Nvidia secured a $20 billion licensing agreement with AI inference specialist Groq on December 24, according to multiple reports. The deal transfers Groq's Language Processing Unit technology and key engineering talent to Nvidia while allowing Groq to continue operating independently.

The arrangement functions as a de facto acquisition without the regulatory scrutiny. Groq stockholders receive cash payments based on the $20 billion valuation, with 85% paid upfront and the remainder distributed through 2026. Approximately 90% of Groq's workforce will join Nvidia, receiving compensation packages that include cash for vested shares and Nvidia stock for unvested equity.

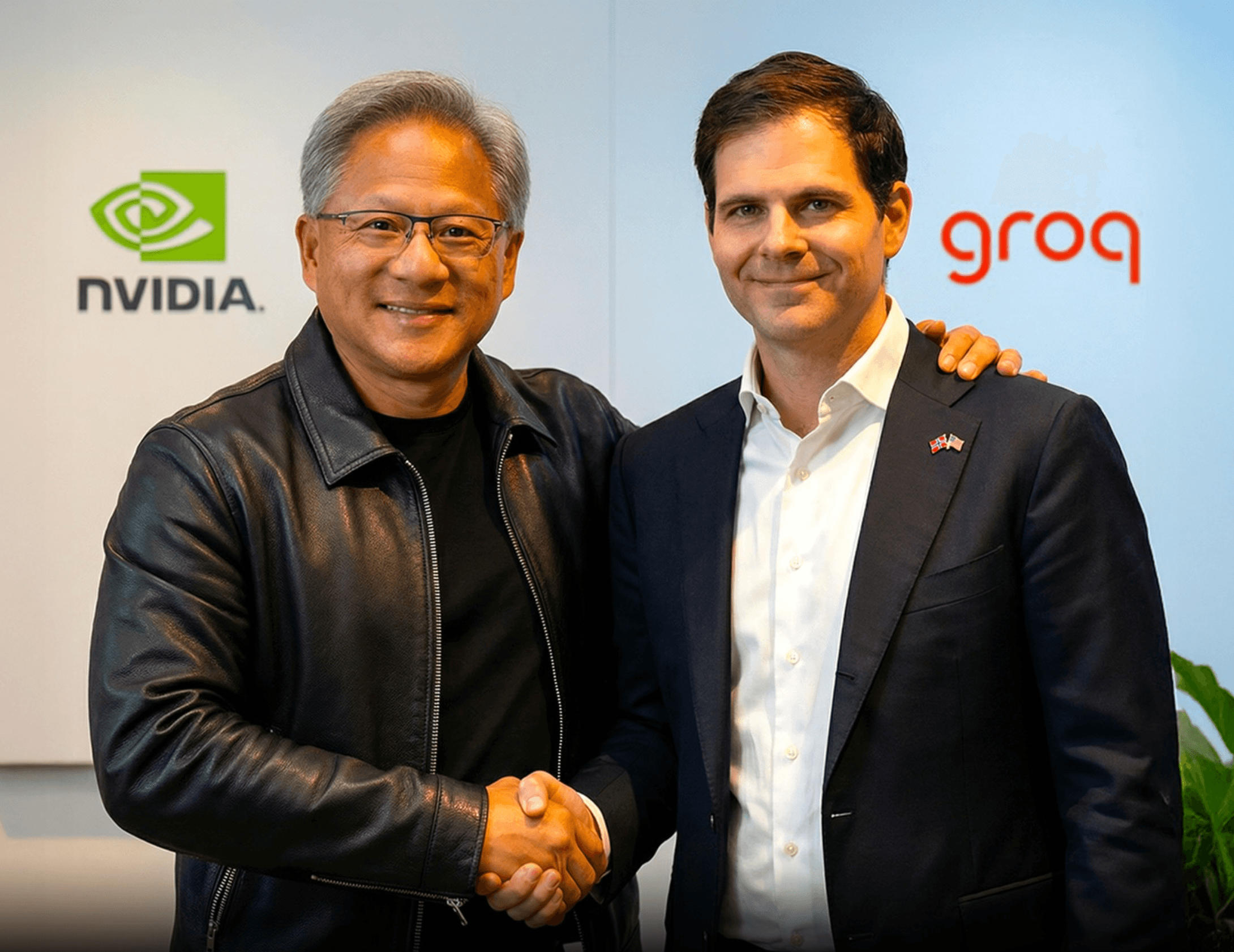

Groq founder Jonathan Ross becomes Nvidia's chief software architect, while former president Sunny Madra takes the role of VP of hardware. Both executives confirmed their new positions on LinkedIn profiles this week. The remaining Groq operations will be led by Simon Edwards, who joined the company as CFO three months ago after serving as finance chief at sales automation vendor Conga.

Nvidia's licensing of Groq's inference-focused chip designs addresses a critical market shift. The AI industry is transitioning from model training to large-scale deployment, creating demand for efficient inference hardware. Groq's LPU architecture executes large language models deterministically with low latency, complementing Nvidia's GPU-dominated training portfolio.

The deal provides Nvidia with memory diversification at a time of supply chain constraints. Nvidia's fastest chips rely on high-bandwidth memory, which faces production limitations and price inflation. Groq's designs integrate static RAM that offers faster performance with lower power consumption and greater availability.

This non-acquisition structure allows Nvidia to sidestep antitrust concerns while gaining immediate access to inference expertise. The company confirmed the arrangement through a statement: "We've taken a non-exclusive license to Groq's IP and have hired engineering talent from Groq's team to join us in our mission to provide world-leading accelerated computing technology."

Industry analysts view the $20 billion valuation as a strategic positioning move rather than a near-term financial play. Bank of America's Vivek Arya noted that Nvidia is "acting like it believes" in the inference market's growth potential. The licensing approach enables selective integration of Groq's designs into future Nvidia products while maintaining commercialization flexibility.

The agreement arrives as Nvidia faces production constraints across its AI chip portfolio. The company's CFO reported during the last earnings call that some chips are "sold out" or "fully utilized," with high-bandwidth memory shortages identified as a contributing factor. Groq's technology could help alleviate these supply chain pressures.

For Groq, the partnership provides validation and access to Nvidia's global distribution network. The company will continue operating its GroqCloud service business independently while benefiting from the licensing revenue. This structure mirrors broader industry trends where Big Tech companies pursue licensing-plus-talent deals to accelerate innovation while navigating regulatory environments.

The December 24 agreement positions Nvidia for the 2026 AI inference market, where performance will be measured by real-world deployment efficiency rather than training benchmarks. As enterprises move AI applications from experimentation to production, the demand for specialized inference hardware is expected to accelerate across customer service, logistics, and autonomous systems sectors.