Intel unveiled its first Z-Angle Memory prototype at Intel Connection Japan 2026, marking the company's return to the memory market after exiting in the 1980s. The vertical-stacked memory, co-developed with SoftBank subsidiary SAIMEMORY, targets AI data centers with promises of higher capacity and better thermal performance than current high-bandwidth memory.

The Z-Angle Memory architecture stacks DRAM dies vertically using diagonal "z-angle copper interconnects." This design reportedly improves thermal conductivity by creating a central thermal pillar through the memory chips.

Traditional planar memory designs face thermal limitations at around 16-20 layers, while ZAM's vertical approach addresses these constraints.

SAIMEMORY aims for ZAM to deliver two to three times the capacity of current HBM products while cutting power consumption by 40-50 percent, with reports suggesting it could be up to 60% cheaper to produce than HBM. The memory could pack up to 512GB per chip, according to early reports from Wccftech. SoftBank is investing approximately 3 billion yen ($19 million) during the prototype development phase, with Intel contributing its Next Generation DRAM Bonding technology rather than capital.

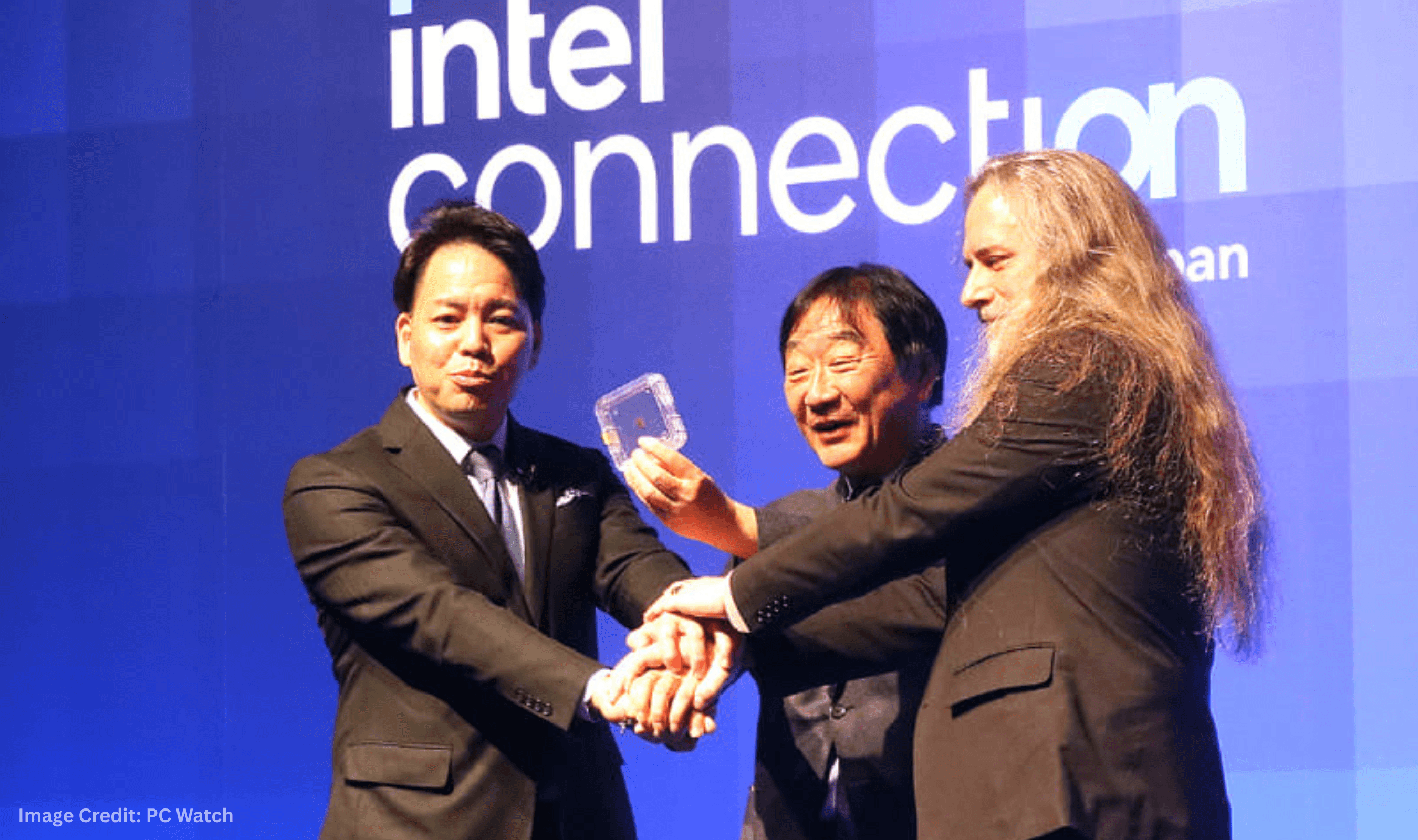

Intel Japan CEO Makoto Ono and Intel Government Technologies CTO Joshua Fryman presented the prototype alongside SAIMEMORY executives at the Tokyo event. The joint venture, founded in December 2024 and launched in June 2025, includes the University of Tokyo as a partner alongside SoftBank and Intel.

Other companies cooperating on ZAM include Japanese IT hardware and services firm Fujitsu; PowerChip Semiconductor Manufacturing (recently acquired by Micron); Shinko Electric Industries; and the University of Tokyo.

Prototype development is scheduled for 2027 with commercialization targeted for 2029-2030. The timeline positions ZAM to compete against HBM4, the next generation of high-bandwidth memory currently dominated by Samsung, SK Hynix, and Micron. Intel's NGDB technology aims to bridge the gap between HBM and conventional DDR DRAM while delivering better energy efficiency.

The memory shortage affecting AI data centers has driven up HBM prices and constrained supply. Data center builders have consumed available HBM production, forcing memory manufacturers to prioritize HBM over consumer products like DDR5 DIMMs and NVMe SSDs.

ZAM represents Intel's attempt to create an alternative supply chain for high-performance memory.

This move follows Intel's $559 million write-off from shutting down its Optane memory business in July 2022. The company has undergone significant restructuring under CEO Lip Bu-Tan, including layoffs and a 10 percent stake acquisition by the U.S. government earlier this year.

"a disruptive challenge" addressing heat dissipation, performance, and supply issues.

SAIMEMORY President Hideya Yamaguchi described the initiative as such. The company plans to leverage both domestic and international investors and supply chain partners beyond its current collaboration with Intel and SoftBank.