Your conversations with ChatGPT are about to become a revenue stream. While you're asking for help with homework, planning trips, or brainstorming ideas, OpenAI is preparing to monetize queries from the 800 million weekly users who can't afford a subscription. This isn't just about ads - it's about what happens when a company that burned through $8 billion in 2025 turns to the only business model that scales fast enough to match its ambitions.

The pattern is unmistakable: OpenAI is following the exact playbook that made Meta and Google advertising giants, but with a crucial twist. They're targeting the most vulnerable users, those who can't pay $20 monthly for ChatGPT Plus - while promising that ads won't influence responses. When CEO Sam Altman called advertising a "last resort" in 2024, he wasn't being modest. He was describing the financial reality of a company that expects to burn $17 billion in 2026 alone.

The Financial Calculus Behind the "Last Resort"

OpenAI's pivot to advertising reveals a brutal truth about AI economics. According to The Information, the company burned through approximately $8 billion in cash during 2025. Leaked figures reported by the same publication suggest OpenAI expects to burn $17 billion in 2026, with losses continuing to mount in subsequent years. This comes despite the company reporting $20 billion in annualized revenue for 2025.

The strategic calculus is simple: subscriptions alone can't cover the $1.4 trillion OpenAI has committed to data-center infrastructure projects over the next eight years. With 800 million weekly active users, many relying on the free tier - advertising becomes the only model that scales quickly enough. CFO Sarah Friar defended the move at the World Economic Forum in Davos, stating, "Our mission is AGI for the benefit of humanity, not for the benefit of humanity who can pay."

But follow the money, and you'll find a different story. OpenAI is charging advertisers on a pay-per-impression basis, with early testers committing under $1 million each. The company projects this advertising initiative could bring in billions in revenue by 2029, with some industry estimates suggesting $25 billion.

The Meta Playbook

OpenAI's recruitment strategy tells the real story. As of October, about 630 former Meta employees worked at OpenAI, making up about 20% of its roughly 3,000-strong workforce. These aren't random hires, they're experts from a company that wrote the book on optimizing algorithms for engagement and ad revenue.

The company has been actively hiring engineers to build monetization infrastructure rather than ad sales teams, signaling a focus on constructing the advertising machine before worrying about selling what comes out of it. As Digiday reported, most of the seven open roles focused on advertising are engineering positions tasked with building ad delivery systems and internal tools needed to connect paid advertising to OpenAI's products.

This hiring pattern mirrors Meta's historical approach, where engineering-driven ad systems eventually generated over $200 billion annually. The difference is that Meta monetized attention and intent, while OpenAI is attempting to monetize thinking, a far more delicate cognitive space.

The Ad-Free Alternative

While OpenAI races toward advertising, Google is drawing a clear line in the sand. Google DeepMind CEO Demis Hassabis told reporters at the World Economic Forum in Davos that there are "no plans" to introduce ads into Gemini, expressing surprise at OpenAI's move to test them in ChatGPT so early in its lifecycle.

"Gemini is your AI assistant," Hassabis emphasized, distinguishing it from search engines that naturally lend themselves to product recommendations. This stance positions Gemini as a purist alternative in an industry increasingly tempted by immediate revenue streams. Google Ads president Dan Taylor reinforced this position in December, stating that ads were not coming to Gemini in 2026.

The contrast couldn't be starker. Google, which derives the vast majority of its revenue from advertising, totaling over $200 billion annuall - is keeping its flagship AI assistant ad-free. Meanwhile, OpenAI, facing financial pressures, is turning to the very model Google is avoiding for its most personal AI product.

OpenAI insists its approach will be different. According to company blog posts, ads will appear in clearly marked areas separate from ChatGPT's actual responses and will not influence how the AI answers questions. The company plans to use contextual cues from conversations to serve relevant ads without relying on personal data tracking.

For instance, if a user inquires about travel destinations, an ad for airlines or hotels might appear in a non-intrusive manner. Ads will be placed in designated interface sections like the home screen or browsing style areas of the app rather than mixed into conversational output.

