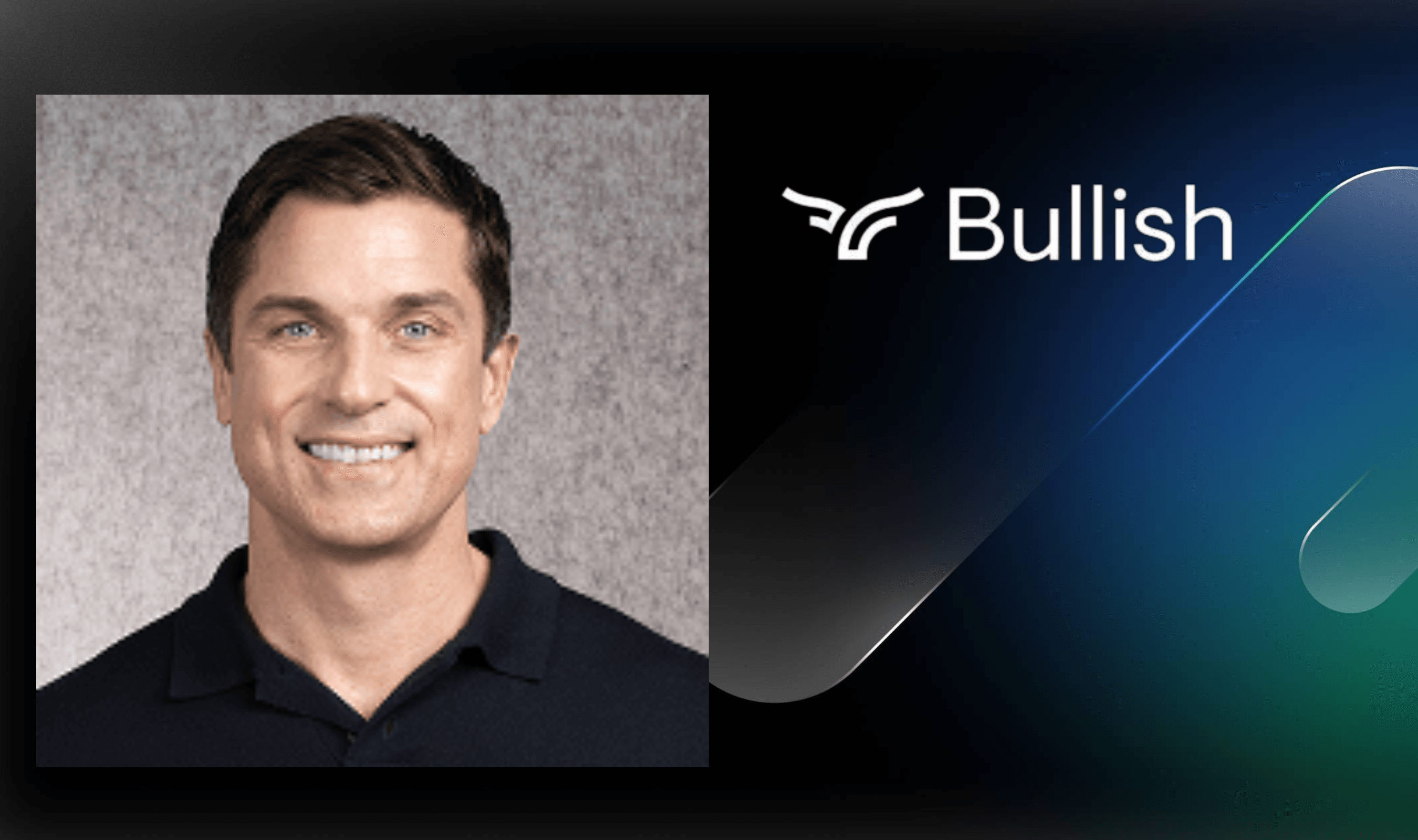

Crypto faces immediate industry consolidation as market downturn exposes weak business models, according to Bullish CEO Tom Farley.

Bitcoin's 45% decline from its October 2025 peak of $126,100 to approximately $69,400 is accelerating a shakeout that should have occurred years earlier. Farley, who previously served as president of the New York Stock Exchange, told CNBC that inflated valuations kept unrealistic expectations alive until now.

"The same thing is going to happen starting right now in crypto," Farley said during his Friday interview.

He witnessed similar consolidation patterns in the exchange sector during his NYSE tenure.

Companies with $10 million in revenue and no growth were still demanding $200 million valuations, according to Farley. That era of over-optimistic pricing is ending as the market correction washes away what he called "false optimism."

"People are going to realize they don't have businesses, they have products, and they need to merge up, and they need to scale, and that is going to happen," Farley said.

The consolidation should have started one to two years ago but was delayed by unrealistic 2020-era valuation expectations.

The process will involve larger companies acquiring smaller, underperforming projects across the crypto market. This absorption will likely lead to significant layoffs, internal reorganizations, and industry-wide restructuring.

Venture capital firms have already become more selective with crypto investments as the market matures. Investment decisions now focus on scalable, sustainable projects rather than speculative ventures, according to industry sources.

Farley believes surviving companies must transition from being "features" to becoming "institutional, compliant, and respected." The shift represents a move away from what he described as "chasing frog coins and 100x use" toward more substantial on-chain finance.

Even traditional financial institutions like the NYSE have shown interest in blockchain systems for stock trading, suggesting the underlying technology has staying power despite individual project failures.

This institutional endorsement indicates blockchain infrastructure is becoming a fixture of modern global finance.

The current market downturn acts as a filter, forcing companies to prove long-term viability to attract buyers or survive independently. The result will likely be a crypto industry that resembles traditional finance, with a handful of large, heavily regulated companies providing most infrastructure.

For firms that adapt during this transition, consolidation offers a chance to become legitimate long-term players in what Farley sees as an increasingly professional global market. The transformation marks the end of what he characterized as the industry's "wild west" phase.