Memory chip prices surged over the past few months, creating a stark divide between semiconductor manufacturers and consumer electronics companies. A Bloomberg gauge of global consumer electronics makers dropped 12% since September while memory producers including Samsung Electronics gained more than 160%.

The price surge stems from AI infrastructure spending that shifted production toward high-bandwidth memory chips used in data centers. This created shortages in traditional DRAM supplies needed for smartphones, PCs, and gaming consoles.

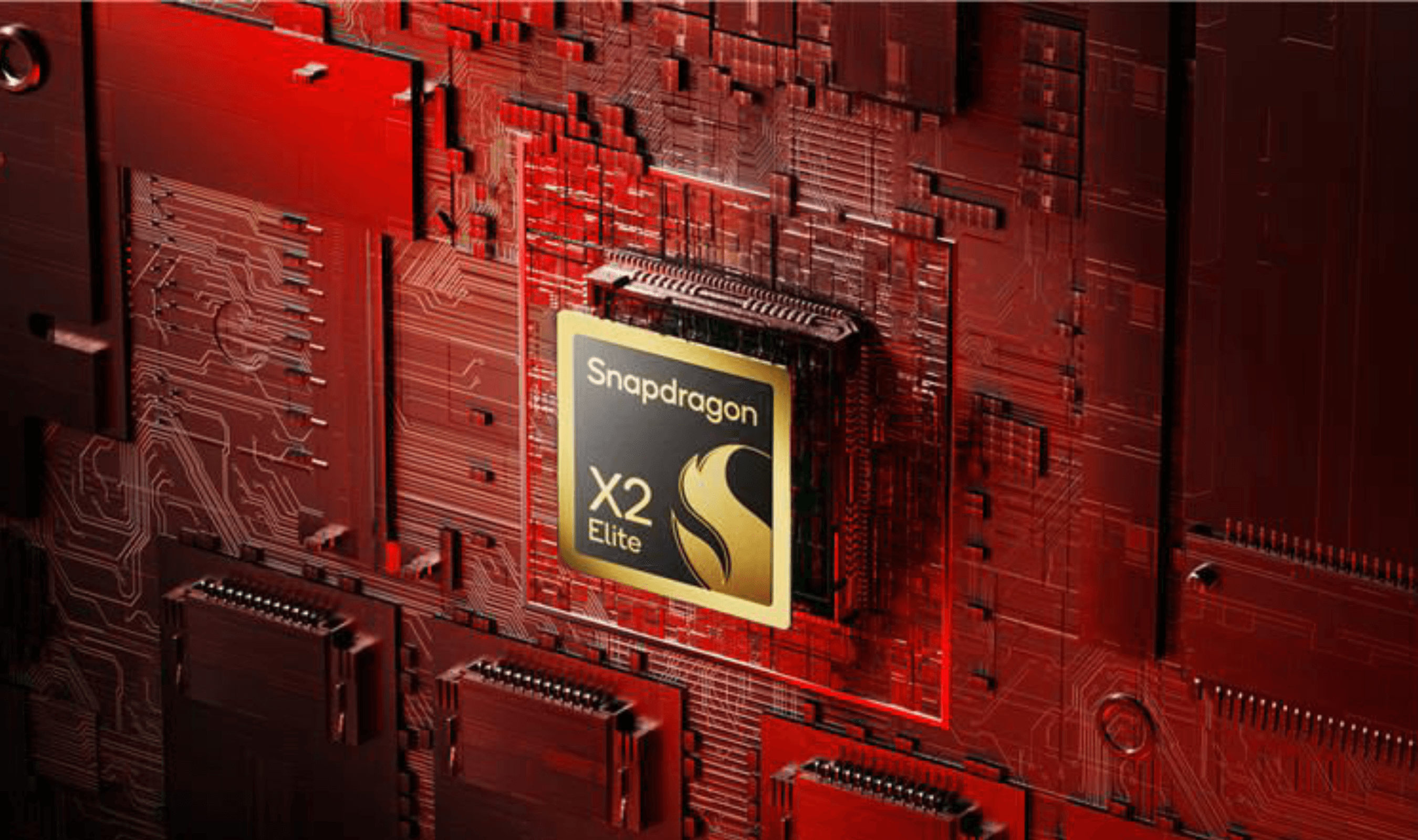

Qualcomm shares fell more than 8% last Thursday after the chipmaker signaled memory constraints would limit phone production. Nintendo dropped the most in 18 months in Tokyo following margin pressure warnings from component shortages.

Swiss peripherals maker Logitech International saw its stock slide around 30% from a November peak as higher chip prices dampened PC demand outlook. Chinese electric vehicle and smartphone makers from BYD to Xiaomi also faced sluggish performance related to chip shortages.

"What remains underappreciated is the risk around duration," said Vivian Pai, a fund manager at Fidelity International. "Current valuations largely factor in that the disruption will normalize within one to two quarters."