But the company's recent deployment of age prediction systems reveals a more complex reality. OpenAI has begun deploying an age prediction model to determine whether ChatGPT users are old enough to view "sensitive or potentially harmful content," as reported by TheRegister.com. This system looks at behavioral and account-level signals, including how long an account has existed, typical times of day when someone is active, and usage patterns over time.

While framed as a safety measure, this same data collection infrastructure could theoretically support more sophisticated ad targeting in the future. The company says it won't sell personal chat content to advertisers, but the line between contextual targeting and behavioral profiling is thinner than most users realize.

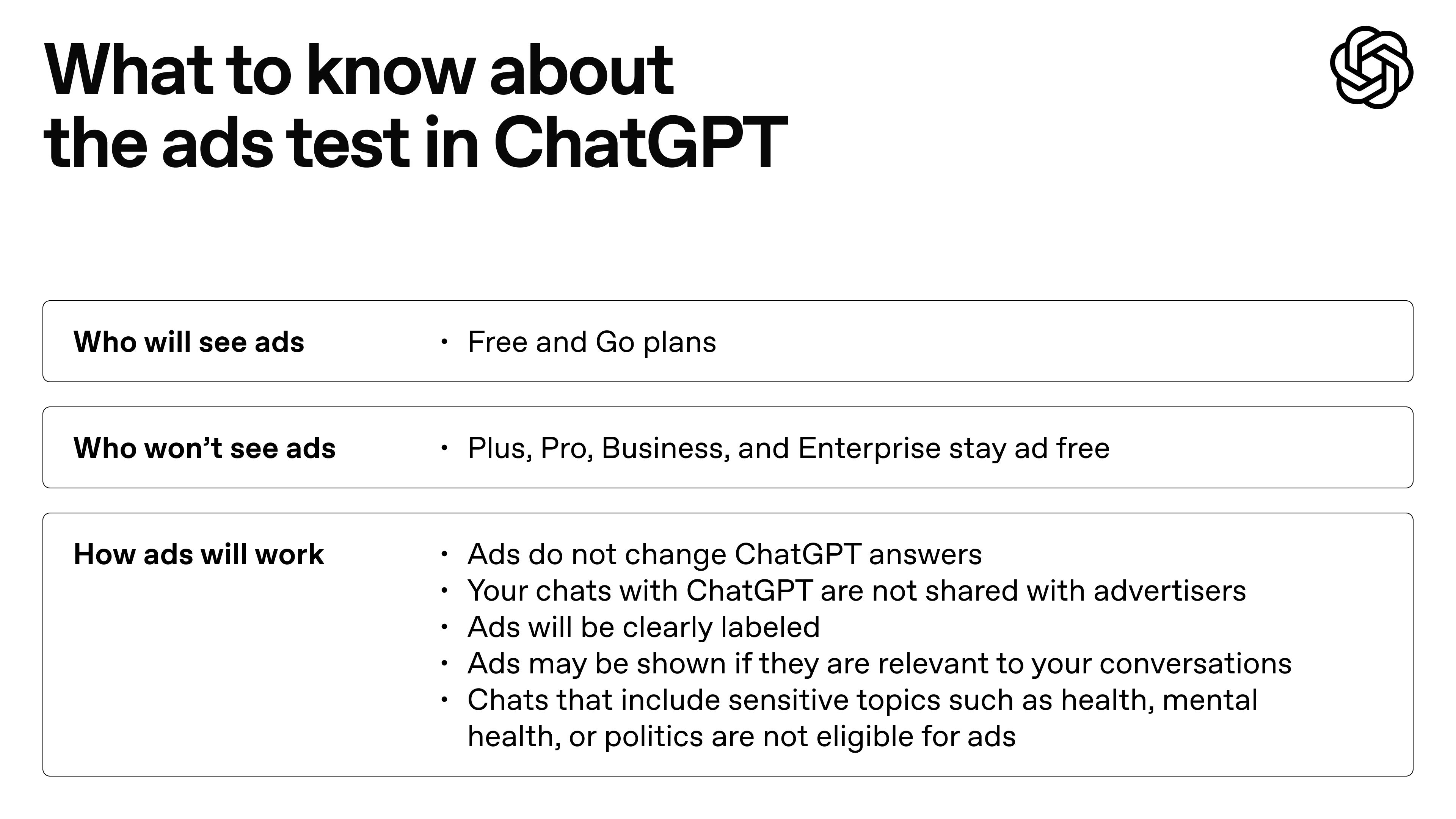

Who Pays, Who Gets Ads

OpenAI's tiered approach creates a clear economic hierarchy. Free users and those on the newly introduced $8-per-month Go plan will see ads, while paid subscribers to ChatGPT Plus, Pro, or Enterprise tiers will remain ad-free. This segmentation effectively creates two classes of users: those who can afford an uninterrupted experience and those who can't.

