Uber has identified Madrid as a key European target for its robotaxi expansion, positioning the Spanish capital among 15 cities slated for autonomous ride-hailing services by year-end.

The company's Madrid plans emerge alongside a $300 million investment in electric vehicle maker Lucid and partnerships with autonomous technology firms Nuro and Baidu. Uber aims to deploy over 20,000 robotaxis globally within six years through these collaborations.

Madrid joins London, Munich, Hong Kong, Houston, and Zurich among priority markets for Uber's autonomous push.

The company plans gradual rollouts starting with limited pilot schemes in controlled zones before expanding service areas.

CEO Dara Khosrowshahi has characterized autonomous vehicles as a "trillion-dollar-plus" business opportunity, with Asia-Pacific markets driving the next growth phase. Uber now works with more than 20 autonomous vehicle partners including China's Baidu, WeRide, and Pony.ai.

Spain's regulatory approach remains cautious, with authorities expected to require strict safety testing, data oversight, and insurance frameworks before commercial services can operate.

Any Madrid deployment would depend on Spanish and EU regulatory approval alongside infrastructure readiness.

Uber's model combines autonomous vehicles with remote supervision and support systems, maintaining human oversight particularly during early operational stages. The company emphasizes that robotaxis will be introduced gradually rather than through immediate widespread deployment.

The autonomous push comes as Uber appointed Balaji Krishnamurthy as its new chief financial officer, signaling increased focus on self-driving investments. Despite this strategic shift, Uber shares dipped 6% earlier this week following weaker-than-expected profit guidance.

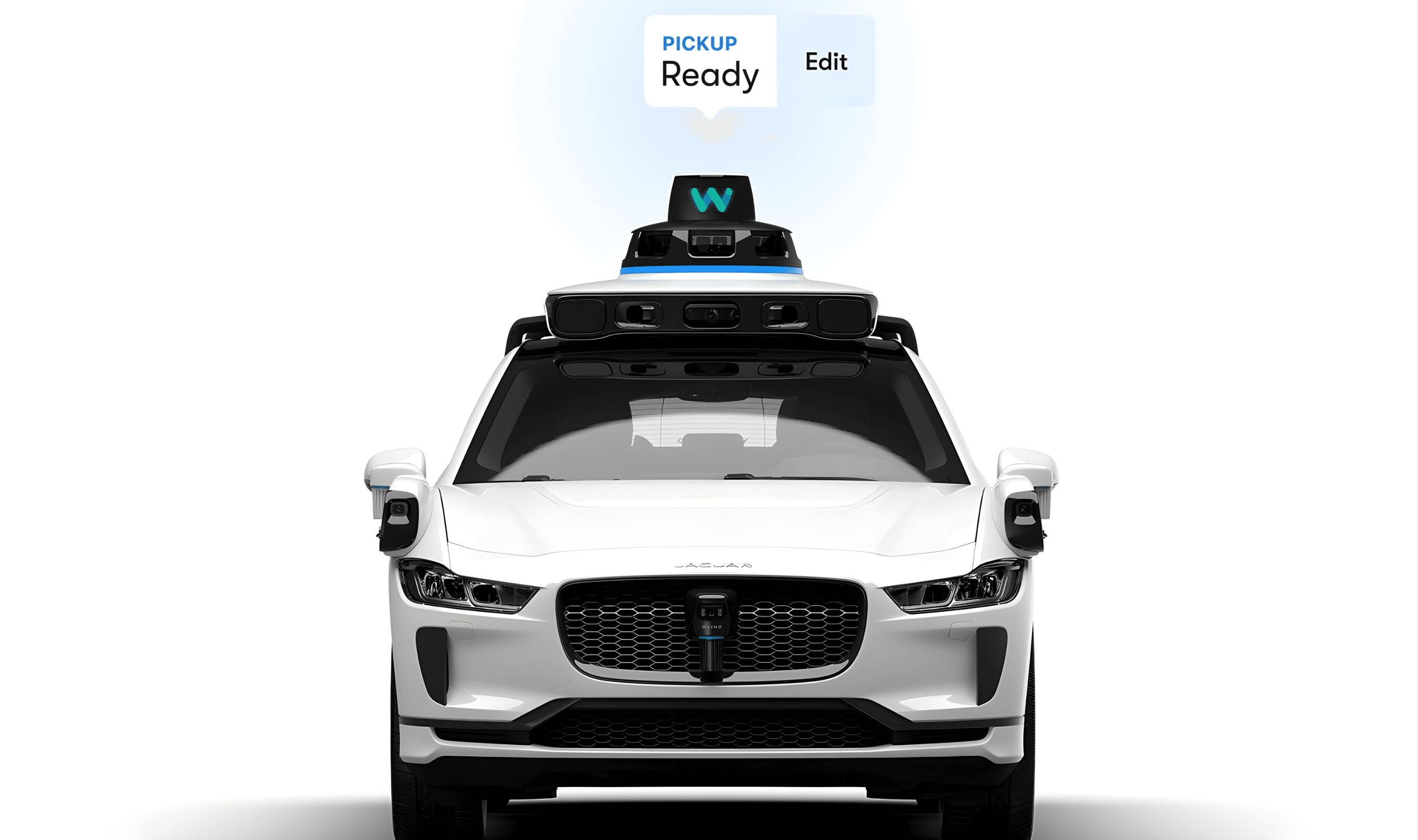

Global robotaxi market projections show significant growth potential, with some estimates suggesting expansion from $0.4 billion in 2023 to $45.7 billion by 2030 at nearly 92% annual rates. Uber's partnerships position it to compete against established autonomous players like Waymo and Tesla.

In the United States, Waymo robotaxis are already available through Uber's app in Phoenix, while Motional launched public robotaxi services in Las Vegas last year. European expansion follows these North American deployments.

Madrid's dense urban layout, strong public transport network, and growing tech ecosystem make it suitable for early European trials.

The city represents Uber's strategic positioning in major European capitals preparing for next-generation transport technology.

Industry analysts suggest widespread European robotaxi deployment remains several years away, but pilot programs in selected cities are likely to expand over the coming years. Spain is monitoring global autonomous vehicle developments as it considers how driverless transport fits into national mobility strategies.

Uber's autonomous vehicle partnerships extend beyond ride-hailing to include delivery services, with the company exploring how self-driving technology can transform both passenger and logistics operations across its platform.