Fintech company Bilt Rewards launched three new credit cards with 10% introductory APRs, directly aligning with President Donald Trump's recent call for rate caps.

The cards debut as political pressure mounts on credit card companies. Trump announced last week he wants a one-year 10% cap on card interest rates, a proposal Vanderbilt University researchers estimate would cost the industry $100 billion.

Bilt's 10% rate applies to new purchases for the first 12 months. After the introductory period, rates rise above 20%, matching industry averages. The $10.75 billion fintech says it now partners with roughly one in four U.S. landlords.

CEO Ankur Jain positioned the move as responding to a "bipartisan call for a solution" on affordability. "If a credit card rate cap is going to happen, we'd rather be at the forefront," Jain said.

The announcement creates political leverage against larger competitors. Lawmakers can now point to Bilt's voluntary cap while questioning why JPMorgan Chase, Capital One and American Express haven't followed.

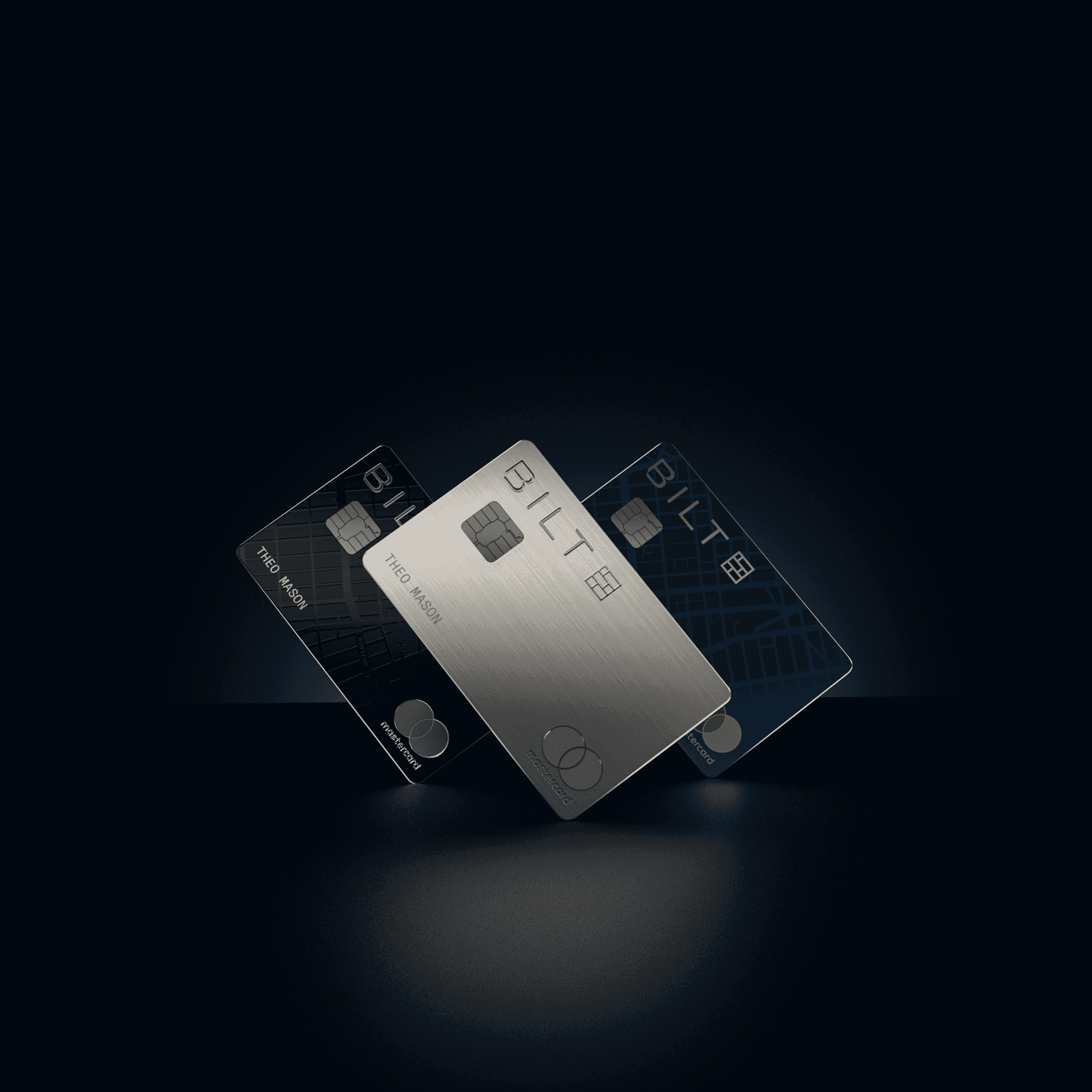

Bilt unveiled three cards using the "good, better, best" model common in financial services. The premium Bilt Palladium Card carries a $495 annual fee with $400 in hotel credits and $200 in Bilt Cash rewards.

The mid-tier Bilt Obsidian Card focuses on dining and grocery rewards for a $95 annual fee. The entry-level Bilt Blue Card has no annual fee but offers lower rewards multiples.

The launch marks Bilt's expansion beyond its "credit card for renters" identity. The company now positions itself as a financial liaison connecting local merchants, landlords and renters.

Bilt's previous partnership with Wells Fargo ends in February. The Wall Street Journal reported Wells Fargo lost $10 million monthly on the Bilt card, prompting early termination of a deal scheduled through 2029.

New cards will be issued through credit card operations company Cardless, with Column N.A. serving as the issuing bank. The company says Bilt is now the largest reporter of on-time rental payments to credit bureaus.

The credit card industry has historically resisted rate caps, with average rates hovering around 21%. Trump's proposal gained support from both conservative populists and progressive politicians including Rep. Alexandria Ocasio-Cortez and Sen. Bernie Sanders.

Bilt's move comes as the company builds rewards programs for mortgage payments and other routine transactions. The fintech aims to create an ecosystem where points convert to cash back at local merchants partnered with Bilt.

The company maintains transfer partnerships with several airlines and hotels through its Bilt Rewards points program. This expansion reflects Bilt's broader strategy to become a comprehensive financial platform beyond rental payments.