Chinese tech giants ByteDance and Alibaba have started preliminary discussions with Nvidia about acquiring its powerful H200 AI chips, according to multiple sources familiar with the matter. This comes just after U.S. President Donald Trump announced he would allow the advanced semiconductors to be exported to China under certain conditions.

The move represents a shift in the ongoing tech cold war between Washington and Beijing, and it's creating some genuinely weird dynamics in the global chip market.

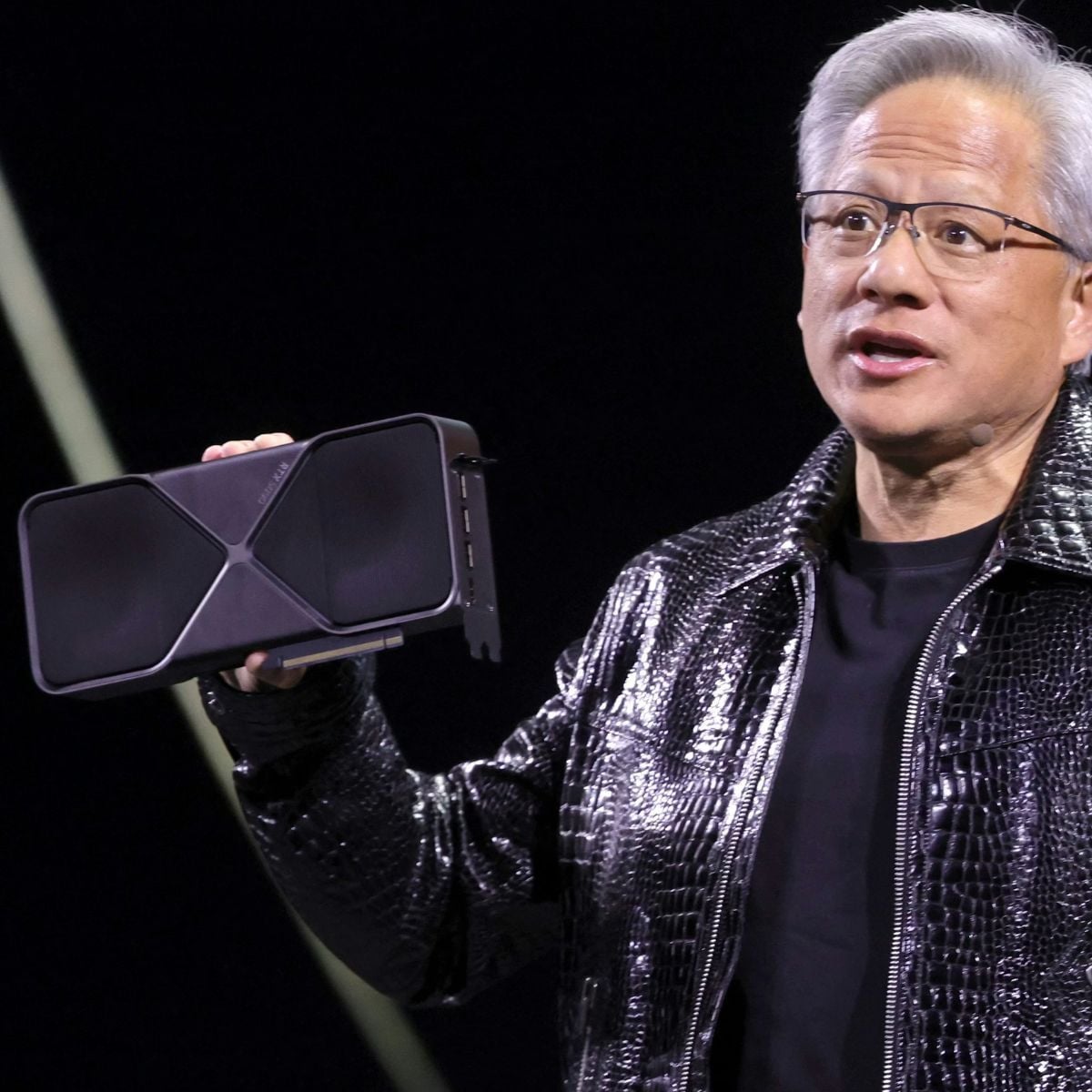

The H200 is almost six times more powerful than the H20, which was previously the most advanced AI chip Nvidia could legally sell to Chinese companies. That performance gap explains why Chinese firms are reportedly so eager to get their hands on the new hardware.

The supply squeeze and Beijing's balancing act

Despite the apparent green light from Washington, there are several layers of complexity here. First, Nvidia is currently producing very limited quantities of the H200, according to sources familiar with the company's supply chain. The chip giant has been focusing instead on its most advanced Blackwell and upcoming Rubin architectures.

Second, and perhaps more importantly, Beijing hasn't actually given its own approval yet. Chinese authorities are expected to review purchase requests and may require companies to provide detailed use cases for the chips. This creates a strange situation where the U.S. has said yes, but China hasn't.

The Chinese government has been walking a tightrope on this issue for months. On one hand, they've been pressuring domestic tech firms to reduce reliance on American technology and support local alternatives from companies like Huawei and Cambricon. On the other hand, they recognize that Chinese AI development still heavily depends on Nvidia's hardware.

"The training of leading Chinese AI models still relies on Nvidia cards," said Zhang Yuchun, a general manager at Chinese cloud service provider SuperCloud's solution and ecology units. "I expect the leading Chinese tech companies to buy a lot although in a low-key manner."

The grey market scramble

What's particularly interesting is that this isn't the first time Chinese entities have tried to get their hands on H200 chips. According to a Reuters review of more than 100 tenders and academic papers, elite Chinese universities, data center firms, and even entities affiliated with China's military have been attempting to procure H200 chips through grey-market channels.

This underground demand highlights just how critical these chips are for AI development. Chinese domestic alternatives, while improving, are reportedly more suitable for inference tasks rather than the computationally intensive training of large language models.

The policy reversal creates an unusual technical situation too. Older and less powerful Nvidia AI chips like the A100 and H100 - two popular models in China - still fall under U.S. export controls, but the more powerful H200 doesn't. That's because Trump's announcement specifically addressed the H200, creating what one source described as a "strange situation" in the export control landscape.

What happens next?

The immediate question is whether Beijing will actually approve these purchases. Chinese regulators recently gathered representatives from companies including Alibaba, ByteDance, and Tencent to assess their demand for the H200, according to The Information. Officials told the companies they would be informed of Beijing's decision soon.

There's also the matter of precedent. Earlier this year, Beijing was pressuring Chinese tech firms to justify why they needed Nvidia's H20 chips instead of local alternatives. Some companies were reportedly considering reducing orders in response to government pressure.

Meanwhile, Chinese companies have been stockpiling Nvidia chips ahead of anticipated restrictions. In April, reports indicated that ByteDance, Alibaba, and Tencent aimed to secure around one million H20 chips - roughly a full year's supply - before the U.S. implemented new curbs.

The bottom line? Everyone wants these chips, but nobody's quite sure how this will play out. Nvidia gets potential access to a massive market, Chinese companies get the hardware they need for AI development, and both governments get to claim strategic victories. The only certainty is that the global AI arms race just got another complicated layer.