U.S. stocks opened 2026 with mixed performance as major indexes diverged on January 2. The S&P 500 gained 0.2 percent to 6,858.47 while the Dow Jones Industrial Average added 319.10 points, or 0.7 percent, to 48,382.39.

The Nasdaq composite slipped 6.36 points, less than 0.1 percent, to 23,235.63, weighed down by losses in Microsoft and Tesla shares. Smaller companies outperformed with the Russell 2000 index rising 26.32 points, or 1.1 percent, to 2,508.22.

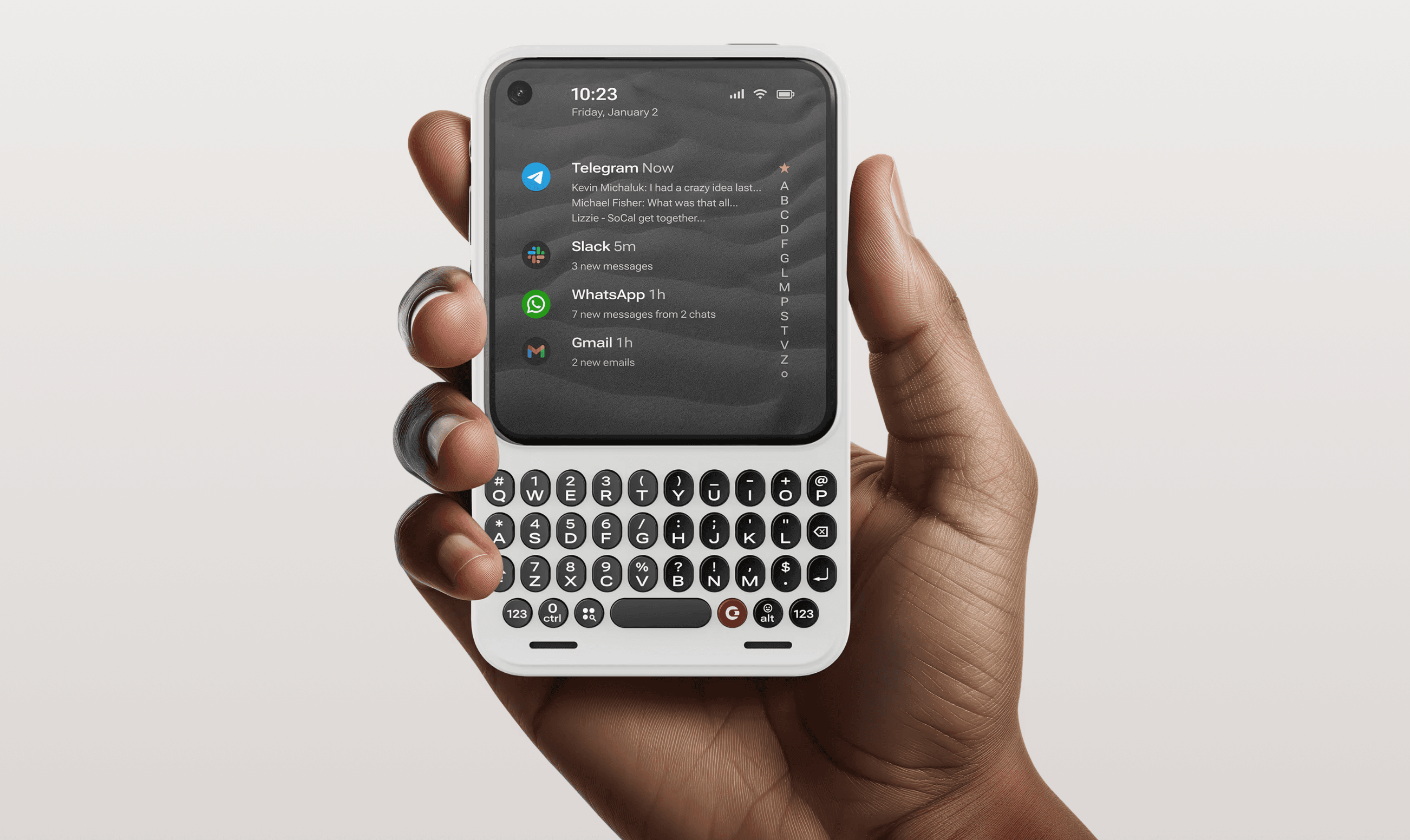

Wall Street's focus on the technology sector and artificial intelligence expansion drove much of the up-and-down market action, according to Associated Press reports. Companies with outsized valuations created the up-and-down movements that characterized the trading session.

Foreign markets showed stronger momentum with benchmarks in Britain and South Korea reaching record highs. The divergence highlighted global economic trends as U.S. investors assessed year-opening positions.

For the week, major indexes remained in negative territory. The S&P 500 declined 1 percent, the Dow fell 0.7 percent, and the Nasdaq dropped 1.5 percent. The Russell 2000 also decreased 1 percent.

The January 2 performance followed a strong 2025 where the S&P 500 gained more than 16 percent. Market analysts continue monitoring technology sector dynamics and AI adoption as key drivers for 2026 market direction.

Trading volume reflected typical post-holiday patterns with investors positioning for the new year. The mixed opening session suggests continued focus on earnings expectations and economic indicators through January.