SoftBank's quarterly earnings report arrives Thursday with OpenAI paper gains expected to lift results, but investor attention shifts to funding capacity for additional $30 billion AI commitments.

The Japanese conglomerate invested over $30 billion in OpenAI during 2025, securing approximately 11% ownership. A December investment tranche of $22.5 billion should generate $4.45 billion in paper gains, according to BTIG analyst Jesse Sobelson.

SoftBank now functions as a public market proxy for the privately held AI company, creating concentration risk that concerns analysts.

"The reality for SoftBank shareholders is that their fortune is tied with OpenAI,"

said Rolf Bulk, head of semiconductor and infrastructure research at Futurum Equities.

Discussions continue about investing up to $30 billion more in OpenAI's latest funding round. This potential commitment raises questions about SoftBank's financing strategy after recent asset sales and increased use.

To fund its AI ambitions, SoftBank sold its remaining $5.8 billion Nvidia stake and reduced T-Mobile holdings for $9.17 billion during the September quarter. The company's loan-to-asset ratio reportedly jumped to 21.5% in December from 16.5% three months earlier.

Nomura senior credit strategist Shogo Tono calculated that even valuing OpenAI at $830 billion, the target for the current funding round, would only reduce SoftBank's leverage ratio to 19.2%.

Financial flexibility remains through Arm Holdings-backed borrowing facilities, with $11.5 billion undrawn as of December. SoftBank maintained 3.5 trillion yen in cash and equivalents at September's end.

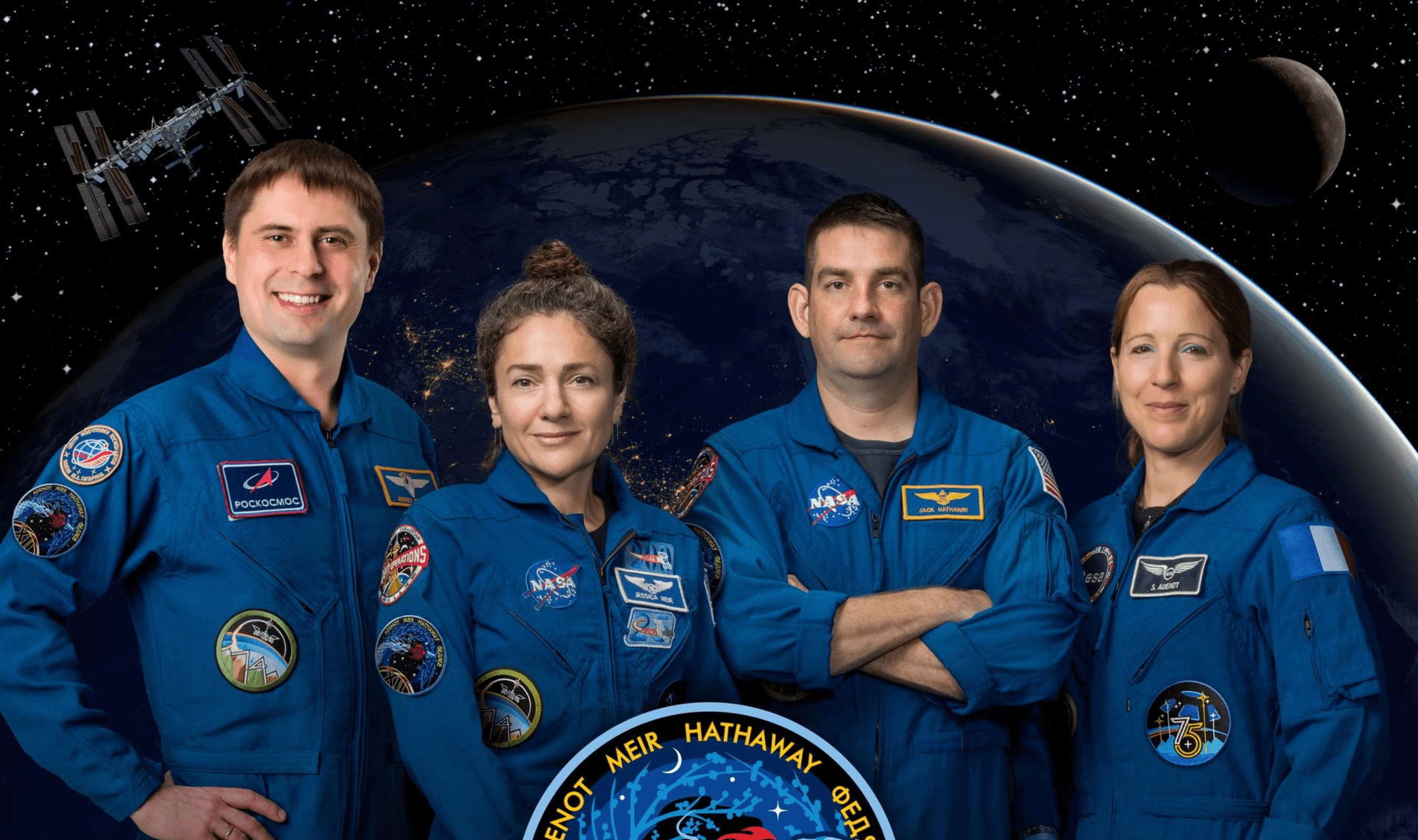

The OpenAI relationship extends beyond direct investment. In November 2025, SoftBank and OpenAI launched SB OAI Japan, a joint venture marketing Crystal intelligence enterprise AI solutions exclusively in Japan.

January 2026 brought a $1 billion partnership with SB Energy, building on the $500 billion Stargate AI infrastructure project announced earlier, with each company investing $500 million to support data center development.

OpenAI employees also arranged a $6 billion secondary share sale to an investor group including SoftBank, Thrive Capital, and Dragoneer Investment Group. That transaction valued OpenAI at $500 billion.

Analyst forecasts for SoftBank's quarterly net income range from a 1.1 trillion yen gain to a 480 billion yen loss, reflecting market uncertainty about AI valuations and funding capacity.

Competition intensifies as OpenAI's growth trajectory matches rivals.

"Just six months ago OpenAI was considered the dominant player, but now its growth outlook matches competitors,"

Bulk noted.

Amazon and Nvidia reportedly consider participating in OpenAI's latest funding round, following strong demand that oversubscribed last year's $40 billion syndicated portion.

SoftBank shares gained about 2% year-to-date in 2026 but declined approximately 15% over the previous three months, indicating investor caution about AI investment sustainability.