The $8 Go tier sits between the completely free version and existing paid plans like ChatGPT Plus, which costs $20 monthly. This ad-supported subscription aims to balance affordability with sustainability, making the platform accessible to more people globally, especially in regions where subscription costs create barriers.

But this segmentation raises ethical questions. As Bloomberg's Parmy Olson noted, OpenAI's introduction of ads may lead to the company optimizing ChatGPT to be habit forming, potentially targeting vulnerable users who can't afford a subscription. The platform could inadvertently target the most vulnerable: those who can't afford a $20 monthly subscription, including many young people.

The Industry Ripple Effect

OpenAI's move is already creating ripple effects across the industry. Meta announced that ads are coming to Threads next week, following an initial rollout to select markets last year. Perplexity rolled out early ad offerings back in the fall of 2024. Even healthcare AI startup OpenEvidence, valued at $12 billion after a $250 million funding round, relies on advertising for revenue.

As Maor Sadra, CEO of ad measurement business INCRMNTAL, told Digiday: "Ads coming to ChatGPT was inevitable. The economics of LLMs just don't work without some monetization layer - and most users aren't going to pay. So what do you do? You offer premium features for 'free' and subsidize them with highly targeted ads."

The pattern suggests that advertising in AI assistants will become normalized, much like it did in search engines and social media. The question isn't whether AI platforms will monetize through ads, but how they'll balance revenue generation with user trust.

The Trust Equation: Promises vs. Historical Precedent

OpenAI's promises sound reassuring. The company states that ads won't influence answers, conversations will remain private, and paid tiers will stay ad-free. As detailed in their official blog, OpenAI emphasizes that "people trust ChatGPT for many important and personal tasks, so as we introduce ads, it's crucial we preserve what makes ChatGPT valuable in the first place."

But history shows that advertising models tend to evolve in ways that prioritize revenue over user experience. When Meta reported an 8% rise in user engagement in the second quarter of 2025, that came with a 22% jump in ad revenue. As Bloomberg's analysis noted, any minor tweaks that OpenAI makes to ChatGPT to juice engagement might not be very noticeable, but they could still boost revenue significantly.

The company's opacity about its AI models makes independent verification difficult. Given that OpenAI is entirely opaque about the mechanics of its AI models, independent researchers would struggle to detect subtle changes that might increase engagement for ad purposes.

OpenAI is preparing to launch impression-based ads inside ChatGPT as early as February. The initial test will be limited, with advertisers committing under $1 million each and no self-serve buying tools available yet. Ads will appear at the bottom of ChatGPT responses, clearly labeled and separated from organic answers.

The rollout begins in the U.S., but plans for international expansion are aggressive. Recent news from Los Angeles Times indicates that ads will help offset costs, enabling broader availability of AI tools worldwide. This is particularly relevant in regions like Asia, where user growth is explosive and where a beta is planned for Q1 2026.

Longer term, the success of this initiative will depend on maintaining the delicate balance between revenue goals and user satisfaction. If OpenAI can deliver on its promises of non-intrusive, privacy-respecting ads while keeping responses unbiased, it could create a new sustainable model for AI access. If it fails, the damage won't be limited to one company - it will set back trust in AI products as a whole.

The stakes are higher than most users realize. Every conversation with ChatGPT represents not just a search for information, but a data point in an economic system that's learning how to monetize human thought. The question isn't whether your AI assistant will show you ads, but whether you'll notice when the line between help and influence begins to blur.

When the company that promised to benefit all of humanity turns to the same monetization playbook as social media giants, that's not innovation - it's inevitability.