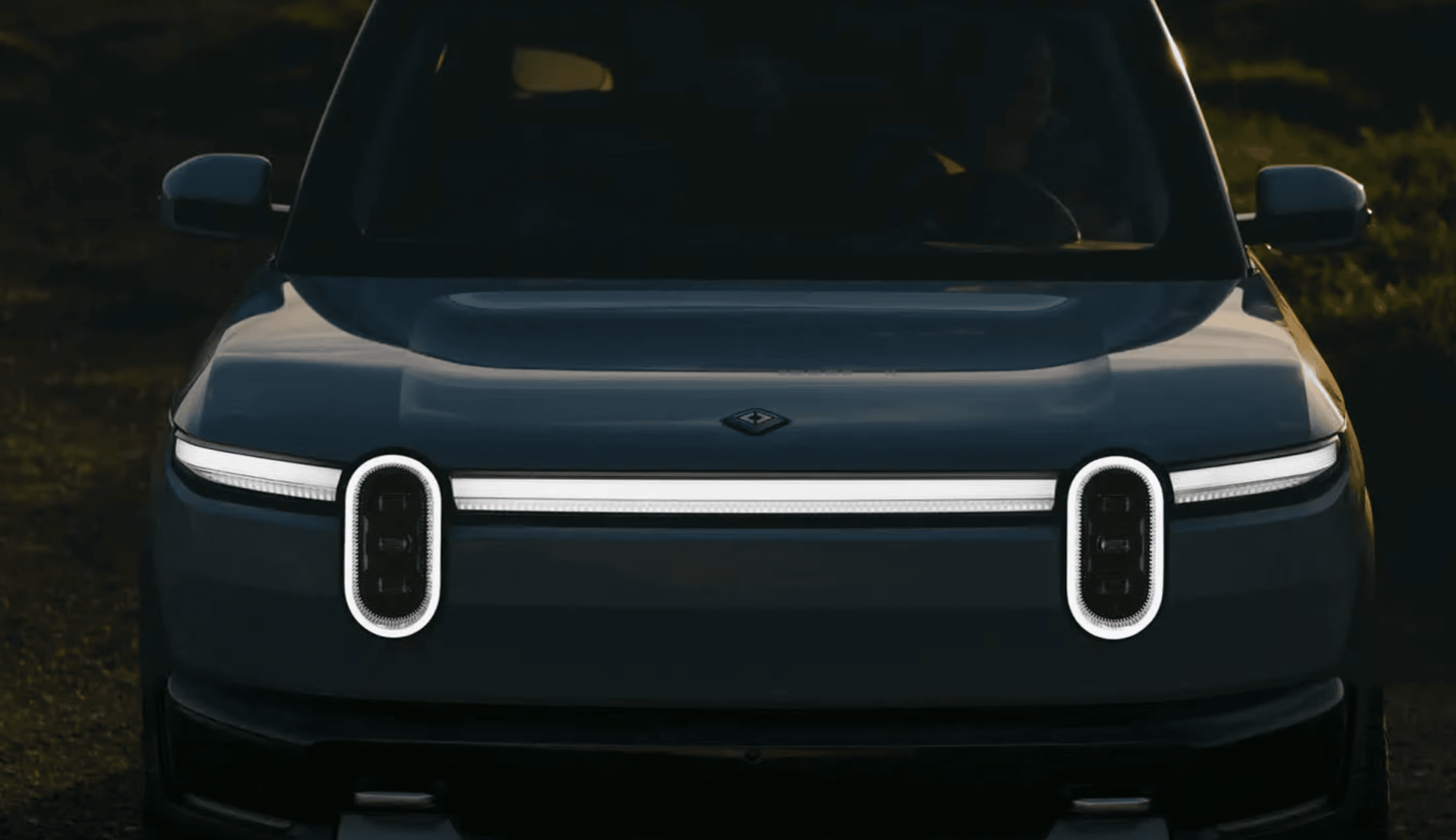

Rivian's first R2 test vehicles rolled off the Normal, Illinois production line earlier this month, marking a critical milestone for the electric vehicle maker's expansion into mass-market pricing.

The manufacturing validation build vehicles represent the final stage before customer deliveries begin, with first shipments scheduled for June.

Construction of the 2.6 million square foot expansion in Normal took just 11 months, a rapid timeline that required thousands of workers and a $1.5 billion investment. The new space roughly equals the size of the entire Mitsubishi plant that Rivian originally took over, bringing the company's total footprint to nearly 9 million square feet after 12 expansions.

The R2 midsize SUV starts at $45,000, positioning it as Rivian's entry into more affordable electric vehicles compared to its premium R1 models that begin above $72,000. The vehicle will compete against established electric offerings like the Tesla Model Y AWD variant priced at $41,990. Initial production will focus on the Normal facility before expanding to a second manufacturing plant under construction in Georgia.

Rivian began rolling out validation units from the Illinois factory last week, according to investor reports. These vehicles are built on actual production assembly lines with production tooling rather than being hand-assembled as prototypes, used for certifications, crash testing, and EPA range estimates.

The company's stock rose nearly 50% in 2025 despite a slow news year, driven by anticipation for the R2 launch. Investors view the vehicle as Rivian's potential "Model 3 moment" that could open doors to a larger addressable market beyond its premium R1S and R1T offerings. This investor enthusiasm mirrors broader interest in EV stocks, as seen when Korean retail investors poured 1 trillion won into Tesla stock and leveraged ETFs earlier this year.

Rivian appointed Greg Revelle as its first Chief Customer Officer on January 12, 2026, signaling increased focus on sales and service ahead of the R2 launch. Revelle previously served as chief marketing officer at Kohl's, Best Buy, and AutoNation, bringing retail and automotive experience to the newly created role.

CEO RJ Scaringe sold 17,450 shares of Class A Common Stock on January 20, 2026, for approximately $279,761. The sales were executed under a pre-arranged Rule 10b5-1 trading plan adopted in March 2025, with Scaringe still owning 1,115,209 shares directly.

The company faces challenges including a recall of over 19,000 R1S and R1T vehicles for rear toe-link issues and an investor lawsuit alleging overstated demand. Rivian's market capitalization stands at approximately $20.19 billion, with the company holding more cash than debt on its balance sheet.

Rivian's decision to accelerate production at its Normal facility while delaying the Georgia factory saved over $2.25 billion, according to investor analysis. The company will begin hiring additional workers in the coming months to support R2 production ramp-up.

First customer deliveries of the R2 are expected by June 2026, with the vehicle positioned to compete in the midsize SUV segment against established electric offerings. The expansion represents Rivian's most significant manufacturing investment since taking over the former Diamond Star Motors plant in Normal.