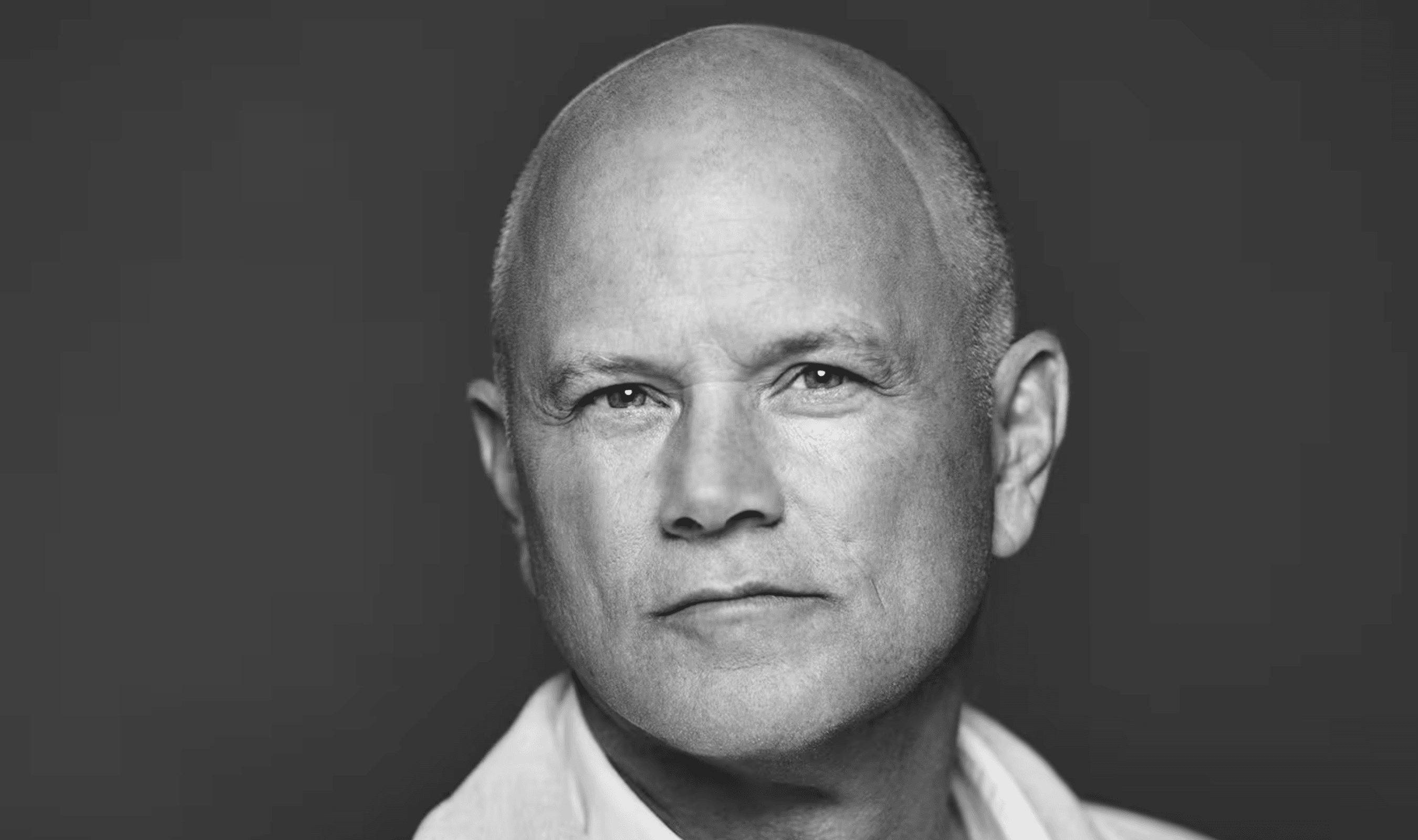

Galaxy Digital CEO Mike Novogratz declared the cryptocurrency sector's speculative era finished during a New York City forum this week. The billionaire investor told CNBC's Digital Finance Forum that digital assets will transition toward real-world applications offering substantially lower returns.

Bitcoin has declined 21 percent since January, reaching $60,062 last week for its lowest valuation in sixteen months. The drop represents nearly half the cryptocurrency's October 2025 peak value.

Unlike the November 2022 FTX collapse that erased 22 percent of Bitcoin's value in one day, current market conditions lack a single triggering event.

"Crypto revolves around narratives," Novogratz explained during the Tuesday presentation. "Building those stories takes time, and when participants exit, reconstruction becomes difficult."

The Galaxy founder contrasted the current downturn with previous crypto winters, noting institutional investors now dominate market participation with different risk tolerances.

October 2025 witnessed $19.37 billion evaporate from leveraged positions within twenty-four hours, affecting 1.6 million traders. The Galaxy CEO identified this event as particularly damaging to retail investors and market makers, creating sustained downward pressure.

The liquidation marked the largest single-day loss in cryptocurrency history.

"Retail participants don't enter crypto seeking eleven percent annual returns," Novogratz stated. "They pursue thirty-to-one or ten-to-one multiples."

The executive predicted digital asset infrastructure will eventually support global banking services rather than speculative trading, with tokenized assets offering distinct return profiles compared to traditional investments.

Galaxy Digital completed its Nasdaq listing in May 2025 after nearly four years and $25 million in regulatory expenses. The publicly traded firm has since expanded into retail trading through its GalaxyOne platform, launched last year with four percent yields on cash accounts.

Galaxy's venture arm simultaneously closed a $175 million fund for blockchain infrastructure investments.

The company recently led a $7 million seed round for Tenbin Labs, developing tokenized gold and emerging market currency products. The investment matches Galaxy's shift toward real-world asset tokenization, contrasting with earlier focus on market speculation.

Tenbin plans to launch its gold tokenization product this year with prime broker support.

The executive originally founded Galaxy Digital in 2018 as what he described as "the Goldman Sachs of crypto." His parallel investments in artificial intelligence infrastructure through bitcoin mining operations could generate up to $20 billion according to recent Forbes analysis.

Market analysts anticipated growth under the current administration's regulatory approach, but 2026 has produced opposite results. Bitcoin's year-to-date performance shows a thirty-nine percent decline, placing it forty-five percent below last October's highs.

The divergence between policy expectations and market reality highlights the fundamental industry transformation Novogratz described.

Galaxy Digital shares trade on Nasdaq under the GLXY ticker, with the firm reporting a $295 million first-quarter net loss earlier this year attributed to digital asset price declines and mining-related impairment charges.