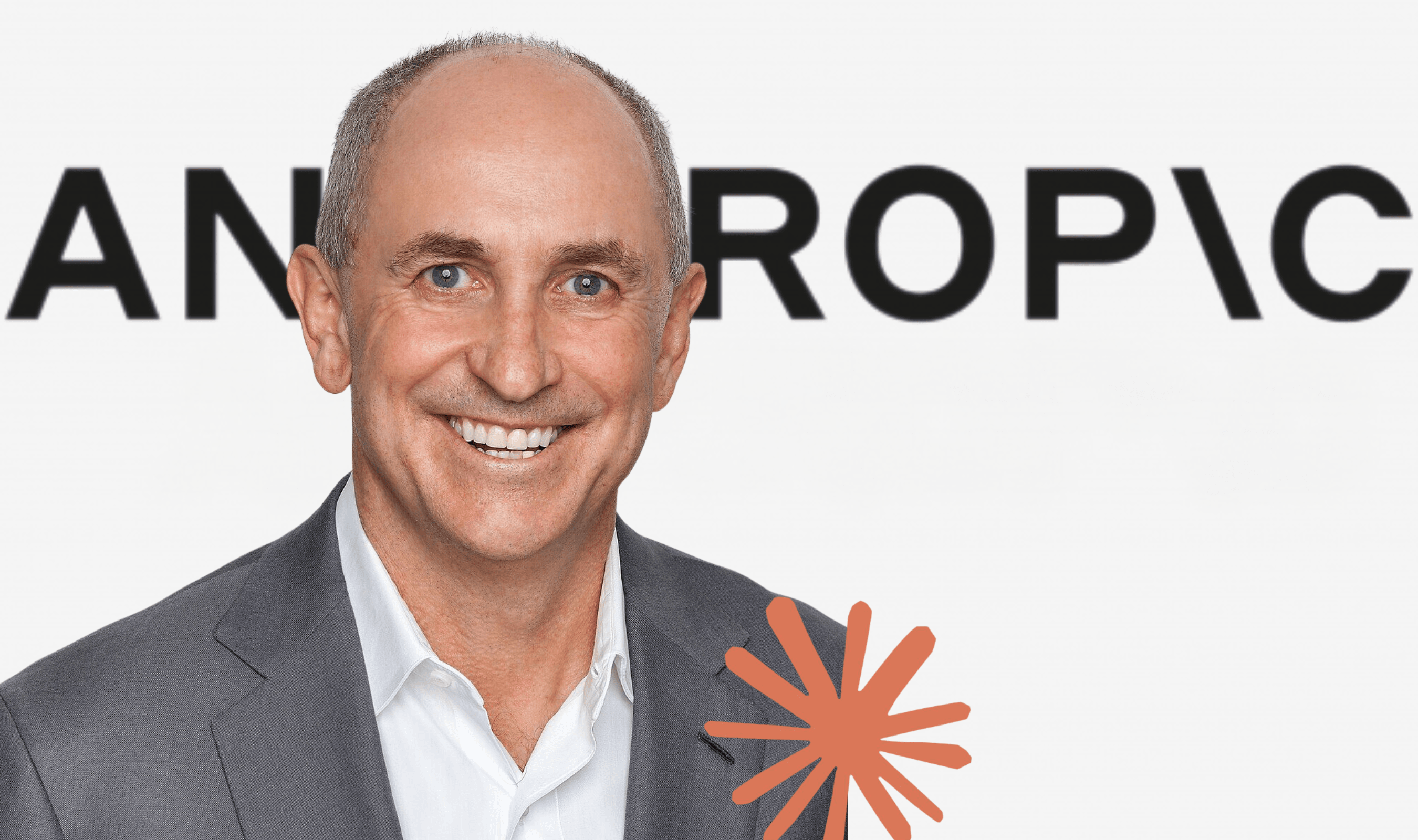

Anthropic appointed former Microsoft CFO Chris Liddell to its board Friday. The AI company gains corporate governance expertise ahead of a potential public offering.

Liddell served as Microsoft's chief financial officer from 2005 to 2009. He oversaw the software giant's transition to cloud computing. The New Zealand native later moved to General Motors.

