Nvidia is in advanced negotiations to acquire Israeli AI startup AI21 Labs for $2-3 billion, according to reports from Israeli financial daily Calcalist. The deal would mark the chipmaker's fourth acquisition in Israel and its second largest after its 2019 Mellanox purchase.

AI21 Labs was last valued at $1.4 billion during a 2023 funding round that included participation from both Nvidia and Alphabet's Google. The startup, founded in 2017 by Amnon Shashua and two others, develops large-scale language models for artificial intelligence applications.

Nvidia's primary interest in the acquisition appears to be AI21's workforce of approximately 200 employees, most holding advanced academic degrees with rare expertise in AI development. The reported $2-3 billion price tag represents about $10-15 million per employee.

The talks have advanced significantly in recent weeks and reached Nvidia's most senior levels, according to Calcalist. AI21 had reportedly been open to a sale for some time and was previously considered a potential acquisition target for Google.

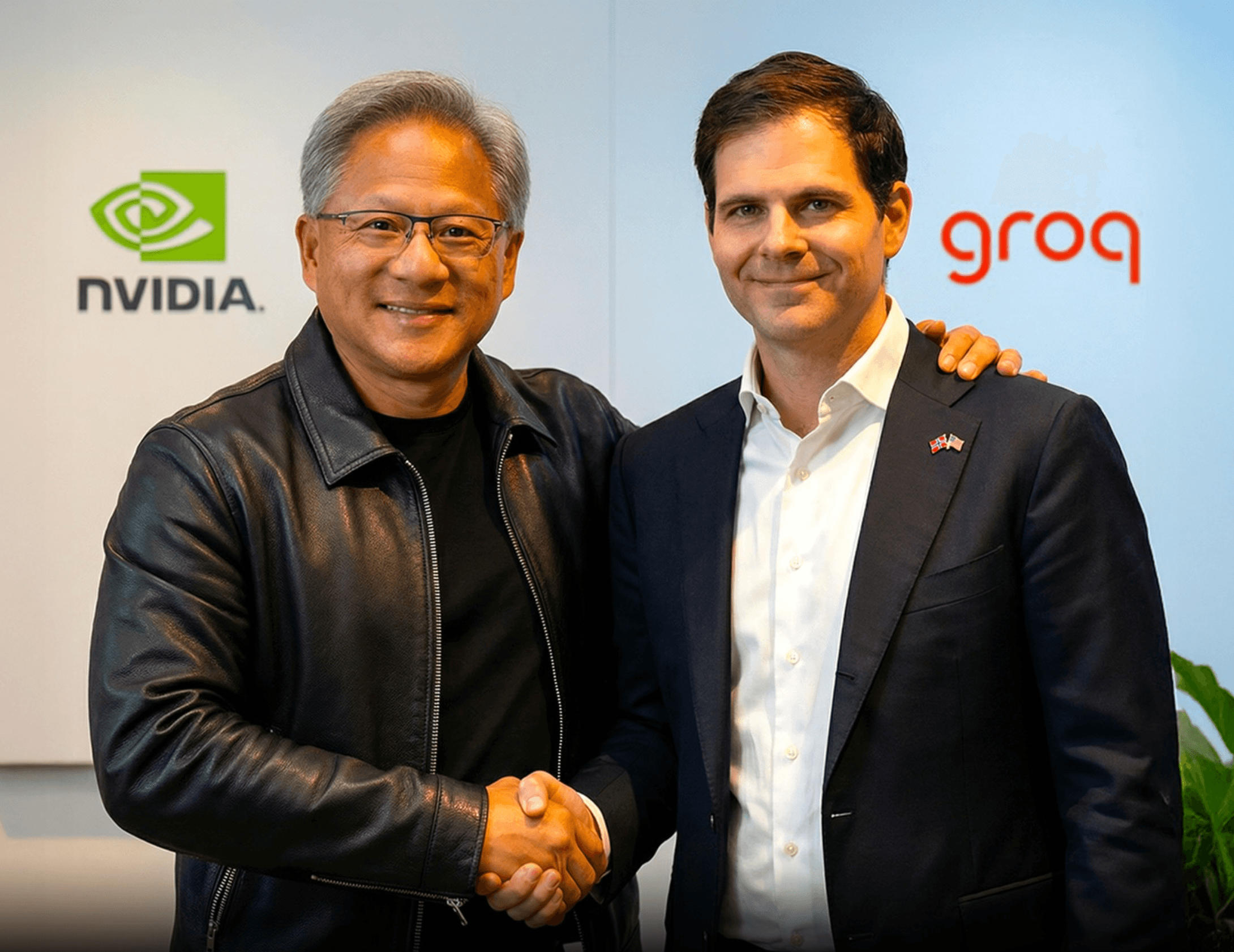

The potential acquisition aligns with Nvidia's broader Israeli expansion plans. The company is developing a new research and development campus in Kiryat Tivon, south of Haifa, that could eventually employ up to 10,000 people. CEO Jensen Huang has described Israel as Nvidia's "second home."

Construction on the 160,000-square-meter campus is expected to begin in 2027, with initial occupancy targeted for 2031. The facility will include office space, parks, and common areas across 90 dunams (22 acres), inspired by Nvidia's Santa Clara, California headquarters.

The AI21 deal comes amid a surge in large-scale AI transactions as companies race to secure talent and infrastructure. Earlier this week, SoftBank Group agreed to acquire digital infrastructure investor DigitalBridge Group for about $4 billion.

Last week, Nvidia agreed to acquire assets from Groq and license its inference technology in a deal CNBC reported could be worth around $20 billion. The agreement includes hiring Groq's founder and senior leaders but does not constitute a full acquisition of the company. The company also finalized a $5 billion purchase of Intel shares this week as part of a larger tech partnership.

AI21 has faced challenges keeping pace with major AI players. The company paused development of its consumer-facing AI reading and writing assistant Wordtune earlier this year. Calcalist reported that AI21 had been struggling to match advances by larger competitors.

Nvidia declined to comment on the acquisition talks, while AI21 was not immediately available for comment. The chipmaker's stock has risen 40% so far in 2025, maintaining its position as the world's most valuable company at over $4 trillion.

Analysts at Citi, Truist, Stifel, and UBS have recently reiterated "Buy" ratings on Nvidia, citing its cash position, earnings momentum, and expanding role across both AI training and inference markets.