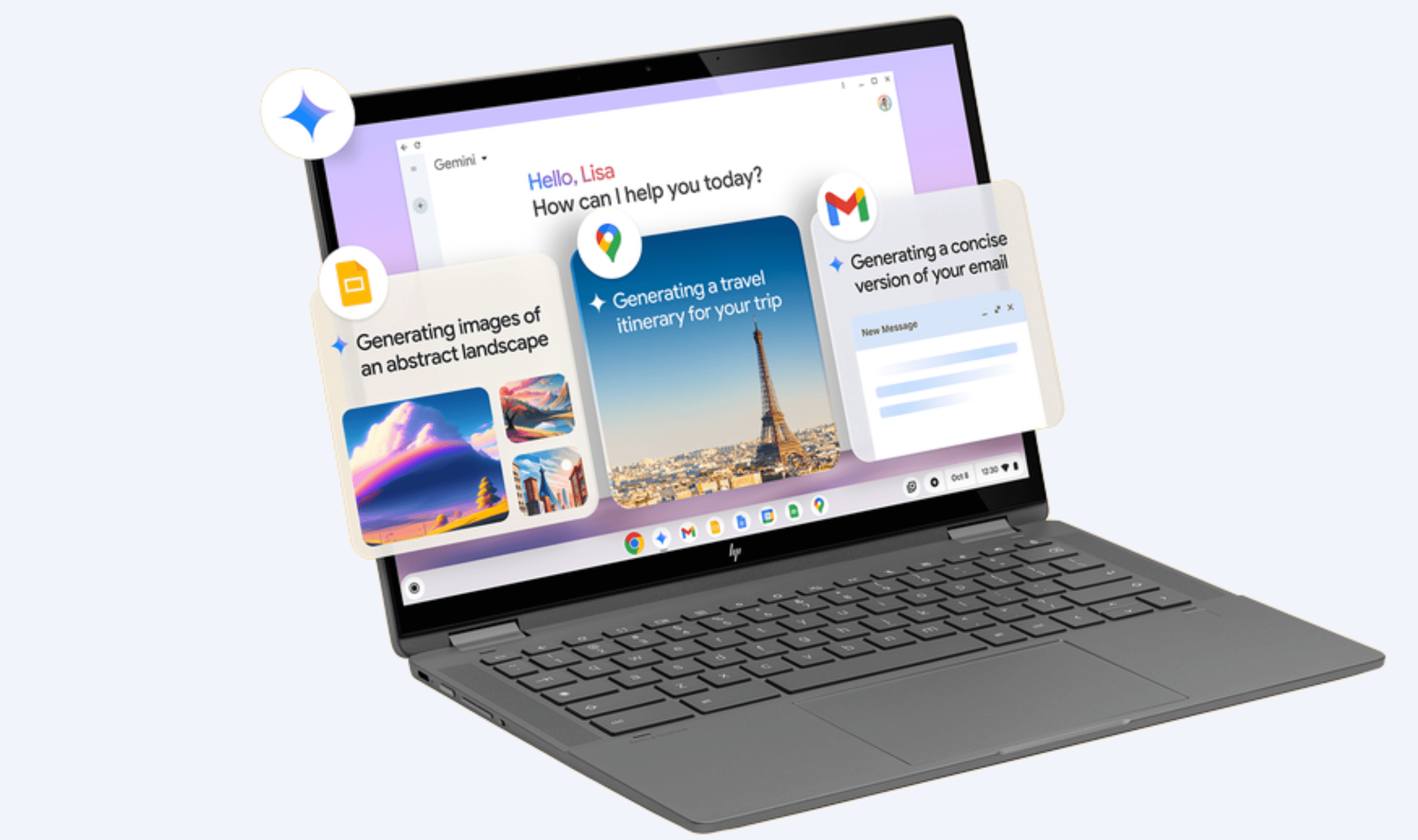

In mid-October, Salesforce launched its Agentforce 360 AI platform at the annual Dreamforce event. The new system focused on agentic AI technology, representing the company's most aggressive push into next-generation artificial intelligence.

Management simultaneously announced a new annual revenue target of $60 billion by fiscal 2030, setting ambitious growth expectations.

The late-year AI initiatives helped spark a recovery in the stock price. By New Year's Eve, Salesforce had trimmed its annual loss to approximately 21%, recovering from deeper declines earlier. Fourth quarter earnings showed revenue of $10 billion, representing 8% year-over-year growth, with subscription and support revenue reaching $9.5 billion.

Full fiscal year 2025 revenue reached $37.9 billion, a 9% increase from the previous year. Operating cash flow reached $13 billion, up 28% year-over-year, while total remaining performance obligation stood at $63.4 billion, an 11% increase. The Data Cloud and AI business generated $900 million in annual recurring revenue, growing 120% from the previous year.

Despite the challenging period, institutional ownership remained strong at nearly 82%. Analysts maintained generally positive outlooks, with consensus price targets suggesting significant upside potential from current levels. Market capitalization stood at approximately $214 billion as of early 2026, down from higher levels earlier.

Activist investor pressure continued throughout the year, with Starboard's chief executive Jeffrey Smith stating in late 2024 that Salesforce still had room to become more efficient and profitable. The company had previously faced intense pressure from activist investors in late 2022 and early 2023, leading to board changes and operational adjustments.