At GM, he helped execute the automaker's $23 billion New York Stock Exchange listing in 2010. That IPO ranked as the largest at the time. Liddell also completed a full term as deputy White House chief of staff during President Donald Trump's first administration.

He was one of few senior Trump appointees to serve all four years. Anthropic's valuation reached $61.5 billion after a $3.5 billion funding round in early 2025. The company's annualized revenue reportedly passed $2 billion.

Total funding exceeds $10 billion. Amazon committed up to $8 billion as the largest single outside investor.

"My career has taught me the governance of transformative technologies matters as much as the technologies themselves," Liddell said.

He added, "Anthropic's approach, building AI that's both capable and responsible, is critical for our future." Daniela Amodei, Anthropic's co-founder and president, noted Liddell's experience at "the intersection of technology, public service, and governance."

She cited his track record of helping organizations navigate high-stakes situations. The board addition comes as Anthropic faces increasing scrutiny over AI safety and governance.

The company operates as a public benefit corporation with a Long-Term Benefit Trust. This structure requires balancing profit objectives with broader societal considerations.

Liddell's experience with GM's post-bankruptcy IPO suggests Anthropic is building institutional infrastructure for future expansion. The move follows boardroom turmoil at OpenAI in late 2023. That incident prompted industry-wide examination of AI company governance.

Founded in 2021 by former OpenAI executives Dario and Daniela Amodei, Anthropic has positioned itself as a safety-focused alternative to competitors. Recent resignations over safety concerns at OpenAI highlight ongoing governance challenges in the AI industry.

The company's Claude chatbot has gained traction among enterprise customers. It competes with OpenAI's ChatGPT and Google's Gemini models. OpenAI recently retired its GPT-4o model from ChatGPT due to safety concerns and low adoption.

Earlier this month, Anthropic released a "co-work" plug-in for Claude capable of handling legal tasks. The announcement sparked concerns among legal software providers. They worry about AI encroaching on professional services.

The AI startup has expanded its Washington presence, increasing lobbying activity. It positions itself as a leading voice in AI safety discussions.

Liddell's government relations experience could prove valuable as regulators worldwide develop AI oversight frameworks. Anthropic is predicted to be one of three major Wall Street listings this year.

SpaceX and OpenAI are also tipped for IPOs. Building a board with public-company experience represents a prerequisite for that process. Liddell's IPO background makes him particularly relevant.

The company's investor base includes Amazon as its largest single outside backer. Google, Microsoft, and Nvidia are among smaller stakeholders. This places Anthropic at the intersection of major tech players while maintaining operational independence.

Liddell's appointment reflects a broader trend of AI companies adding experienced corporate directors as they mature. OpenAI has restructured its board multiple times. Google's AI efforts benefit from Alphabet's established governance systems.

Smaller AI firms have also begun recruiting board members with backgrounds in regulated industries and finance. The move underscores that AI development has evolved beyond purely technical challenges.

Managing billions in capital requires boardroom expertise. Navigating international regulatory frameworks demands governance experience.

Maintaining dual mandates of safety and profitability needs sophisticated leadership. Anthropic's decision arrives during intense competition in enterprise AI.

OpenAI, backed by Microsoft, dominates market attention while expanding enterprise offerings. Google has integrated Gemini across its product suite. Meta has pursued an open-source strategy with its Llama models.

In this competitive environment, Anthropic's success depends not only on model quality. Building durable enterprise relationships matters.

Making strategic resource allocation decisions is crucial. A board member who has occupied the CFO position at two of the world's largest corporations brings perspective on these challenges.

The appointment sends several signals to the market. First, Anthropic is treating financial infrastructure and governance with the same seriousness as technical research. This message resonates with institutional investors.

Second, the company is preparing for operational complexity that extends beyond language model development. Third, leadership recognizes that long-term success depends as much on corporate strategy as on technological capabilities.

By bringing Liddell into the boardroom, Anthropic makes a calculated bet. Traditional corporate governance discipline can coexist with its ambitious, safety-focused mission.

The move may be remembered as a turning point. Anthropic evolves from research laboratory to fully realized commercial enterprise.