Apple's iPhone Air lost 47% of its value within 10 weeks, marking the steepest depreciation in iPhone history according to SellCell analysis. The ultra-thin device's 1TB model performed worst, while even the 256GB variant dropped over 40% in resale value during the same period.

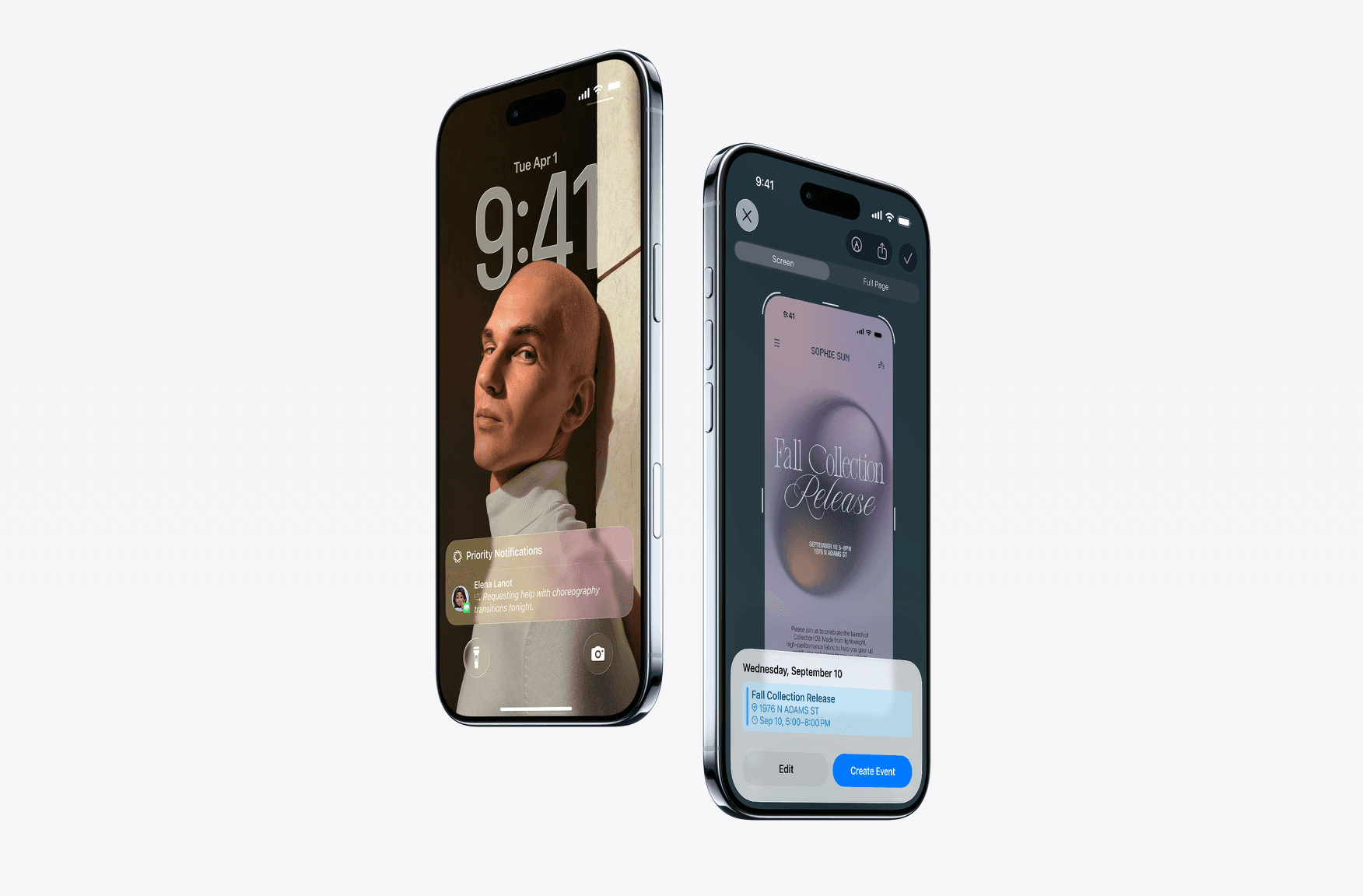

The $999 smartphone launched in September 2025 at just 5.64mm thick, making it Apple's thinnest iPhone ever, though not the thinnest non-foldable phone overall. Apple achieved this through 3D-printed recycled titanium components that reduced material waste by 33-50%, with laser powder bed fusion technology building titanium parts layer by layer.

Market rejection became evident as customers admired the Air's design in stores but purchased iPhone 17 or Pro models instead. The device became what retailers call a "foot traffic driver" - impressive enough to attract attention but not compelling enough to convert sales.

Two critical compromises undermined the Air's appeal. Battery life rated at 27 hours of video playback fell short of the iPhone 17 Pro's 33 hours and Pro Max's 39 hours. Reviewers reported only 12 hours of typical usage, making daily charging necessary for heavy users.

The camera system featured only a single 48MP sensor, eliminating telephoto, ultrawide, and macro photography options that have become standard expectations. While the main camera performed well in good lighting, users missed the versatility of multiple lenses for different shooting scenarios.

Production cuts reached 90% as suppliers scaled back capacity, with Foxconn dismantling entire production lines by late 2025. This market response forced competing manufacturers including Xiaomi, Oppo, and Vivo to cancel their own ultra-thin phone projects.

Samsung cancelled its Galaxy S26 Edge after similar poor reception for the S25 Edge, while Chinese manufacturers redirected resources from ultra-thin development back to traditional flagship designs. The industry-wide retreat suggests fundamental market preferences prioritize functionality over form factor innovation.

Apple reportedly delayed the second-generation Air while redesigning it to potentially include a second camera and improved battery life. This represents a rare public course correction for a company that typically doubles down on controversial design decisions.

The iPhone Air's struggles occurred while Apple prepared four new iPhone models for 2026 launches. The iPhone 17e arrives in the next month or two at $599, while the iPhone Fold debuts this fall at $2,000 or higher with a 7.6-inch inner display and zero screen crease.

iPhone 18 Pro and Pro Max launch in September 2026, building on the iPhone 17 Pro's success. The base iPhone 18 reportedly gets pushed to early 2027, with the lower-cost iPhone 18e and possibly iPhone Air 2 arriving in spring 2027.

Telecom carriers like Globe in the Philippines continue offering iPhone 17, Air, and Pro models through subscription programs that allow annual upgrades. The carrier was recognized as the most consistent network for iPhone based on Ookla's Speedtest Intelligence analysis for the first half of 2025.

Apple's manufacturing innovations from the Air project will likely influence future devices. The titanium construction methods, component miniaturization, and sustainable manufacturing techniques developed for the ultra-thin phone could appear in more balanced form factors.

The iPhone Air demonstrates that engineering brilliance without practical benefit cannot justify premium pricing in today's smartphone market. While the device succeeded as a technological showcase, its commercial failure reinforces that consumers demand comprehensive capability alongside innovative design.

Market data shows the Air continued declining in value while other iPhone 17 models stabilized around the ten-week mark, signaling deeper rejection than typical launch hesitation. The device's legacy will be found in pushing boundaries rather than achieving commercial success.