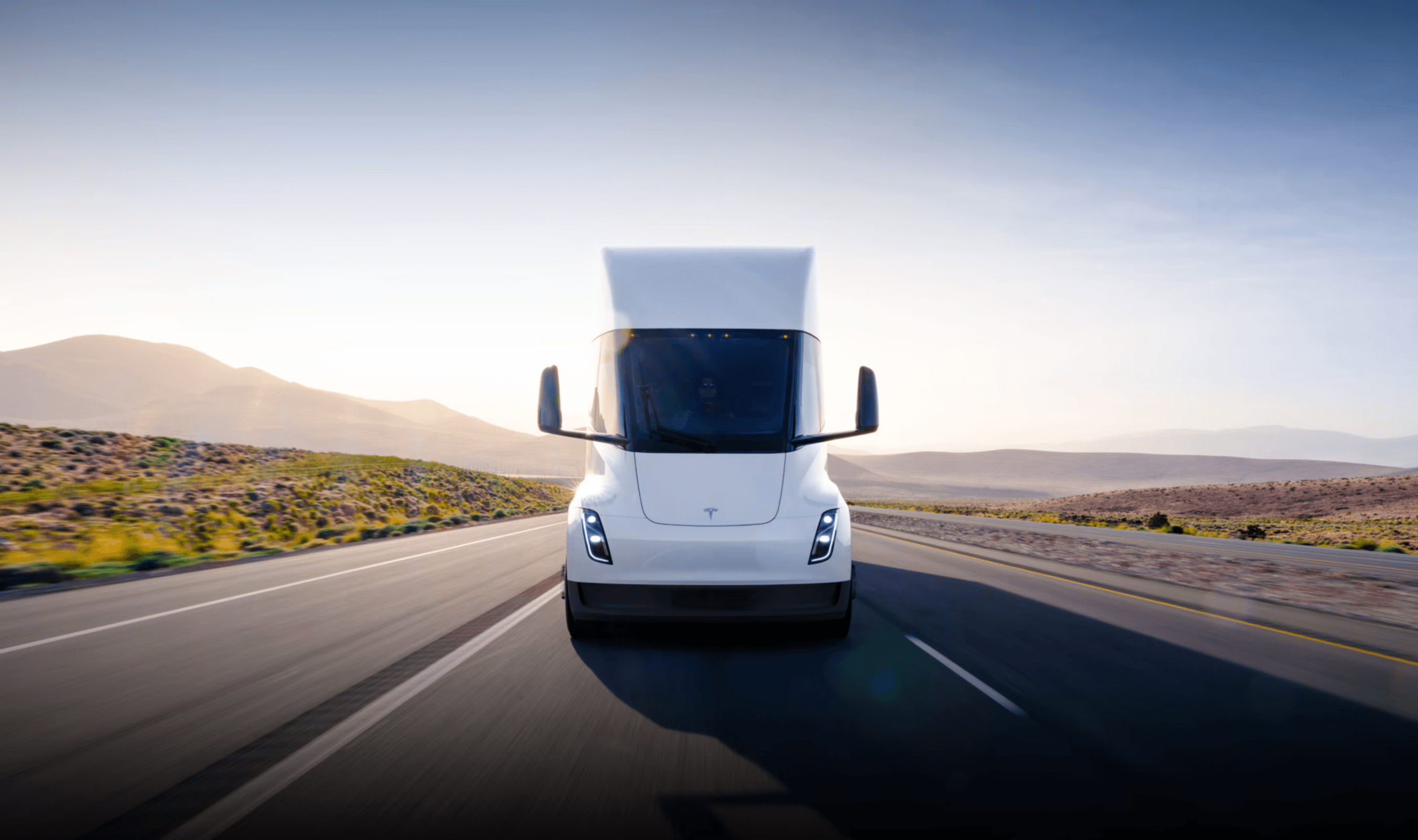

Elon Musk confirmed Tesla will begin high-volume production of its Semi electric truck this year, marking a shift from limited pilot deployments to commercial manufacturing nearly nine years after the vehicle's initial unveiling.

The Tesla CEO posted "Tesla Semi starts high volume production this year" on X Sunday, signaling the Class 8 truck's transition from test programs to scaled manufacturing.

The announcement follows years of delays since the Semi's 2017 debut, with battery supply constraints previously limiting production to approximately 200 units delivered to select customers including PepsiCo and DHL.

Tesla updated its official website with final specifications for two Semi variants. The Standard trim offers 325 miles of range at 82,000 pounds gross combination weight, while the Long Range version extends to 500 miles with a higher curb weight of 23,000 pounds.

Both configurations consume 1.7 kWh per mile and can recover 60% of driving range in 30 minutes using compatible charging infrastructure.

Mass production will occur at a dedicated factory near Gigafactory Nevada, with initial assembly scheduled for the first half of 2026 and volume ramp-up in the second half. The timeline represents Tesla's confidence in resolving battery production and supply chain challenges that previously constrained Semi manufacturing.

DHL operates one of the delivered Semis on roughly 100-mile daily routes in California, requiring charging approximately once weekly. PepsiCo expanded its Tesla Semi fleet in 2024, adding 50 units to operate from California facilities as part of its electric truck deployment.

The production commitment arrives as Tesla faces multiple business challenges, including its first annual revenue decline in 2025 with sales falling in three of the last four quarters.

The company also announced it will end Model S and X production this quarter, converting Fremont factory lines to manufacture Optimus humanoid robots.

In Europe, Tesla ranked last in Germany's 2025 brand reputation survey, scoring 2.48 out of 5 and placing behind companies including Temu and Nestlé.

The 0.77-point year-over-year decline represents the steepest reputational collapse recorded in the study's history since 2013.

Competitive pressure intensified in January as BYD outsold Tesla 10-to-1 in Australia, delivering 5,001 vehicles compared to Tesla's 501. Chinese brands now occupy four of Australia's top ten EV sales positions, with BYD's Sealion 7 becoming the country's best-selling electric vehicle.

Tesla expects capital expenditures exceeding $20 billion in 2026 to support Semi production, lithium refinery development in Texas, LFP battery factories, Optimus robot manufacturing, and AI computing infrastructure.

The company recently expanded its Model Y lineup with a new AWD variant priced at $41,990 and renamed the Standard version as Model Y RWD.

Vanguard Group increased its Tesla stake by 6.54 million shares in the fourth quarter of 2025, bringing its total holdings to approximately 258.9 million shares valued around $102.85 billion at year-end. The investment firm remains Tesla's largest institutional shareholder ahead of BlackRock.

Tesla plans to unveil its next-generation Roadster in April and begin Cybercab robotaxi production, though regulatory hurdles and development delays have affected both programs.

The company is also expanding its solar manufacturing capacity as part of its broader energy strategy, with Semi production scheduled to begin in the first half of 2026 at its Nevada facility.