Intel could manufacture Apple's iPhone chips starting in 2028, according to GF Securities analyst Jeff Pu. The analyst reiterated his prediction today that Intel would produce non-Pro iPhone processors using its 14A manufacturing process.

Apple would maintain full design control over the chips, with Intel serving strictly as a foundry partner. This arrangement differs from Apple's previous Intel Mac era, where Intel designed x86 processors. Apple transitioned Macs to its own Arm-based silicon starting in 2020.

The potential partnership extends beyond iPhones. Analyst Ming-Chi Kuo previously indicated Intel could begin shipping entry-level M-series chips for Macs and iPads as early as mid-2027 using Intel's 18A process. Pu's latest research note aligns with that timeline while expanding the scope to include iPhone system-on-chips.

Supply chain diversification drives Apple's interest. Nvidia has reportedly surpassed Apple as TSMC's largest customer amid surging demand for AI accelerators. This shift creates capacity constraints at TSMC, Apple's primary chip manufacturer since 2020.

Intel's 14A process represents its next-generation 1.4nm-class technology. The company has released version 0.5 of its Process Design Kit for 14A, with customers expected to make firm commitments between late 2026 and early 2027. Pu lists Apple alongside Nvidia and AMD as likely partners for the advanced node.

Geopolitical considerations add another layer. Intel's U.S.-based fabrication facilities offer Apple a hedge against risks associated with Taiwan-based production. The partnership aligns with broader U.S. manufacturing initiatives supported by government incentives under the CHIPS Act.

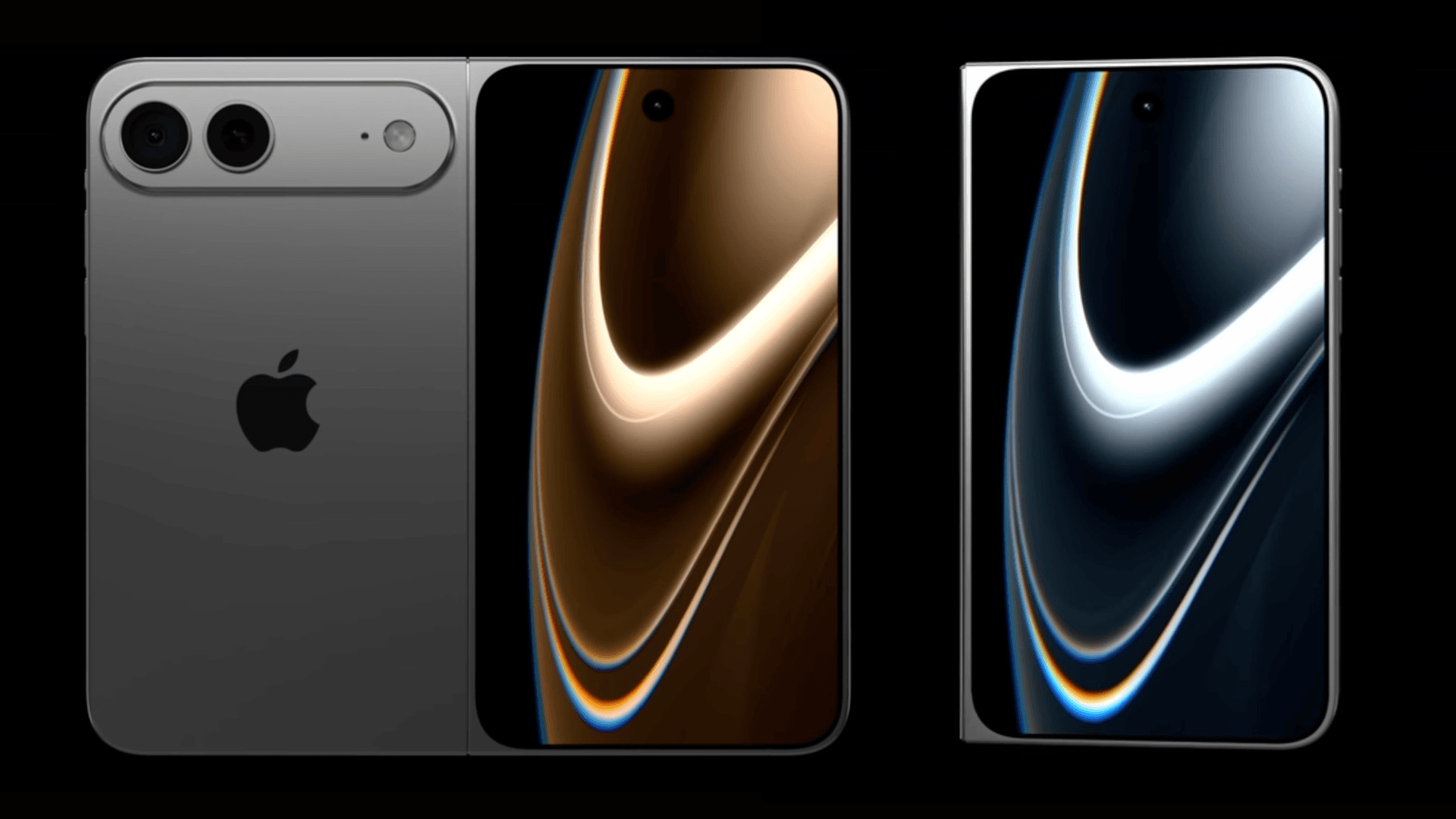

The timeline places any Intel-fabricated iPhone chips multiple generations away from current products. Production would likely target non-Pro iPhone variants, potentially including base models and budget-oriented "e" series devices. These could involve portions of Apple's A21 or A22 system-on-chips.

Industry checks from KeyBanc Capital Markets support the potential partnership. Their analysis notes Intel's 18A yields exceeding 60%, sufficient for production ramp-up. The firm confirms Apple as a client for low-end M-series chips in 2027, with discussions underway for 14A-based iPhone processors.

Historical ties between the companies add credibility to the rumors. Intel previously supplied cellular modems for some iPhone 7 to iPhone 11 models, before Apple shifted to Qualcomm and eventually developed its own modem technology.

TSMC would remain Apple's dominant manufacturing partner under this scenario. Intel would handle supplementary volumes for lower-tier devices, providing Apple with production flexibility and negotiation leverage. The arrangement represents strategic evolution rather than wholesale replacement.

No official agreements have been confirmed by either company. The predictions reflect analyst expectations about how Apple might diversify its chip manufacturing several years from now. Until Intel demonstrates consistent efficiency and yields at iPhone scale, TSMC remains Apple's only confirmed manufacturer capable of meeting its requirements.