Apple reported more than 2.5 billion active devices worldwide during its fiscal first quarter earnings announcement on January 29, 2026. The milestone represents a significant jump from the 2.35 billion devices reported in the year-ago quarter.

CEO Tim Cook revealed the installed base figure alongside record-breaking financial results for the December quarter. Apple posted $143.8 billion in revenue, a 16% year-over-year increase that exceeded analyst expectations. This follows Apple's record holiday quarter performance.

iPhone revenue reached $85.3 billion, marking 23% growth from the previous year. Cook described demand for the iPhone 17 family as "simply staggering" during the holiday quarter, with all-time records achieved across every geographic segment.

The company's services business generated $30 billion in revenue, rising 14% year-over-year. Services gross margin climbed to 76.5%, providing Apple with financial flexibility amid rising component costs.

Supply constraints emerged as the primary growth limitation rather than consumer demand. Analysts from Bank of America, J.P. Morgan, and Wedbush Securities noted that Apple's production capacity, not customer interest, now defines the company's near-term outlook.

Component shortages affected multiple product lines. AirPods Pro 3 wireless earbuds, which debuted in September, experienced inventory shortages that contributed to a 2% revenue decline in Apple's Wearables, Home, and Accessories segment.

Memory and storage chip prices are rising, though Cook said they had "minimal impact" on December quarter margins. He expects a "bit more of an impact" in the current quarter but noted Apple will "look at a range of options to deal with that" long-term.

Apple's massive installed base provides strategic advantages. With 2.5 billion active devices, the company can absorb rising hardware costs while expanding its services ecosystem through subscriptions to Apple One, Apple Music, iCloud, and third-party apps.

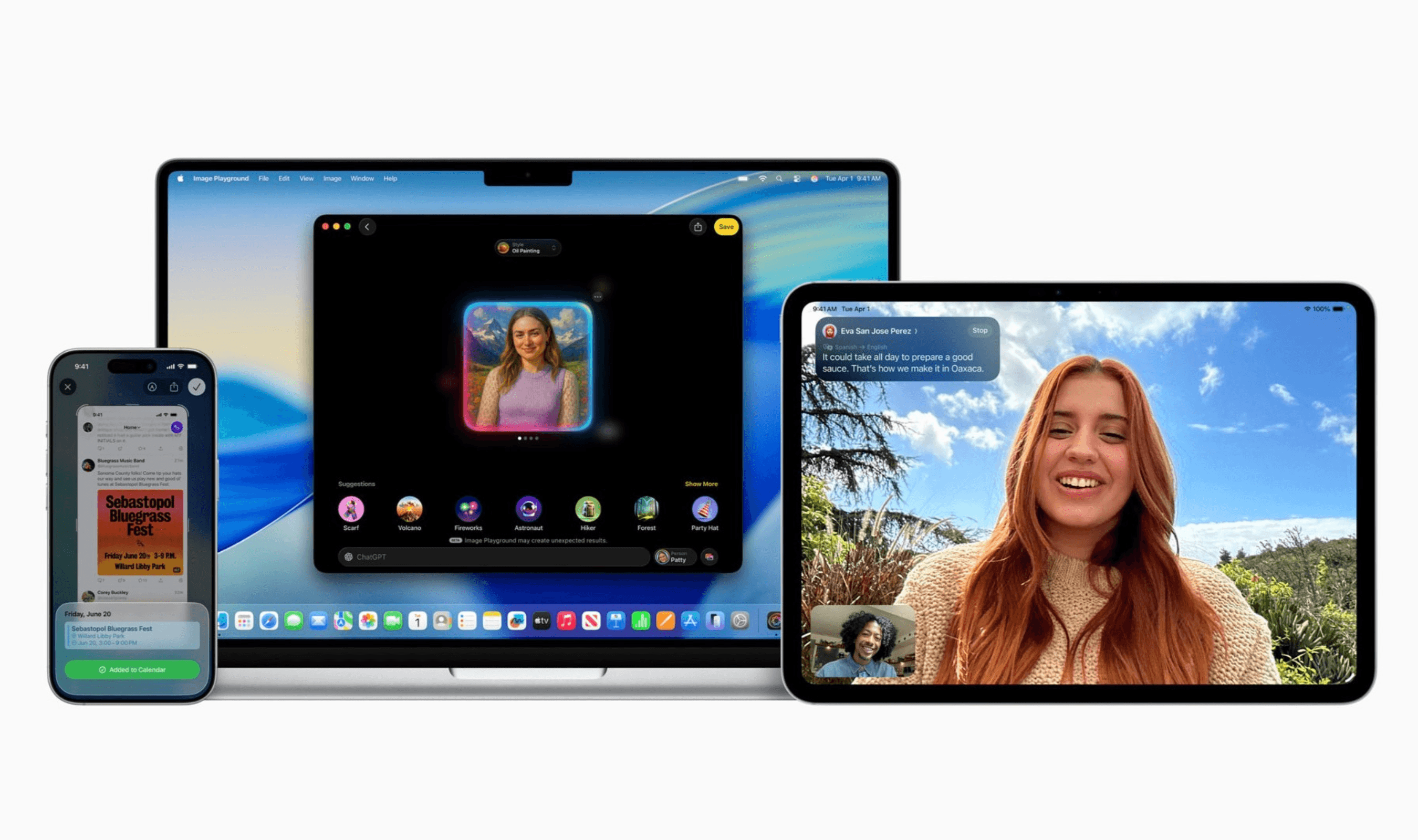

Apple Intelligence adoption is accelerating among iPhone users. Cook identified Writing Tools, Clean Up, Visual Intelligence, and Live Translation as the most popular AI features during the quarter. The AI platform requires iPhone 15 Pro or newer devices with at least 8GB of RAM. This comes as Apple continues to invest in AI technology.

For the March quarter, Apple projects revenue growth between 13% and 16% year-over-year. Gross margins are expected to range from 48% to 49%, slightly above the 48.2% reported in the first quarter.

The company's scale presents both opportunities and challenges. While Apple's size provides leverage over suppliers, even small demand increases require massive manufacturing capacity that cannot be added quickly. Smaller competitors can adjust production faster than Apple, which must secure chips, memory, and components years in advance.

Analysts maintain a "Moderate Buy" consensus rating on Apple stock. The company trades at 31.4 times forward earnings, a premium multiple relative to projected 9.5% earnings growth in fiscal 2026 and 11.6% growth in 2027.

Apple's services momentum continues to support long-term growth. Customer engagement across the services portfolio reached an all-time high during the quarter, with both paid accounts and transaction activity setting records.

The 2.5 billion device milestone underscores Apple's ecosystem strength. As Cook stated, the figure represents "a testament to incredible customer satisfaction for the very best products and services in the world." The company's earnings report arrives amid ongoing speculation about future iPhone upgrades.