Apple is exploring whether to end its decade-long exclusive chip partnership with TSMC, according to a Wall Street Journal report. The company may shift some lower-end processor production to alternative suppliers as early as 2027.

TSMC has manufactured Apple's systems-on-a-chip exclusively since 2016, but that arrangement could change for non-Pro iPhone models. The Taiwanese chipmaker now conducts more business with AI companies like Nvidia, which reportedly surpassed Apple as TSMC's largest customer amid the AI boom.

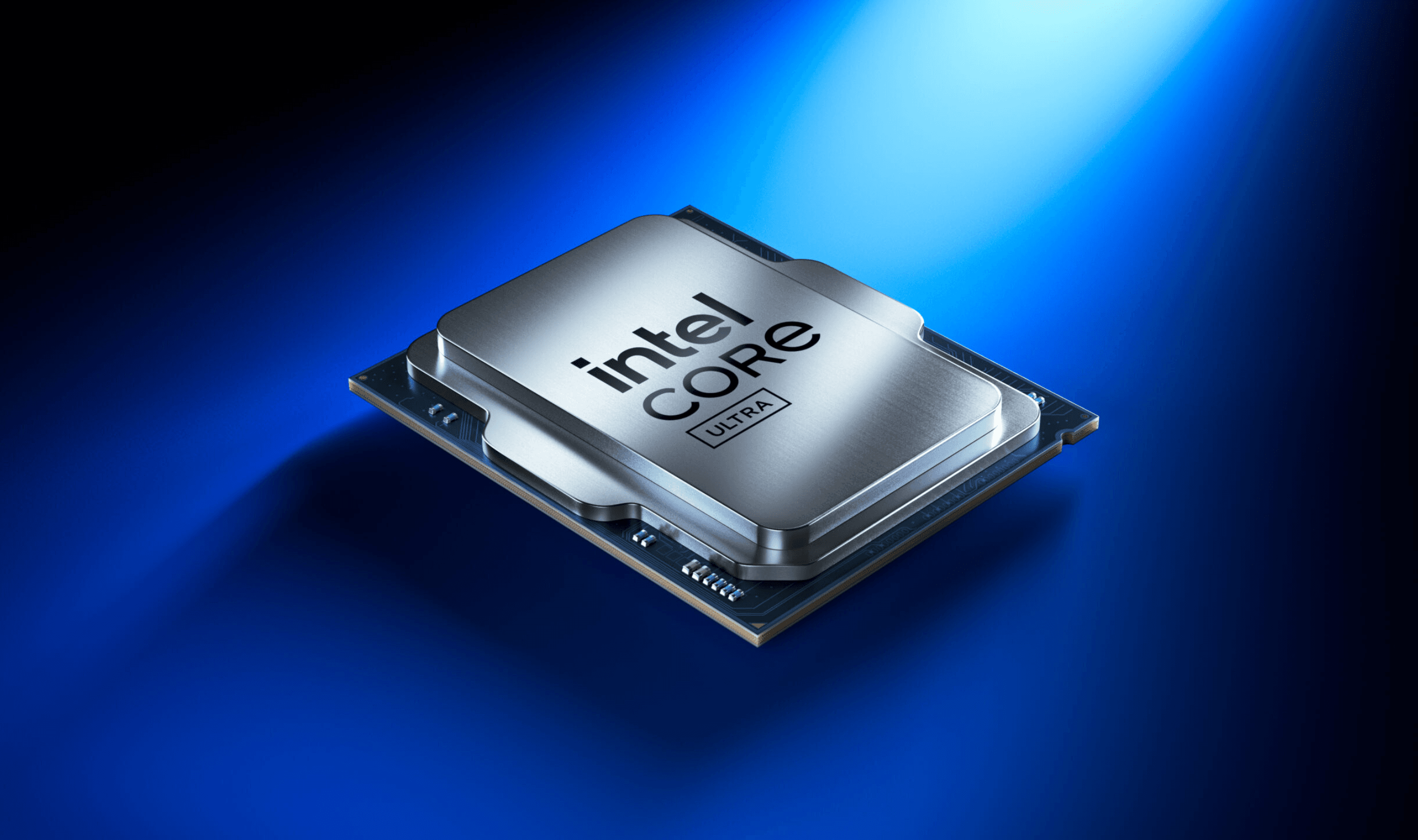

Intel could begin supplying chips for some iPhone models starting in 2028, according to GF Securities analyst Jeff Pu. The chipmaker would likely produce lower-end A-series processors for non-Pro devices, with Apple continuing to design the silicon itself. Apple has been exploring Samsung and Intel as alternative foundries amid TSMC's capacity constraints.

Supply chain analyst Ming-Chi Kuo suggested Intel might start shipping Apple's lowest-end M-series chips for select Mac and iPad models as early as mid-2027. Intel's involvement would be limited to fabrication using its 18A process technology.

Apple faces pressure from multiple directions. Memory suppliers Samsung and SK Hynix have raised prices for RAM chips, squeezing profit margins.

During last week's earnings call, CEO Tim Cook acknowledged that rising memory costs had minimal impact on gross margins last quarter but could have "a bit more of an impact" in the current period.

Nvidia's explosive growth in AI chips has reshaped TSMC's customer market. The chipmaker's revenue climbed 36% last year to $122 billion, with high-performance computing sales increasing 48%. Apple's product revenue grew just 3.6% during the same period.

The potential shift comes as both companies expand US manufacturing operations. Apple announced a $600 billion US investment commitment in August 2025 through its American Manufacturing Program. TSMC plans to invest $165 billion in US semiconductor manufacturing, including three new fabrication plants in Arizona.

Apple previously used Samsung for some chip supply in 2015 before transitioning exclusively to TSMC. The company ended its 15-year Intel partnership for Mac processors in 2020, moving to its own Apple Silicon designs manufactured by TSMC.

Diversifying chip suppliers would help Apple manage costs and secure production capacity. The company reported record-breaking revenue of $143.8 billion last quarter, up 16% year-over-year, despite concerns about memory chip pricing.

Intel's US manufacturing base could provide additional advantages amid trade considerations. The chipmaker has existing facilities that could support Apple's supply chain diversification efforts.

TSMC's dominance in leading-edge semiconductor manufacturing remains unchallenged, having been expected to handle almost 90% of global smartphone SoC shipments at 5nm and below in 2025, according to Counterpoint Research. Apple, Qualcomm, and MediaTek are all expected to launch 2nm chips with TSMC in late 2026.

The evaluation of alternative suppliers represents Apple's first serious look beyond TSMC in 12 years, as the company seeks to diversify from a foundry whose revenue grew 36% to $122 billion last year.