Nvidia shares jumped 7.9% on Friday, February 6, delivering the chipmaker's strongest single-day performance since April 2025. The surge ended a five-session decline and restored Nvidia's market valuation to approximately $4.5 trillion.

Amazon's capital expenditure announcement drove the rally, with the cloud giant committing $200 billion to AI infrastructure for 2026. This is a 53% increase from Amazon's 2025 budget and signals continued demand for Nvidia's data center processors, which control 81% of that market according to International Data Corporation.

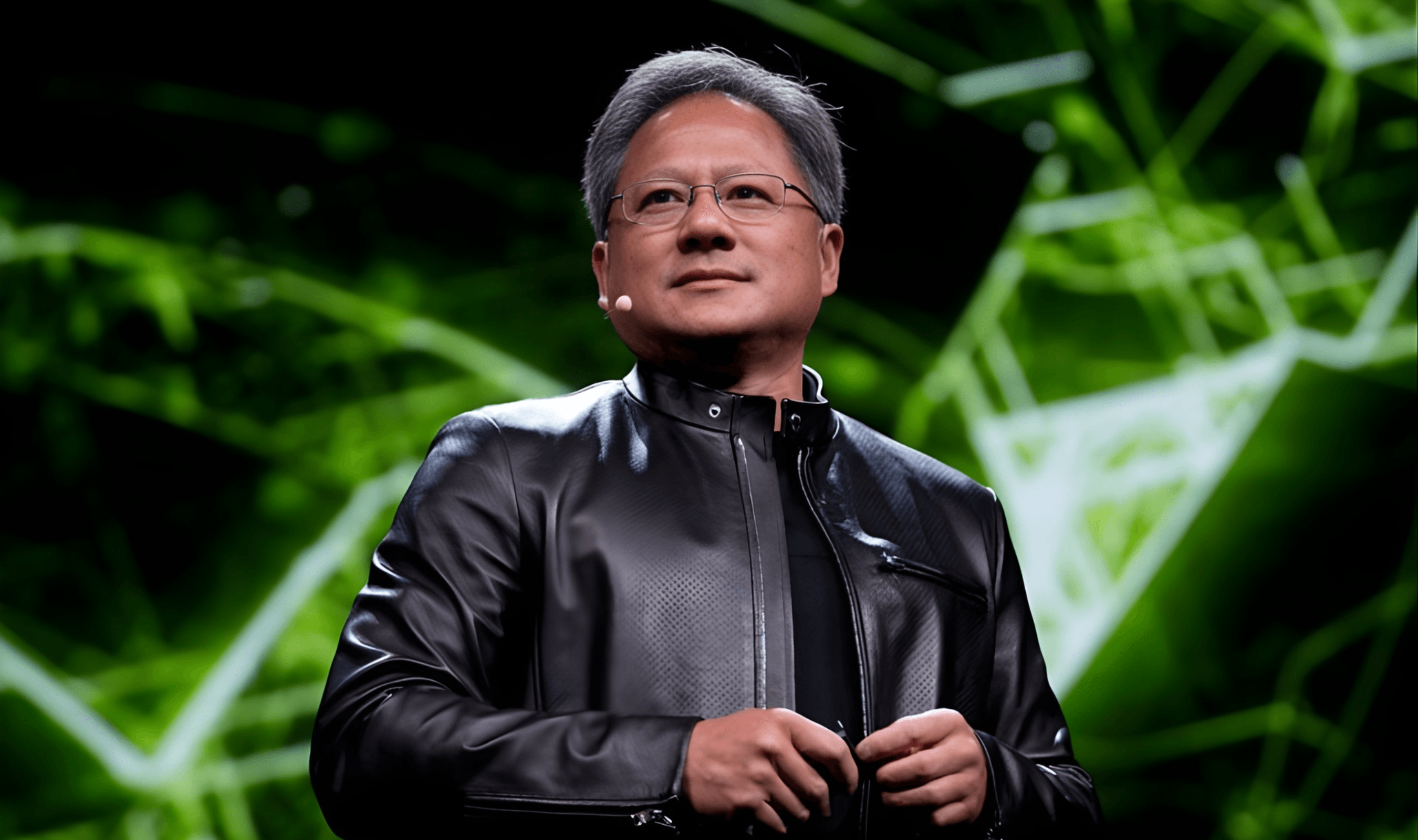

Nvidia CEO Jensen Huang reinforced market confidence during a CNBC appearance, describing the technology sector's $660 billion AI infrastructure investment as sustainable.

"He identified Meta, Amazon, Google, and Microsoft as primary contributors to this spending wave, with significant portions directed toward Nvidia hardware."

The stock reached $185 after opening at $176.69, with after-hours trading extending gains to $186.08. This recovery followed earlier volatility that saw shares fluctuate between $172.62 and $186.93 during regular trading hours.

A separate development involved Nvidia's $20 billion commitment to OpenAI, marking the chipmaker's largest startup investment. Both Huang and OpenAI CEO Sam Altman publicly addressed partnership concerns, affirming their continued collaboration.

This follows recent reports about Nvidia's broader OpenAI investment strategy.

Taiwan's capital city approved a NT$12.2 billion ($380 million) agreement for Nvidia's new headquarters in the Beitou-Shilin Technology Park. Construction is scheduled to begin before June 2026, strengthening Nvidia's Asia-Pacific supply chain operations.

Semiconductor stocks broadly advanced on AI spending optimism. Advanced Micro Devices gained 8%, while Super Micro Computer and Astera Labs recorded larger increases. This sector-wide movement indicates investor belief in the durability of AI infrastructure expansion despite valuation questions.

Nvidia achieved a $5 trillion valuation milestone in October 2025, becoming the first company to reach that level. The accomplishment followed intense demand for AI processors, with October quarter sales and profits exceeding 60% growth year-over-year and surpassing Wall Street projections.

Huang highlighted practical implementations among Nvidia clients to demonstrate AI investment returns. Meta is shifting recommendation systems from traditional processors to generative AI platforms, while Amazon Web Services employs Nvidia technology to enhance retail product suggestions.

All Nvidia graphics processors remain actively used through rental arrangements, including six-year-old A100 models. This continuous usage pattern indicates persistent demand for AI computing resources.

The company projects 2026 revenue approaching $500 billion, establishing new corporate records. Nvidia will disclose fourth-quarter and full-year 2026 financial results on February 25, providing the next assessment of its AI-driven expansion trajectory.