Competition intensified, with Microsoft's Dynamics 365 software challenging Salesforce directly in the CRM market. Other rivals including Oracle's NetSuite, SAP, HubSpot, and Zendesk increased competitive pressure as enterprise software buyers evaluated AI capabilities across multiple platforms.

This came as OpenAI launched its Frontier enterprise AI platform targeting Fortune 500 companies, further intensifying the AI platform competition.

Salesforce's Agentforce platform handled 380,000 conversations since its October launch, achieving an 84% resolution rate with only 2% of requests requiring human escalation. The company closed 5,000 Agentforce deals in the months following the platform's introduction, including more than 3,000 paid implementations.

Data Cloud surpassed 50 trillion records during the fiscal year, doubling from the previous year's total. The platform's growth reflected increasing enterprise adoption of Salesforce's data management and AI capabilities despite broader market concerns about its competitive position.

Looking forward, Salesforce faces continued challenges in maintaining growth momentum while investing heavily in AI development. The $60 billion revenue target for 2030 represents nearly a 60% increase from current levels, requiring sustained execution amid evolving market conditions and competitive dynamics.

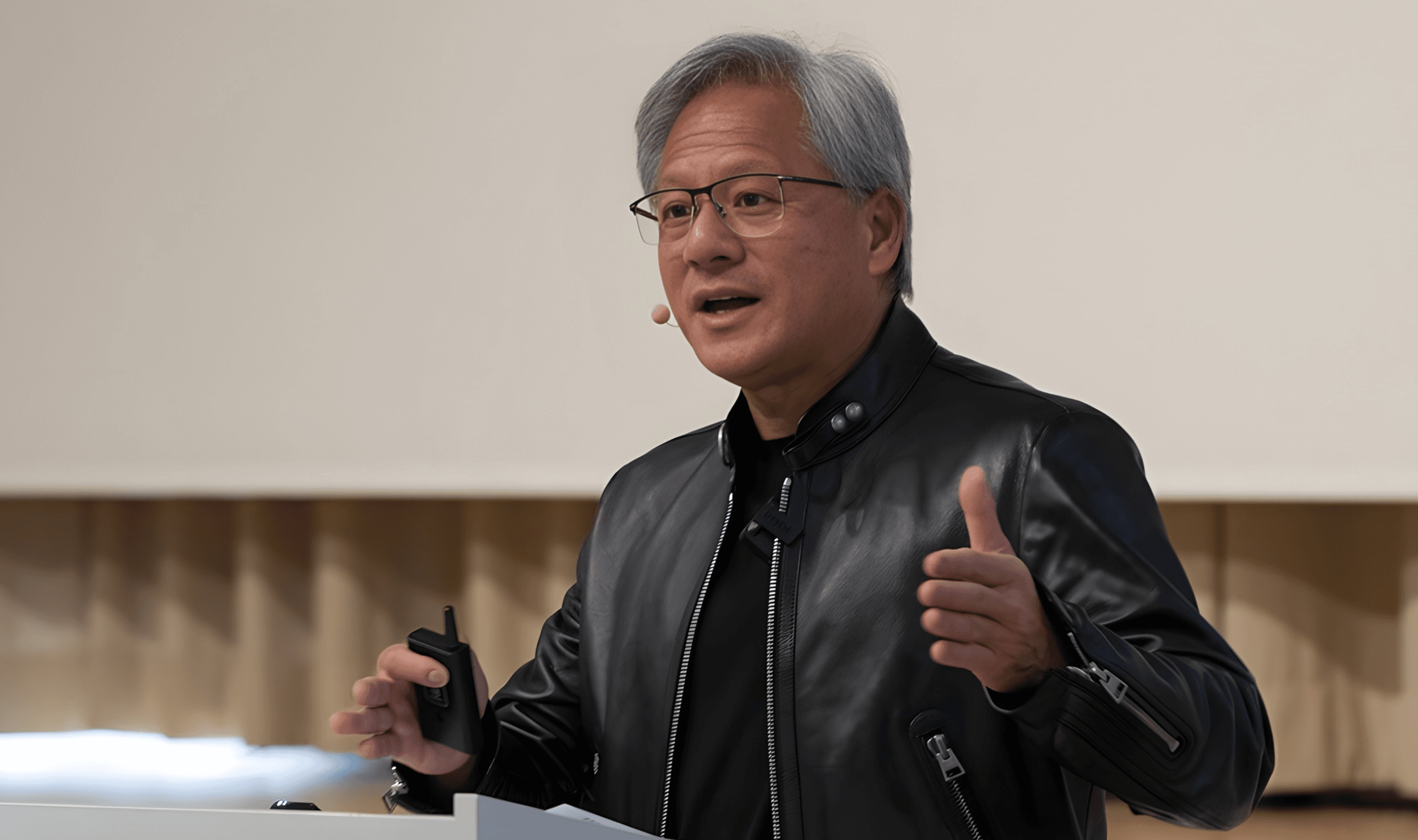

The broader AI infrastructure boom, highlighted by Nvidia's $5 trillion valuation driven by AI chip demand, highlights the massive investments flowing into artificial intelligence technologies that Salesforce must compete against.