South Korean display manufacturers completed their strategic pivot from LCD to OLED production in 2025, cementing the technology's dominance in premium displays. Samsung Display exited the LCD business entirely in the first half of 2022, while LG Display halted large LCD panel production in April 2025.

OLED panels now generate nearly all revenue for Samsung Display and reached a record 65% share for LG Display in the third quarter of 2025. The shift reflects fundamental technical advantages that address LCD's persistent limitations.

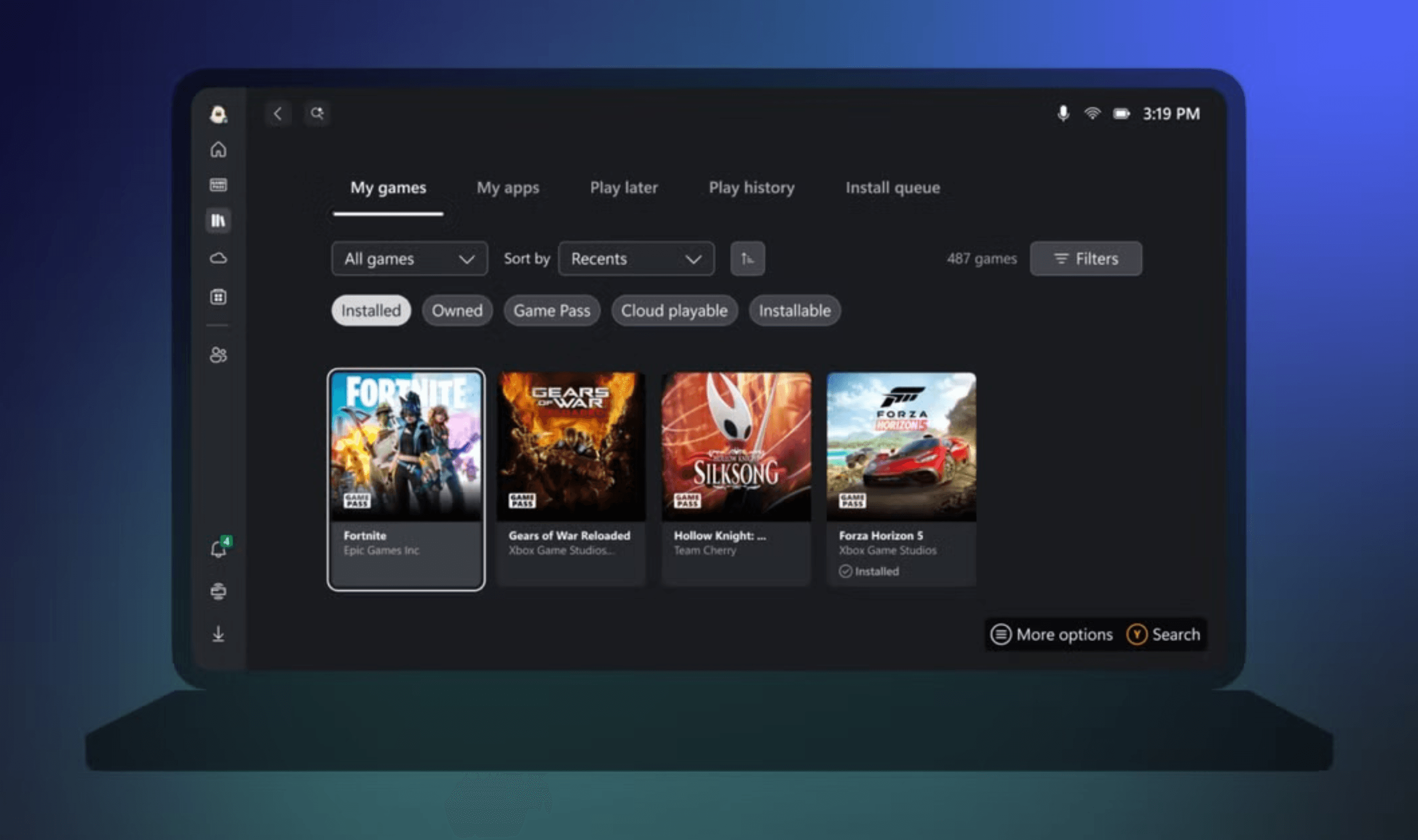

OLED technology uses individually self-emissive pixels instead of LCD's LED backlighting system. This eliminates light bloom and delivers unbeatable black levels with near-perfect contrast ratios. The architecture also enables faster response times, with gaming monitors now reaching 240Hz refresh rates at 0.03ms response times.

Early OLED televisions carried premium price tags approaching $10,000, but expanded production and competition triggered a price collapse. AOC now offers 27-inch QD-OLED gaming monitors for $400, while Samsung's 65-inch S90F OLED TV dropped to $1,399 from $2,499.

The 2025-2026 panel price crash democratized what was once exclusive technology. Market research firm Omdia projects 6.1% OLED market growth in 2026 despite a 2% overall display market decline. South Korea maintains 92.4% global share in large OLED panels, with all television OLED production concentrated in the country.

Gaming and television applications drive adoption. Samsung's S90F OLED TV supports 144Hz refresh rates with four HDMI 2.1 ports for 4K 165Hz gaming. LG's UltraGear 32-inch monitor switches between 4K 240Hz and FHD 480Hz modes for different gaming scenarios.

Memory semiconductor shortages present challenges for display manufacturers. The AI-driven demand for memory semiconductors has increased DRAM prices by 45-50% in late 2025, with further 55-60% increases projected for early 2026, according to TrendForce. This pressures display pricing as memory accounts for 18% of smartphone manufacturing costs.

Chinese manufacturers BOE and CSOT prepare to enter the 8.6-generation IT OLED market, threatening South Korea's technological lead. Samsung Display commenced mass production of 8.6-generation panels in 2025, targeting 10% IT panel market share by 2030.

The smartphone market transitioned from 40% LCD to 60% OLED ratio, while automotive OLED shipments are projected to increase 63% to 5.2 million units in 2026. Omdia estimates the global OLED market will grow from $50.2 billion in 2026 to $63.1 billion by 2030, while LCD declines from $77.8 billion to $73.3 billion.

Major sporting events including the 2026 Winter Olympics, World Baseball Classic, and North America World Cup are expected to drive premium OLED television sales. The technology's superior motion handling and contrast ratios make it ideal for sports viewing.

OLED's technical advantages over LCD have proven decisive for manufacturers. Self-emissive pixels provide lighting and color control that eliminate LCD's viewing angle limitations and contrast issues. As production scales and prices continue falling, OLED establishes itself as the baseline for premium displays across television, monitor, and mobile applications.