Nvidia finalized its $5 billion investment in Intel on Monday, acquiring approximately 214.7 million shares at $23.28 each. The transaction gives Nvidia a roughly 4% stake in its long-time rival and follows U.S. Federal Trade Commission clearance earlier this month.

Nvidia shares slipped about 1.3% in pre-market trading after the announcement, while Intel stock remained largely unchanged. The deal represents a private placement that delivers cash directly to Intel's balance sheet rather than through open market purchases.

For Intel, the $5 billion infusion arrives after years of heavy capital expenditure on new fabrication plants and advanced process development. The company reported an $18.8 billion annual loss in 2024, its first since 1986, following execution missteps and intense competition.

Despite an 80% share price recovery this year, Intel remains approximately 50% below its pandemic-era highs. The Nvidia investment combines with a separate $9 billion U.S. government stake acquired in August, bringing recent outside investment to $16 billion.

The partnership centers on NVLink technology integration between Nvidia's AI accelerators and Intel's x86 CPU ecosystem. Intel will design custom data center CPUs specifically for Nvidia platforms and manufacture system-on-chips combining its processors with Nvidia RTX GPU chiplets for consumer devices.

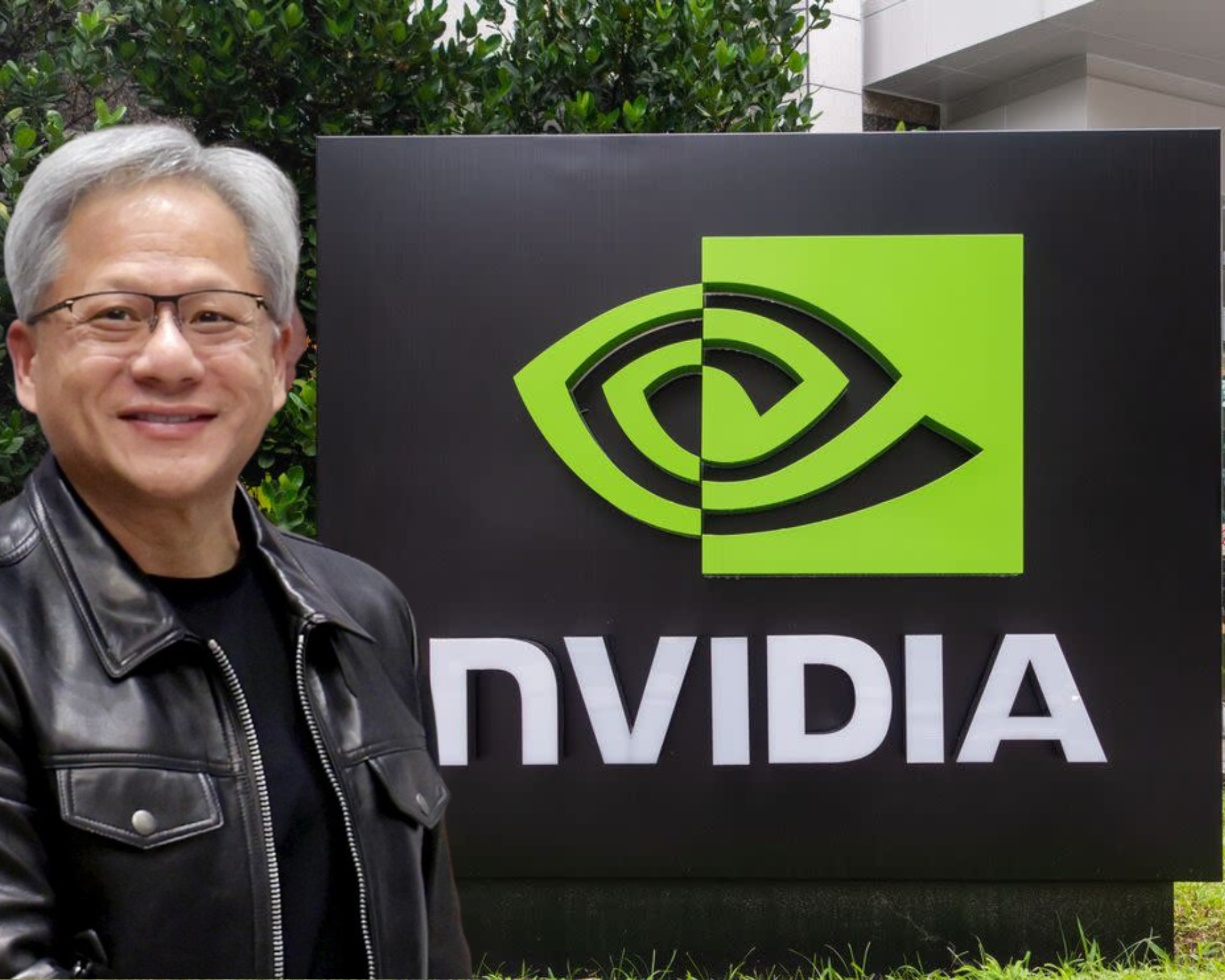

Nvidia CEO Jensen Huang described the collaboration as "a fusion of two world-class platforms" that will "lay the foundation for the next era of computing." The companies plan multi-generation cooperation across both PC and data center markets.

Intel CEO Lip-Bu Tan emphasized that x86 architecture remains foundational to modern computing, with ongoing innovations to support future workloads. The partnership follows reports that Nvidia scrapped plans to produce advanced chips using Intel's 18A manufacturing node.

Analysts note Intel's real inflection point may come with its upcoming "14A" process, expected to enter volume production in 2028. Daniel Newman of Futurum Group argues Taiwan Semiconductor "can't produce enough chips" to meet AI-driven demand, creating opportunities for Intel as an auxiliary capacity provider.

The investment fits within Nvidia's broader $125 billion dealmaking this year, including a nonexclusive license for Groq technology reportedly valued at $20 billion and up to $100 billion committed to OpenAI. Some analysts have raised concerns about vendor financing arrangements, though Nvidia denies relying on such deals for revenue growth.

Wall Street maintains a "Hold" rating on Intel with a mean target price near $37, roughly in line with current trading levels. Nvidia trades at over 35 times sales compared to Intel's approximately 3 times multiple, reflecting divergent market perceptions of their AI positioning.

The AI chip sector is projected to reach $565 billion by 2032, according to MarketsandMarkets research, driven by demand for real-time analytics and advanced models. Both companies aim to capture significant portions of this growth through their combined hardware integration strategy.