Memory chip shortages and pricing dominated recent earnings reports and conference calls. Spot prices for DRAM shot up more than 600% in recent months despite weak demand for end-products like smartphones and cars.

SK Hynix, a key supplier of high-bandwidth memory to Nvidia, gained more than 150% since September in Seoul trading. Japan's Kioxia Holdings and Taiwan's Nanya Technology each rose around 280% in that period, while Sandisk climbed more than 400% in New York.

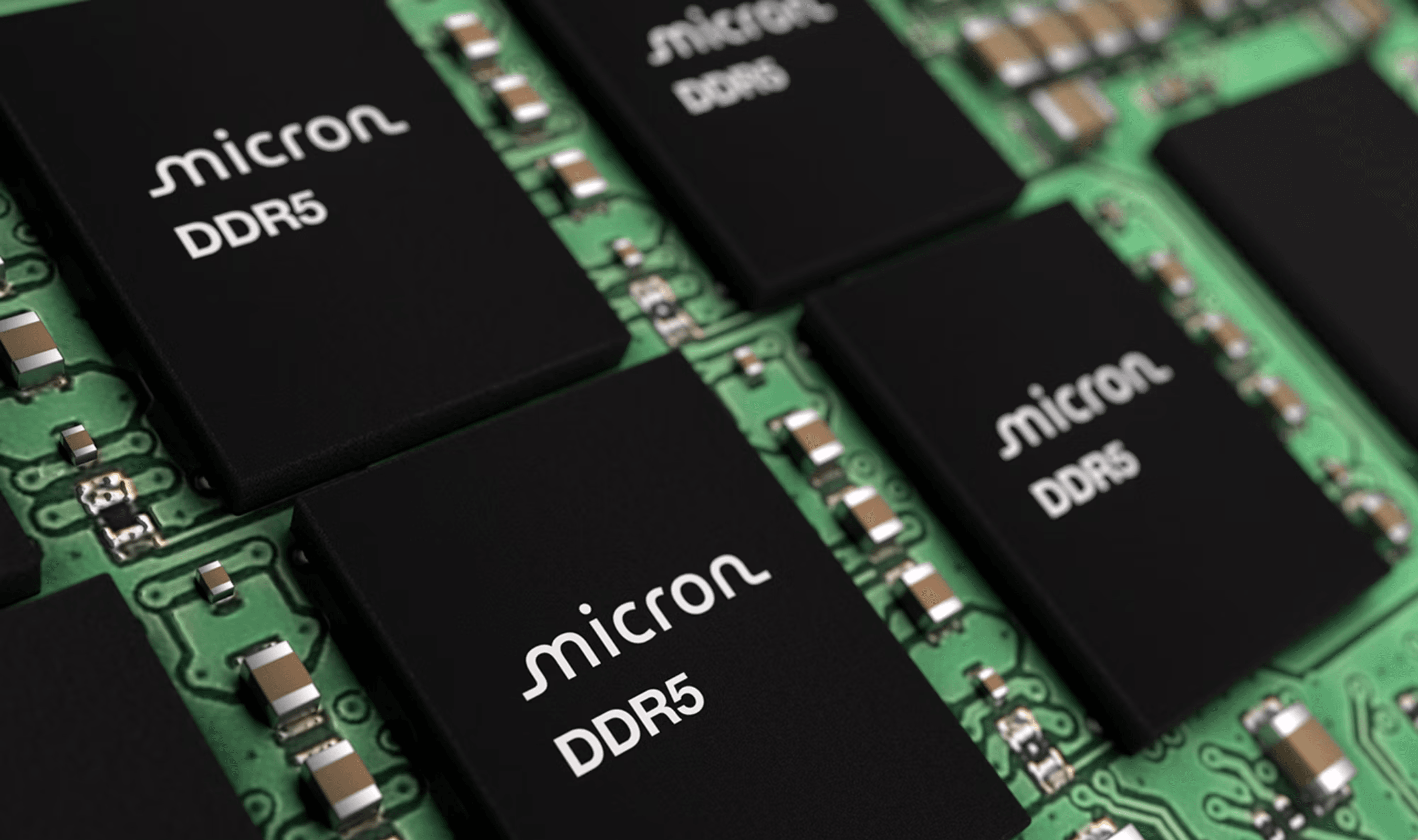

Analysts expect shortages to persist well into 2027 despite production increases from Samsung, SK Hynix, and Micron Technology. Industry expansion plans through 2026 and 2027 reportedly won't bridge the global supply gap.

"Historically, the memory cycle normally lasted three to four years," said Jian Shi Cortesi, a fund manager at GAM Investment Management. "The current cycle already exceeded previous cycles both in length and magnitude."

The AI-driven demand shift created what some analysts describe as a "supercycle," breaking traditional boom-to-bust patterns in memory supply and demand. This has led to unprecedented stock performance divergence between component makers and device manufacturers.