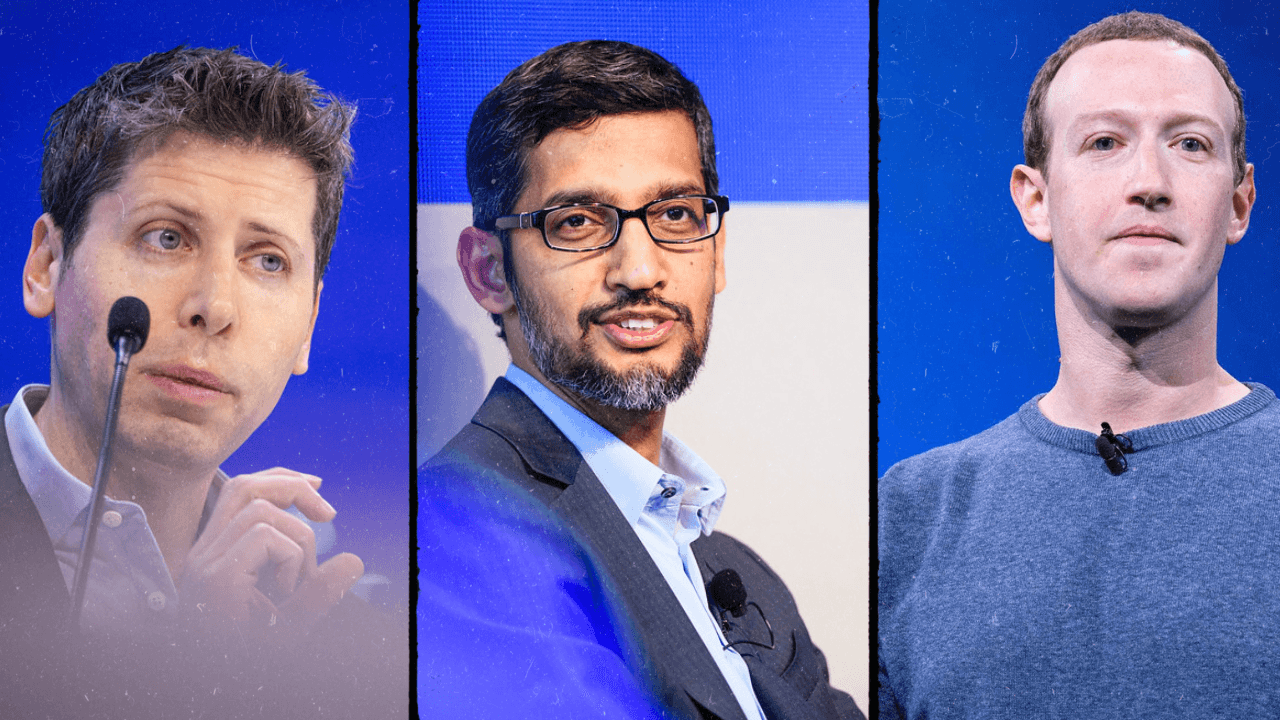

When OpenAI CEO Sam Altman starts talking about bubbles, you know something's up. In August 2025, Altman acknowledged that investors are "overexcited about AI" and compared the current situation to the dotcom bubble. He warned that "people will overinvest and lose money" during this phase of the AI boom.

Google CEO Sundar Pichai echoed similar concerns, telling the BBC that there's some "irrationality" happening in the AI boom, and a burst bubble would not spare anyone. "No company is going to be immune" if the AI bubble bursts, he cautioned.

The staggering scale of AI spending

The numbers behind the AI boom are mind-boggling. Total global AI spending is expected to hit $375 billion this year, and is forecasted to reach $500 billion in 2026, according to UBS. To put that in perspective, the entire Apollo program that put humans on the moon cost about $300 billion in today's dollars.

More than 1,300 AI startups now have valuations of over $100 million, with 498 AI "unicorns" - companies with valuations of $1 billion or more - according to CB Insights. The combined market capitalization of the so-called "Magnificent 7" tech giants (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) represents a record 37% of the S&P 500's total value.

Here's the problem: the major AI players, with the exception of Nvidia, still haven't demonstrated what their long-term AI business models will be. OpenAI, Anthropic, and the AI-embracing tech giants are burning through billions, inference costs haven't fallen, and these companies still lose money on nearly every user query.

A recent MIT study made waves with a finding that 95% of enterprise AI pilots fail to deliver measurable impact. Their research revealed that 95% of the 52 organizations considered had achieved zero return on investment, despite spending $30 billion to $40 billion on GenAI across more than 300 initiatives.

The circular investment problem

The AI industry has developed what some analysts call a "circular investment" problem. Nvidia invests $100 billion in OpenAI, which uses that money to buy Nvidia chips. Microsoft invests in OpenAI, which relies on Microsoft's computing power. OpenAI then reports this as revenue, creating a feedback loop that inflates valuations without necessarily creating real economic value.

As Cory Doctorow explains it:

"Microsoft 'invests' in OpenAI by giving the company free access to its servers. OpenAI reports this as a ten billion dollar investment, then redeems these 'tokens' at Microsoft's data-centers. Microsoft then books this as ten billion in revenue."

What happens when the bubble bursts?

The economic consequences could be severe. Former IMF chief economist Gita Gopinath estimates that if the market crashes like it did after the dotcom bubble burst at the turn of the century, it would wipe out $20 trillion in US household wealth and $15 trillion in international investor wealth at risk.

AI-related stocks have contributed to roughly 75% of the S&P 500's returns, 80% of earnings growth, and 90% of capital spending growth since the launch of OpenAI's ChatGPT in November 2022. A significant correction could therefore have outsized effects on the broader market.

What would remain?

When the dotcom bubble burst, it left behind valuable infrastructure : fiber-optic lines, data centers, and the foundational technologies that would eventually power the modern internet. Similarly, if the AI bubble bursts, the massive server farms built by the hyperscalers would not disappear. The open-source models, the software frameworks, and the research papers would all still be there.

Large Language Models might already have reached the peak of their utility, but they will continue to be useful. The technology would finally be freed from the impossible burden of returning impossible returns, and could focus on providing real value rather than chasing speculative returns.

The silver lining

A burst bubble might actually be good for AI development in the long run. The immense intellectual and capital resources currently being funneled into a narrow, speculative tunnel would be released to flow into countless other productive streams. The industry would have to wean itself off the venture capital drip and learn to create products that people will actually pay for because they provide tangible value, not because they promise a sci-fi future.

As one analyst put it: "The technology, which is genuinely limitedly useful, would finally be freed from the impossible burden of returning impossible returns."