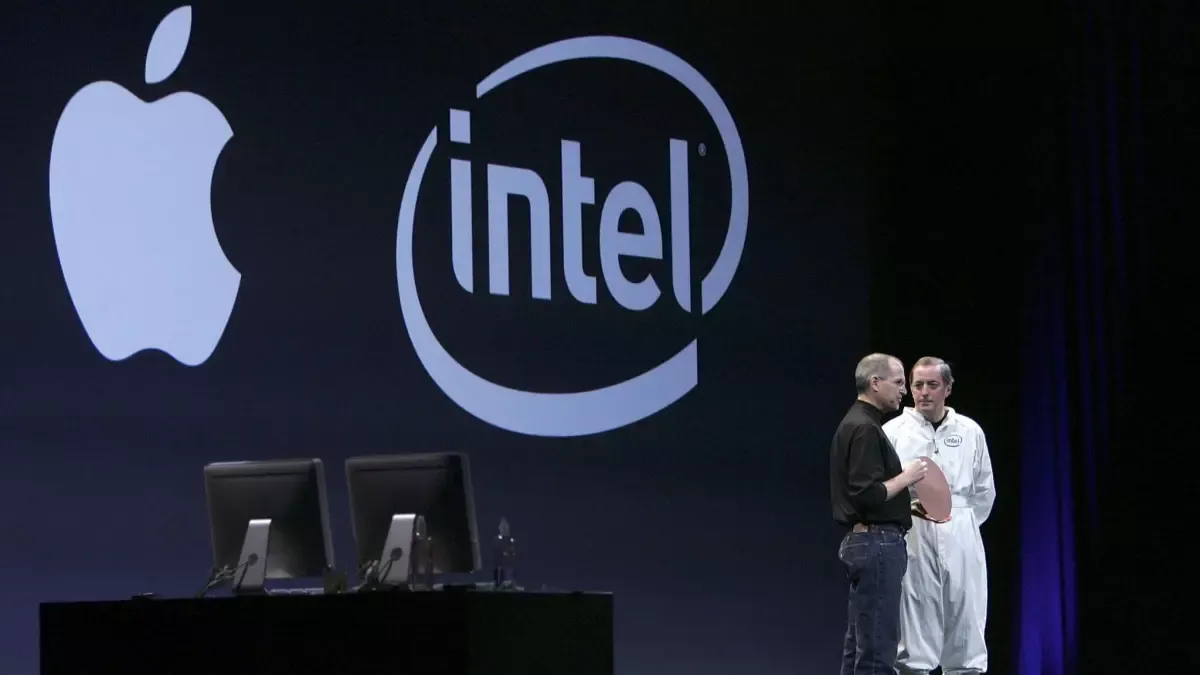

The tables have turned in Silicon Valley's strangest relationship drama. Intel, the semiconductor giant that Apple famously dumped in 2020, is now reportedly approaching its former partner with hat in hand, seeking investment as the company fights to avoid becoming another cautionary tale in tech history.

According to Bloomberg sources familiar with the matter, Intel has reached out to Apple about securing a potential investment, marking yet another desperate attempt by the struggling chipmaker to shore up its finances. The talks are reportedly in early stages and may not lead to any agreement, but the very fact that Intel is having these conversations speaks volumes about how far the company has fallen.

Intel's stock jumped 6% on news of the Apple discussions, building on what's already been a wild ride for investors. The company's shares have climbed more than 40% since mid-August, thanks to a series of high-profile investment deals that read like a who's who of tech heavyweights stepping in to rescue a drowning giant.

The desperation play comes just days after Nvidia announced a $5 billion investment in Intel for roughly 4% of the company. That deal includes plans for the AI chipmaker to collaborate with Intel on developing PC and data center chips, though notably, it won't involve Intel's struggling foundry business actually manufacturing chips for Nvidia. Translation: even Nvidia doesn't trust Intel's manufacturing capabilities enough to bet real money on them.

But wait, there's more. The Nvidia deal followed a $2 billion equity investment from SoftBank Group, and on August 22, 2025, the U.S. government announced an $8.9 billion purchase that equates to roughly a 10% stake in Intel. When the U.S. government is taking equity stakes in your company, you know things have gotten serious.

For Apple, this potential partnership represents a fascinating role reversal. The iPhone maker famously broke up with Intel in 2020 after 15 years together, transitioning to its own custom silicon starting with the M1 chip. That breakup wasn't exactly amicable - Intel exited the 5G smartphone-modem business in 2019, and Apple later acquired the majority of that unit for about $1 billion.

Since then, Apple has been working exclusively with TSMC to manufacture its chips, while Intel has watched from the sidelines as its former partner revolutionized laptop performance and battery life. The new MacBook Air went from up to 11 hours of wireless web on Intel models to up to 15 hours on Apple Silicon - a 30% improvement that made Intel's offerings look ancient by comparison.

The irony is thick here. Apple has invested heavily in building its silicon expertise, including a $278 million purchase of P.A. Semi in 2008 that started its chip division, and a $1 billion acquisition of part of Intel's modem business in 2019. Now Intel is essentially asking Apple to invest in the very company it's been systematically replacing.

What makes this particularly interesting is what Intel might offer Apple in return. According to multiple sources, the discussions center around Intel potentially serving as a foundry partner for some of Apple's chip manufacturing needs. Currently, Apple relies heavily on TSMC, which creates supply chain risks that became painfully obvious during recent global semiconductor shortages.

For Apple, diversifying its manufacturing base makes strategic sense, especially given the company's commitment to domestic production. Apple has pledged about $600 billion to domestic initiatives over the next four years, and Intel's massive $28 billion investment in Ohio facilities could align with those goals. The federal government's involvement in Intel's rescue also adds a layer of strategic importance for Apple's supply chain resilience.

Intel CEO Lip-Bu Tan has been aggressively pursuing partnerships as part of his turnaround strategy, and the Apple discussions represent perhaps the most high-stakes conversation yet. Intel is in the middle of a major restructuring, having announced plans to cut about 15% of its workforce and halt previously planned factories in Germany and Poland. The company is trying to reinvent itself as both a chip designer and a contract manufacturer for other companies - a strategy that requires massive capital investment and customer confidence.

The reported talks highlight just how dramatically the semiconductor landscape has shifted. Five years ago, Intel was the undisputed king of PC processors. Today, it's scrambling to stay relevant as competitors like AMD gain market share and companies like Apple prove that designing your own chips can deliver superior results.

Whether Apple will actually write Intel a check remains to be seen. The talks are reportedly early-stage, and Apple has shown little interest in bailing out struggling partners in the past. But the fact that these conversations are happening at all represents a remarkable shift in the power dynamics of Silicon Valley.

For Intel, landing Apple as both an investor and manufacturing customer would provide the credibility boost the company desperately needs. For Apple, it could offer manufacturing diversification and alignment with U.S. industrial policy. For the rest of us watching this tech soap opera unfold, it's a reminder that in Silicon Valley, today's breakup can become tomorrow's business opportunity - especially when survival is on the line.

Image source: (Justin Sullivan / Getty Images)

If you enjoyed this guide, follow us for more.