Korean retail investors poured approximately 1 trillion won ($655 million) into Tesla stock and leveraged ETFs in early January, according to Korea Securities Depository data. The purchases accounted for 44% of all U.S. stock net purchases by domestic investors during the period. This surge in investment activity comes as foreign ownership in South Korean stocks reached its highest level since 2020 in December.

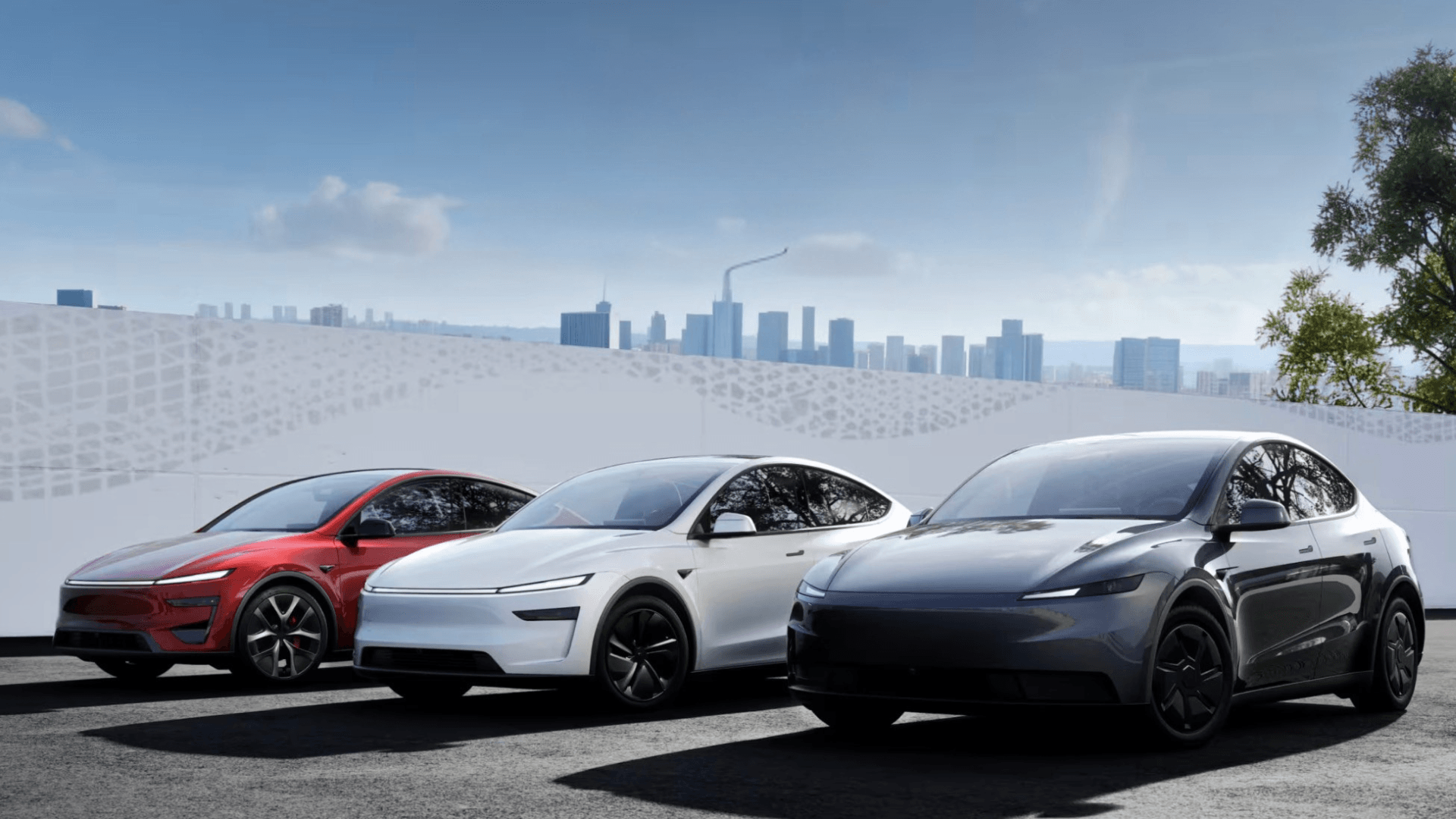

Tesla shares reached a record high of $489.88 in mid-December but fell 11% to $435.80 by early January. Fourth-quarter 2025 deliveries dropped 16% year-over-year to about 418,000 vehicles, falling short of market expectations. Annual deliveries declined 8.6% to 1.64 million units, ceding the global EV sales crown to China's BYD.

The investment surge comes despite Tesla's price-to-earnings ratio of nearly 300 and forward P/E of 192. Korean investors net-bought $374.16 million in Tesla shares and $281.04 million in Direxion Daily TSLA Bull 2X Shares, a leveraged ETF tracking twice Tesla's stock gains, according to Korea Securities Depository data through January 8.

Wall Street analysts remain sharply divided on Tesla's outlook. Wedbush Securities analyst Dan Ives set a $600 target price, predicting Tesla could capture 70% of the global autonomous driving market over the next decade. Baird analyst Ben Kallo maintained a $548 target citing robotaxi expansion and new vehicle launches.

Conversely, Morningstar assigned a $300 target, arguing the robotaxi business is overvalued. Tesla's EV segment, which generates most revenue and profits, faces continued challenges with 2026 delivery forecasts cut to 1.8 million units from 3 million projected two years ago.

Korean retail investors appear focused on Tesla's robotics and AI initiatives rather than traditional automotive metrics. The company plans to unveil and mass-produce its third-generation Optimus humanoid robot in the first quarter of 2026, with robotaxi production also scheduled for this year. This focus on AI technology aligns with broader industry trends, including Google's recent launch of a Universal Commerce Protocol for AI shopping agents.

Tesla CFO Vaibhav Taneja warned of substantially increased capital expenditures in 2026 for AI initiatives including Optimus investments. The company expects to spend around $9 billion in 2025 with significant increases planned for next year.

Competition in the autonomous ride-sharing space intensified when Nvidia announced its robotaxi entry on January 5, causing Tesla shares to drop over 4%. Alphabet, Amazon, Rivian, Lucid, and BYD all have self-driving initiatives underway, while Uber and Lyft partner with multiple autonomous technology providers.

DS Investment & Securities analyst Choi Tae-yong projects Tesla will generate about 70% of robotics operating profit by 2030 from high-margin software subscription models. This shift could re-rate Tesla as an AI platform beyond traditional manufacturing valuations.

Tesla's fourth-quarter earnings announcement scheduled for January 29 will provide concrete details on business strategy and long-term outlook, according to reports. The company's stock has declined 3.1% since the start of 2026, continuing its adjustment from December highs.

Individual investor Lee, a 29-year-old Seoul office worker, invested half his year-end bonus in Tesla. "I judge that Tesla, beyond being an electric vehicle company, is now a leading stock that will drive the robot market," he said, planning to hold shares long-term.

The divergence between retail optimism and institutional caution highlights Tesla's transition from automotive manufacturer to robotics and AI platform. Korean investors' concentrated bets suggest confidence in this strategic pivot despite near-term financial headwinds. As the EV market continues to evolve, infrastructure developments like Brooklyn's new 88-space EV charging depot with battery storage demonstrate the ongoing expansion of charging networks that support broader EV adoption.