Microsoft will retire standalone SharePoint and OneDrive business plans, ending sales in June 2026 and shutting down service by December 2029. The company confirmed the phaseout of SharePoint Online Plan 1 and Plan 2 alongside OneDrive for Business Plan 1 and Plan 2 in a partner advisory shared in late January 2026.

The decision reflects low customer demand for standalone offerings, increased instances of what Microsoft calls "unintended or nonstandard usage," and higher operational costs associated with maintaining these plans. The Register suggested the "nonstandard usage" refers to customers signing up for these products primarily to access cheap cloud storage, as the plans offered more capacity for less cost than some of Microsoft's other storage options.

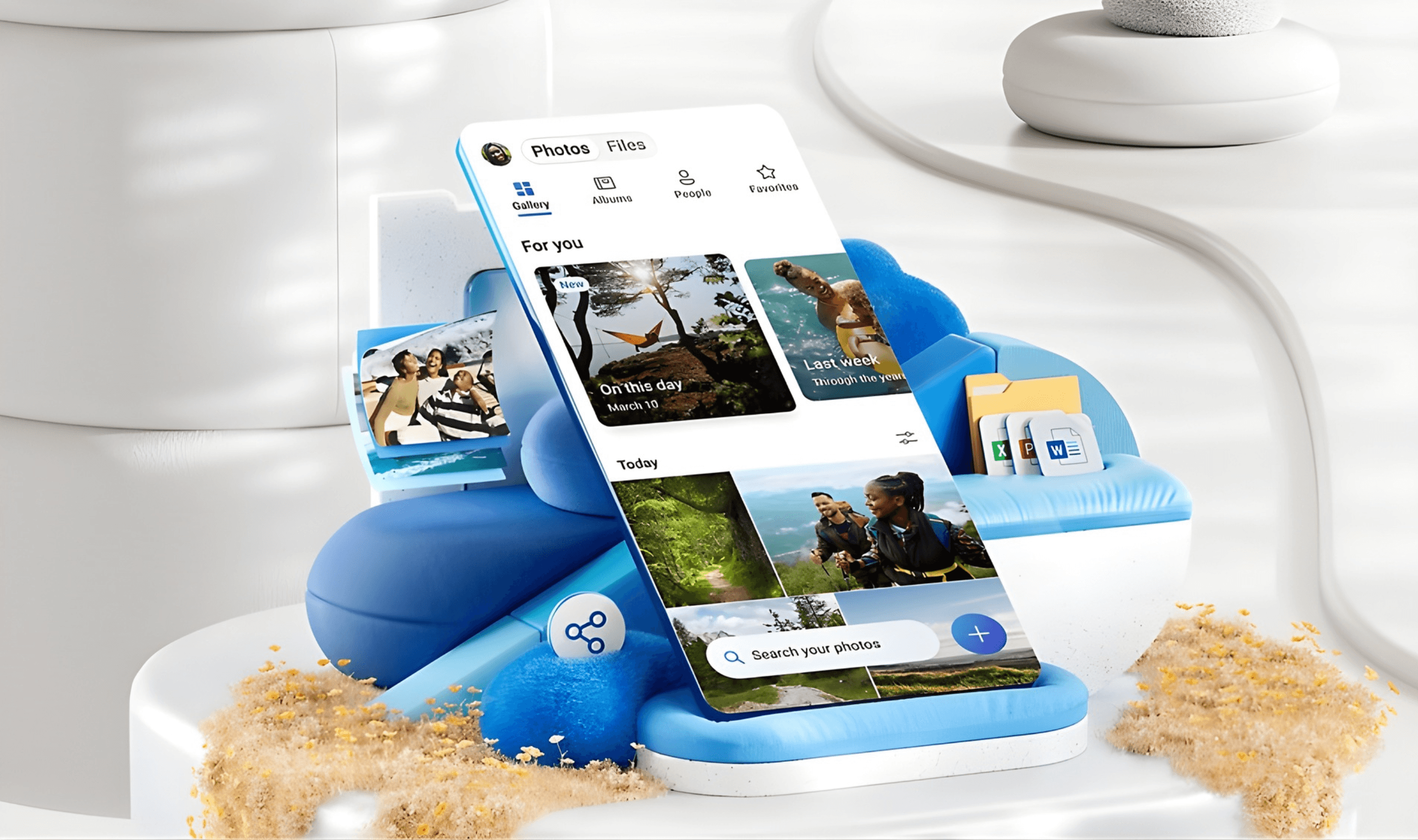

SharePoint Online Plan 1 cost $5 per user monthly with 1TB of cloud storage, while Plan 2 doubled the price to $10 for unlimited storage and advanced features. OneDrive for Business Plan 1 offered a terabyte at $5 per user monthly, with Plan 2 providing up to 5TB of storage and extending to 25TB for team users.

Microsoft will push affected customers toward Microsoft 365 bundles, which the company says "remain the primary way customers access SharePoint and OneDrive capabilities." Partners are being directed to migrate customers to Microsoft 365 Business or Enterprise E3/E5 plans, capacity packs, or pay-as-you-go storage options.

The transition timeline gives organizations several years to adapt. New sales will cease after May 31, 2026, with existing customer renewals ending in January 2027. Full service retirement arrives in December 2029, giving current users nearly four years to complete migrations.

Microsoft's bundled subscription strategy aligns with strong financial performance in its cloud business. TechRadar reported that in the final three months of 2025, Microsoft 365 Commercial cloud revenue increased 17% while Consumer cloud revenue surged 29%. Moving customers toward subscription models generates higher and more predictable recurring revenue for the company, even as the broader cloud computing sector faces AI and power challenges in 2026.

The retirement signals a broader industry shift away from standalone cloud storage products toward integrated platform bundles. Google has long bundled Drive storage with Workspace subscriptions, while Apple ties iCloud storage to its device ecosystem. Amazon Web Services positions S3 storage as infrastructure rather than an end-user product.

Small and medium-sized businesses face the most significant impact from Microsoft's decision. These organizations often adopted standalone plans precisely because they needed cloud storage without the expense or complexity of full productivity suites.

A small business paying $500 monthly for ten OneDrive for Business users could see costs jump to $600 or more for Microsoft 365 Business Basic, representing a 20% increase for services they may not need.

"Proactively identify impacted customers, communicate key dates early, and guide customers toward the most appropriate Microsoft 365 suite or storage alternative to ensure continuity and a smooth experience."

Microsoft recommends partners follow this guidance. The company aims to steer users toward what it describes as a "unified, cloud-first ecosystem" that prioritizes security and AI tools like Copilot, features standalone plans weren't built to handle.

The cloud storage market has experienced dramatic commoditization over the past decade, with storage becoming an expected baseline feature rather than a premium service. Competitors like Google, Dropbox, and Box engage in fierce price competition, creating razor-thin margins that make standalone storage plans increasingly difficult to sustain profitably.

For enterprise IT leaders, Microsoft's announcement serves as a catalyst for broader strategic reassessment of cloud service dependencies. Organizations heavily invested in Microsoft's ecosystem must evaluate whether deeper integration serves their interests or creates problematic vendor lock-in.

The most resilient IT strategies will balance the convenience of integrated platforms against the risks of excessive vendor concentration, a trend reflected in the broader enterprise shift to hybrid AI for cost and sovereignty in 2026.

The era of cloud storage as a distinct product category appears to be ending, replaced by storage as a feature within broader platforms or as infrastructure for custom applications. As the cloud services market continues maturing, similar consolidation moves from other major providers are likely, further entrenching the platform model as the dominant paradigm for enterprise cloud computing.